In recent years, Ruaka has become one of the fastest-growing satellite towns in the Nairobi Metropolitan Area (NMA) and has become a major centre for Real Estate investment and development.

The fast-rising town offers relatively higher returns of up to 7.5%, compared to the overall satellite towns’ average of 6.9%, as highlighted in our Annual Markets Review 2022.

This has also driven a construction boom in Ruaka supported by the growing demand for residential property. Additionally, there has been a shift by investors towards satellite towns attributable to the availability of cheaper land for development in these areas, coupled with improved accessibility owing to key infrastructural developments that have unlocked value for investors.

In 2022, land prices in satellite towns recorded the highest capital appreciations of 11.1% and 8.0% for unfurnished and furnished schemes respectively, against the 4.3% market average cementing their affordability.

Furthermore, infrastructural developments have played a fundamental role in connecting Ruaka to main transport networks, and have also reduced commute time to the city centre thus benefitting home buyers seeking to settle in serene neighbourhoods around away from the city, and at the same time have the convenience of travel time.

This makes the area attractive for investment, by reason of which Cytonn Investments has two residential developments; The Alma and Taraji Heights within Ruaka.

Read Steps Ruto’s Administration Should Take for Real Estate Investment Trusts To Fund Housing

Some of the strengths that have continued to drive the growth of the Real Estate sector in Ruaka over the years include;

i) ample infrastructure

ii) presence of amenities

iii) strategic location

iv) improved security measures and systems

v) presence of educational institutions

vi) presence of health facilities.

Market Performance

The vibrant market performance in Ruaka is animated by the area’s constantly growing demand for housing, driven by an expanding population which is a mix of both local middle-income earners as well as foreign residents.

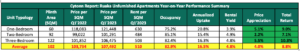

The table below shows the year-on-year comparison in performance for unfurnished apartments in Ruaka;

The best-performing typology was three-bedroom unfurnished apartments owing to high average total returns coming in at 10.3% compared to one-bedroom and two-bedroom apartments offering total returns of 9.0% and 7.1%, respectively.

The unfurnished apartments’ rental yield reduced by 0.8% points to 4.8% in 2023 from 5.6% recorded in Q1’2022, majorly attributable to a decrease in average asking rent to Kshs 510 from Kshs 559 realized in Q1’2022.

In addition, the Limuru Road area hosting Ruaka serves as a residence for workers in foreign embassies and headquarters of international organizations, thus creating demand for housing units.

Consequently, Limuru Road recorded an average rental yield of 5.8%, though lower than the 6.2% furnished apartments’ average yield according to our NMA Furnished Apartments Report 2022.

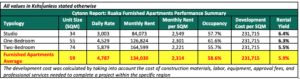

The table below shows the performance of furnished apartments in Ruaka;

Source: Cytonn Research

The best-performing typology was studio furnished apartments as a result of offering investors the highest rental yield of 6.4%, attributable to investors asking for relatively high monthly rents per SQM of Kshs 2,549 compared to the market average of Kshs 2,314, owing to their relatively smaller unit size averaging 34 SQM, compared to one and two-bedroom furnished apartments with sizes of 55 SQM and 74 SQM, respectively.

Conclusion and Recommendation

Overall, furnished apartments perform better in Ruaka, offering investors a higher average rental yield of 5.9%, compared to unfurnished apartments with an average rental yield of 4.8%. This makes furnished apartments more attractive to investors.

Additionally, we expect that occupancy levels will continue to increase in the course of the year, as the country continues to fully recover from the 2022 electioneering period and easing of inflationary pressures.

For the investment opportunity in unfurnished apartments, we recommend investing in one and three-bedroom unfurnished apartments which offer the highest returns to investors. Notably, one-bedroom unfurnished apartments sell more in Ruaka, with the annualized uptake coming at 20.8%, compared to Ruaka’s unfurnished apartments’ market average of 16.5%.

Additionally, one-bedroom apartments registered higher selling prices and rents per SQM owing to their relatively smaller unit sizes compared to other typologies. In furnished apartments, we recommend investing in the studio and one-bedroom apartments owing to closely-tied average rental yields to investors per typology.

Notably, one-bedroom furnished apartments recorded the highest occupancy rates at 61.6% compared to Ruaka’s furnished apartments’ average occupancy rate of 58.6%. This is because one-bedroom furnished apartments attract the highest demographic of young, working-class people and young families within Ruaka that seek short to medium stays while being more spacious than studio-furnished apartments. For more information, see our Ruaka Research Note topical.

Email your news TIPS to editor@thesharpdaily.com