The Central Bank of Kenya (CBK) has announced that only 10 applicants have now been licensed as Digital Credit Providers (DCPs), pursuant to the CBK Act and the Regulations.

CBK announced that the transition period for all operating unregulated DCPs to apply to CBK for a license ended on September 17, 2022.

“This is pursuant to Section 59(2) of the Central Bank of Kenya Act (CBK Act), which required all operating unregulated DCPs to apply to CBK for a license within six months of the publication of the Central Bank of Kenya (Digital Credit Providers) Regulations, 2022 (the Regulations), i.e., by September 17, 2022, or cease operations,” CBK said.

Among the licenced DCPs include Ceres Tech Limited, Getcash Capital Limited, Giando Africa Limited (Trading as Flash Credit Africa), Jijenge Credit Limited, Kweli Smart Solutions Limited, Mwanzo Credit Limited, MyWagepay Limited, Rewot Ciro Limited, Sevi Innovation Limited and Sokohela Limited.

Read: Several Digital Lenders Set To Lose Licences In New CBK Regulations

On March 21, 2022, CBK announced the publication of the Regulations on March 18. They provide for the licensing and oversight of DCPs. The Regulations were issued pursuant to Sections 57(1), 57(3) and 57(4) of the CBK Act. Further, on May 17, 2022, CBK reminded all currently operating DCPs to apply to CBK for a license.

CBK has received 288 applications since March 2022.

“We acknowledge the efforts of the applicants and the support of other regulators and agencies in this process. Other applicants are at different stages in this process, mainly awaiting the submission of requisite documentation. We urge these applicants to submit the pending documentation expeditiously to enable the completion of the review of their applications. All other unregulated DCPs that did not apply for licensing must cease and desist from conducting digital credit business,” added CBK.

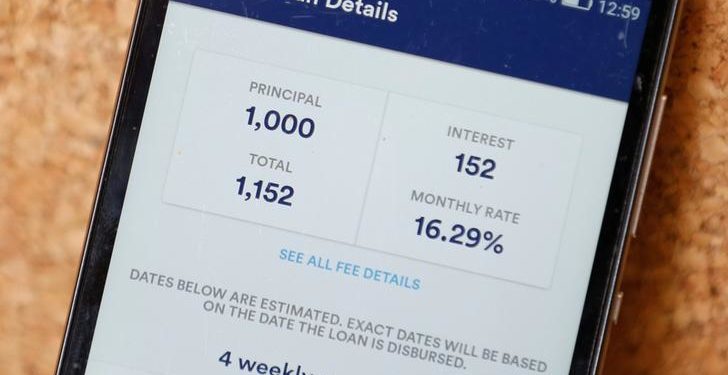

As indicated previously, the licensing and oversight of DCPs was precipitated by concerns raised by the public about the predatory practices of the unregulated DCPs, in particular, their high cost, unethical debt collection practices, and the abuse of personal information.