The Kenya National Chamber of Commerce and Industry (KNCCI) has raised serious concerns over the government’s proposed KES 2 million monthly penalty for businesses failing to comply with a new electronic tax system, warning it could devastate the vital small enterprise sector that forms the bedrock of the economy.

In a statement released on Monday, the influential business lobby said the hefty fines for non-compliance with the Electronic Tax Invoice Management System (eTIMS) outlined in the draft 2024 Finance Bill are “punitive” and risk forcing many micro, small and medium enterprises (MSMEs) to close down operations.

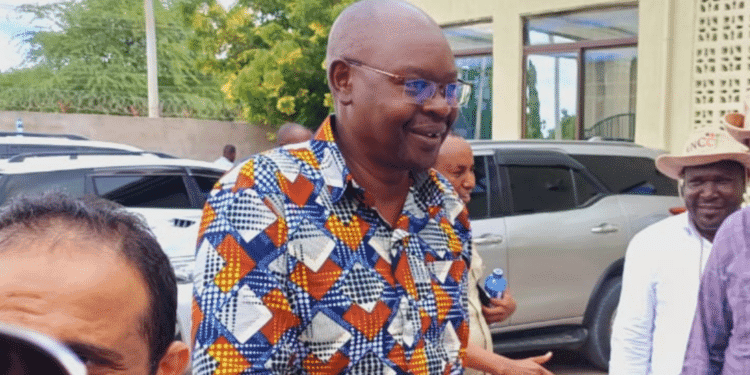

“MSMEs are the backbone of our economy, contributing about 40% of GDP and employing more than 80% of Kenyans,” KNCCI President Dr. Erick Rutto said. “The majority of them operate in the informal economy and have neither clearly understood nor adopted eTIMS. Placing a penalty of KES 2 million a month on these businesses that make less than half of that in a year will undoubtedly lead to widespread closures and massive job losses.”

The eTIMS system, introduced by the Kenya Revenue Authority to enhance tax collection and compliance, has faced an uphill battle in gaining traction since its launch last year.

KNCCI cited its own Quarterly Business Barometer Survey for the first quarter of 2024, which revealed that over half of respondents were businesses generating less than KES 1 million in annual revenue, underscoring just how crippling the proposed fines could be for Kenya’s army of small enterprises.

“Many of these small business owners simply may not have the technical skills, resources or capacity to effectively implement such digital tax systems,” Rutto stated. He urged the government to take a “phased approach” that allows businesses sufficient time to understand the requirements, receive training and adapt their operations accordingly before enforcing penalties.

The chamber proposed an initial grace period with no financial sanctions or a tiered penalty system that starts with warnings or smaller fines for initial non-compliance, only escalating to the KES 2 million monthly fine if non-compliance persists over an extended period.

KNCCI pointed to the poor performance of the original eTIMS registration deadline of March 31, which saw only about 20% of the targeted businesses actually register on the platform by the cut-off date. This low uptake, the chamber argued, demonstrated the widespread lack of comprehension, preparedness and capability among MSMEs regarding the system’s requirements.

“Before implementing such stringent penalties that could make or break thousands of small businesses, it is crucial that the government first invests in comprehensive capacity-building programs,” Rutto advised. “There is need to provide clear, accessible information and training to ensure MSMEs are well-equipped to comply with eTIMS from a position of understanding.”

While acknowledging the government’s efforts to reform tax administration and enhance compliance through adoption of technology, KNCCI reiterated its commitment to “working collaboratively” with authorities to find solutions that balance revenue collection needs with supporting the growth and sustainability of Kenya’s MSME sector.

“We believe that through constructive dialogue and well-designed, targeted support measures, we can achieve a tax system that is fair, efficient and conducive to economic growth across all segments,” the statement read.