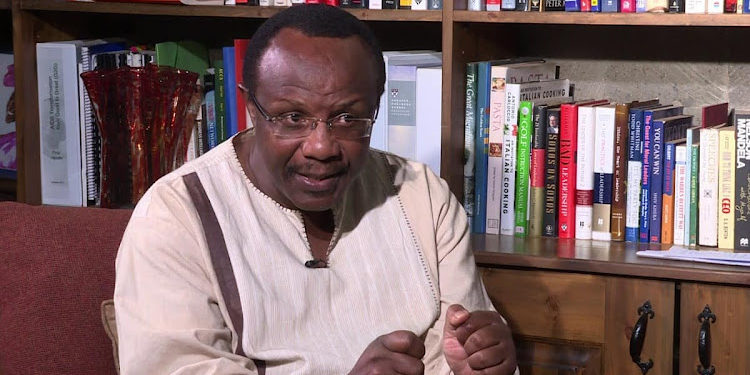

Kenya’s economic outlook is bleak, with a recession looming, according to a candid series of tweets by President William Ruto’s chief economic advisor, David Ndii.

In the Twitter thread, Ndii issued a scathing critique of former President Uhuru Kenyatta’s economic legacy, calling the debt-fueled growth of recent years “fake prosperity” that failed to benefit ordinary Kenyans.

“The debt consumption economy will shrink because it has reached where I’ve warned it would end a decade ago,” Ndii tweeted, referring to warnings he issued as early as 2013 about the economy’s dangerous over-reliance on borrowing.

Detailing a recent conversation with a luxury car dealer, Ndii tweeted that he bluntly told the businessman “his line of business was unlikely to recover” under the new austerity-minded administration.

Instead, Ndii advised the car dealer to “look into a production oriented sector” like manufacturing or agriculture. Ndii even offered specific ideas like farm input supplies and food processing. “Most people don’t know that farming accounts for only 20% of agricultural value chains— rest is input supply, logistics, processing etc,” he tweeted.

Ndii predicted tough times ahead for government contractors, vendors of luxury items, and establishments catering to high-rolling “tenderpreneurs” who earned fortunes off graft under Kenyatta’s administration.

“I’m not saying corruption will end, just that there simply isn’t enough lootable resources to sustain an industrial scale corrupt lifestyle economy,” Ndii explained.

Addressing criticism about Ruto’s own role as Kenyatta’s deputy, Ndii essentially argued Kenyans must deal with “the reality.”

He also defended Ruto’s new administration: “Yes we do” have a plan to fix things, Ndii tweeted, involving a shift “from debt consumption addiction to production.”

“The withdrawal symptoms means its working,” he added about the imminent economic pain.

On whether Kenyatta should return allegedly pilfered funds, Ndii tweeted: That argument means “everyone who was part of the gravy train” must also give back ill-gotten gains.

Ultimately, Ndii wrote, there is no escaping consequences: “As I keep saying, financial delinquency has no solutions, only consequences.”