Banks play a central role in Kenya’s economy, yet many customers are unsure how these institutions actually earn profits. While banks are trusted with safeguarding deposits, their business model goes far beyond holding money. Kenyan banks generate income by lending, investing and charging for financial services all while managing risk and liquidity in a changing economic environment.

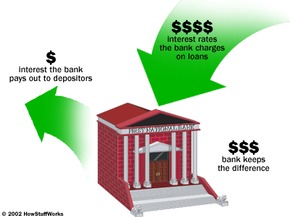

The primary way banks make money is through interest income. When customers deposit money, banks pay them a relatively small interest or in some cases, none at all. The same money is then lent out to individuals, businesses and governments at much higher interest rates. The difference between what banks earn on loans and what they pay on deposits is known as the interest spread and it forms the backbone of bank profitability.

Loans and advances are therefore a critical income source. Kenyan banks issue personal loans, mortgages, asset-finance facilities and credit to small and large businesses. Borrowers repay these loans over time with interest providing banks with predictable cash flows. However, lending also carries risk. When borrowers default, banks must set aside provisions, which reduce profits. Recent CBK banking supervision reports show that non-performing loans have risen, yet profitability has remained strong due to higher interest eearnings.

Beyond interest, banks increasingly rely on non-interest income. This includes fees charged for account maintenance, mobile and electronic transactions, ATM usage, card services and foreign exchange trading. With Kenya’s high adoption of digital banking, transaction volumes have grown significantly.

Banks also earn money by investing in government securities such as Treasury bills and bonds. These instruments are considered low risk and provide steady interest income. During periods of elevated interest rates, returns on government securities rise, making them an attractive alternative to private lending. The performance of these securities, tracked publicly on the Central Bank of Kenya website, provides interest income. Furthermore, banks trade in foreign exchange markets profiting from buy-sell spreads on currencies, a particularly active segment in a trade-dependent economy like Kenya’s.

Ultimately, bank profitability depends not only on income but also on efficiency. Operating costs such as staff, technology and branch networks must be carefully managed. According to Kenya Bankers Association’s 2025 report, Kenyan banks recorded a combined profit before tax of about KES 260.0 billion in 2024, supported by strong interest income and diversified revenue streams, as reported at.

In essence, banks in Kenya make money by transforming deposits into loans and investments, charging for service and managing costs and risks. Their success lies in balancing these elements while adapting to economic and regulatory changes. ( start your investment journey today with the cytonn money market fund. Call + 254 (0)709101200 or email sales@cytonn.com)