Cytonn Real Estate, the development affiliate of Cytonn Investments, has released their Nairobi Metropolitan Area Residential Report 2022, a report that highlights key performance and activities of the real estate residential sector in the Nairobi Metropolitan Area.

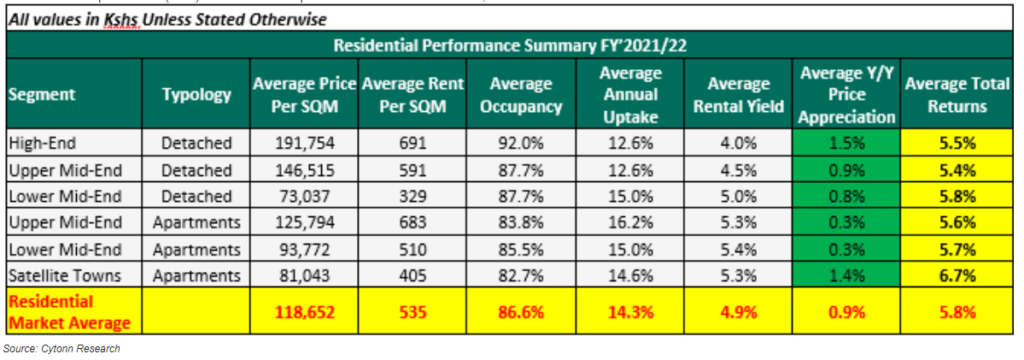

According to the report, the residential sector registered improved performance with average total returns coming in at 5.8% in FY’2021/22, a 0.3% points increase from 5.5% recorded in FY’2020/21, attributed to residential average year-on-year price appreciation, which came in at 0.9%, 0.3% points higher compared to a price appreciation of 0.6% recorded in FY’2020/21. Market uptake remained subdued coming in at 14.3% on average, 1.2% points lower than 15.1% recorded in FY’2020/21, indicating reduced demand for residential units attributed to constrained purchasing power.

“We expect the sector’s contribution to improve more for the rest of the year despite the upcoming general elections supported by Government focus on infrastructural development having increased budgetary allocation to Ksh212.5 billion for FY’2022/23 from Ksh182.5 billion in FY’2021/22, Government and private sector aggressiveness in implementing housing initiative programs, with focus on affordable housing, the growing trend towards alternative financing for real estate development especially public-private partnerships (PPPs) delivering development projects, and increased budgetary allocation to the Kenya Mortgage Refinance Company (KMRC) to Ksh4.6 billion in the FY’2022/23 Budget Statement from Ksh3.5 billion in FY’2021/22. This is expected to boost mortgage financing to Primary Mortgage Lenders (PMLs) for onward lending to homebuyers,” stated Fidelis Wanalwenge, a Research Analyst at Cytonn Investments.

Read: Court Bars CMA From Making Further Defamatory Statements Against Cytonn

The Nairobi Metropolitan Area (NMA) residential market performance is summarized below;

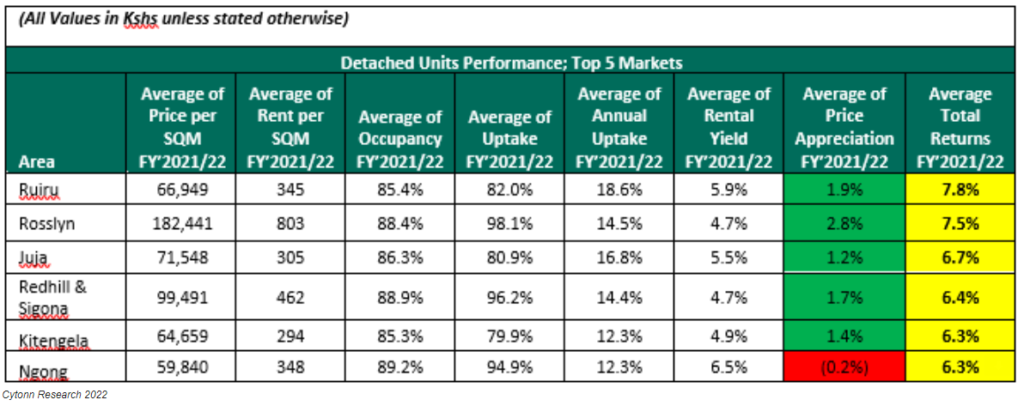

The detached market registered improved performance in returns, coming in at 5.6% in FY’2021/22 thus representing a 0.2% points y/y increase from 5.4% recorded in FY’2020/21. The average rental yields came in at 4.5%, 0.3% points higher than 4.2% recorded in FY’2020/21 attributable to increased rental rates while house prices remained flat, coming in at 1.1% in FY’2021/22.

