Chain retailer Naivas has ceded a 40 percent stake to French firm Proparcoin in a $31.5 million (Ksh3.7 billion) deal.

This comes days after Naivas announced that Proparco, Mauritian conglomerate IBL Group and German sovereign wealth fund DEG were acquiring a minority stake in the company.

The conglomerates will acquire stakes previously held by World Bank’s International Finance Corporation (IFC), MCB Equity Fund, Amethis, and German sovereign wealth fund DEG, which acquired the shares for Ksh6 billion in April 2020.

Read: Electricity Demand In Kenya Hits A New High Of 2,051MW

DEG will exit its initial investment in Naivas and re-enter the retailer’s shareholder list as part of the new consortium.

“Proparco is pleased to announce its partnership with IBL Group, the largest conglomerate of Mauritius [and] DEG … to jointly acquire a 40 percent interest in Naivas International, which owns 100 percent of the shares of Naivas Limited,” the French fund in a statement.

If Proparco and its partners are investing equal amounts, it means the 40 percent stake is being acquired at a cost of Ksh11.1 billion, valuing Naivas at Ksh27.8 billion.

Read: Private Sector Calls For Cross-Sector Collaboration In Fight Against Drought

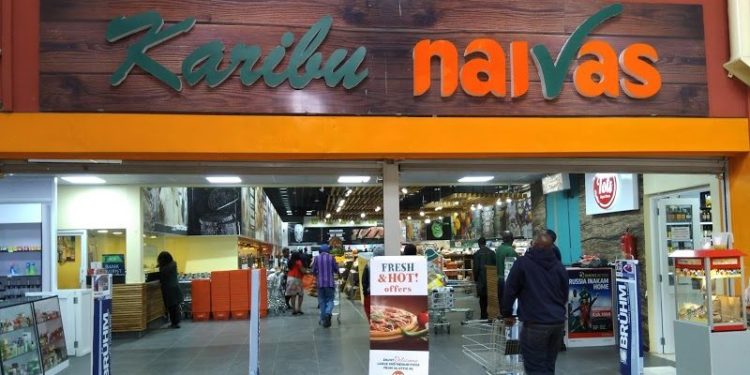

Currently, Naivas boasts of 84 outlets in 20 cities and towns across Kenya, making it the biggest chain retailer in Kenya in terms of the branch network.

Naivas’ closest rival in terms of branch network is Quick Mart which had 51 stores as of April.

Proparco said Naivas will continue with its expansion in the modern retail market across various formats, responding to consumers’ needs and increasing demand for food quality and safety.

Email your news TIPS to editor@thesharpdaily.com