The table below shows performance of the top 5 nodes in the detached units market of the Nairobi Metropolitan Area;

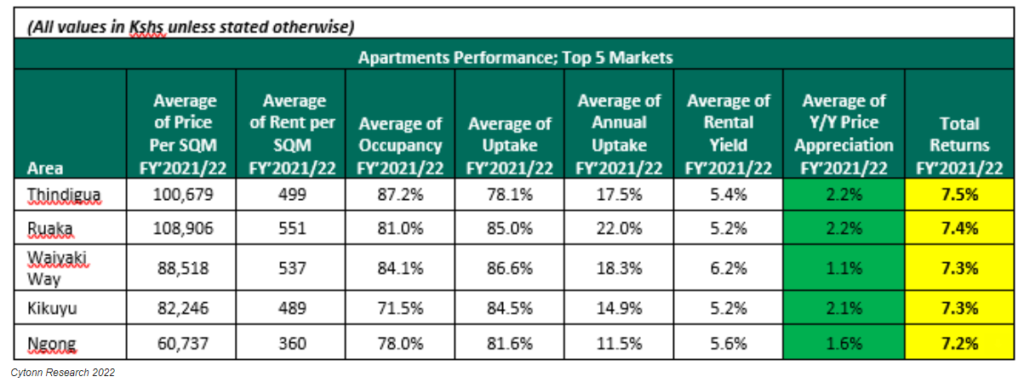

Apartments recorded improved performance with average returns to investors coming in at 6.0% in FY’2021/22, a 0.5% points increase from 5.5% recorded in FY’2020/21. The average y/y price appreciation registered a 0.6% y/y increase to 0.7% in FY’2021/22, up from the price appreciation of 0.1% in FY’2020/21. However, the rental yields remained flat at 5.4% in FY’2021/22 similar to last year.

The table below shows performance of the top 5 nodes in the apartments market of the Nairobi Metropolitan Area;

Demand for affordable housing continues to remain high with the annual demand at more than 200,000 units, and is expected to cumulatively grow to two million units with the government yet to realize delivery of 50,000 units every year despite the growing urbanization and population rates estimated at 4.0% p.a and 2.3% p.a. respectively, against the global average of 1.8% p.a and 1.0% p.a.

Read: Cytonn Launches Hospitality Company Focused On Serviced Apartments

The government increased the CBR rate to 7.5% in May 2022 from 7.0% since March 2020 which is expected to increase the cost of borrowing for developers thus constraining residential supply.

The number of mortgages advanced by banks declined in 2021 with mortgage loan accounts coming in at 26,723 from 26.971 in 2020 attributed to tight lending standards following high default rates. We expect cautious lending to continue amidst the tough economic times with Non-Performing Loans to gross mortgage ratio of 11.6% being attributed to lesser loans to be granted.

Despite the government supporting affordable housing through mortgage financing by the Kenya Mortgage Refining Company (KMRC), budgetary allocation reduced to Ksh8.7 billion in FY’2022/23 from Ksh13.9 billion in FY’2021/22. Over reliance on bank funding for Real Estate development still remains a challenge with funding through banks being 99.0% while 1.0% is through capital markets. There is a growing trend towards alternative financing for development especially through Public-Private Partnerships (PPPs).

Read: Jubilee Holdings Ranked As The Most Attractive Insurance Company In Kenya

Infrastructural developments remain one of the key drivers of residential developments by boosting price appreciations and increase in rental yields.

The government has reiterated its commitment to infrastructural developments having boosted its budgetary allocations in FY’2022/23 to Ksh212.5 billion from Ksh182.5 billion in the last financial year.

Numerous infrastructure projects are ongoing including the Northern and Westen Bypasses, LAPPSET project, and Nairobi Commuter Rail project among others, while others such as the 27-km Nairobi Express Way running from Westlands to Jomo Kenyatta International Airport (JKIA), and the first three births of the t Northern Bypass and the LAPPSET project are complete.

In terms of performance, the sector recorded improved performance with average total returns averaging at 5.8%, 0.3% points higher than 5.5% recorded in Q4’2021, and can be attributed to y/y price appreciation, which came in at 0.9%, 0.3% points lower compared to a price appreciation of 0.6% recorded in FY’2020/21.

Read: Effects Of Elections On The Investments Environment In Kenya