The Central Bank of Kenya (CBK) has announced that it will not extend the deadline for registering Digital Credit Providers (DCPs) popularly known as digital lenders.

The lenders had been given up to September 17, 2022 to register, with CBK indicating that a number of them have registered.

“In accordance with Section 59(2) of the CBK Act, all previously unregulated DCPs are required to apply to CBK for a license within six months of the publication of the Regulations, i.e., by September 17, 2022, or cease operations. Two months have elapsed since the publication of the Regulations and several DCPs have already applied to be licensed. The purpose of this announcement is to remind all currently unregulated DCPs that have yet to apply for licensing, that they now have four months to the September 17, 2022, deadline. They should apply in good time as no extension will be granted after the application deadline of September 17, 2022,” CBK said.

Read: Equity Group Shareholders To Harvest Ksh11 Bn As Lender Mints Ksh40 Bn In Profits

The regulator wants the mobile-phone-based and online lenders to disclose more information, including the source of funds and details on ownership.

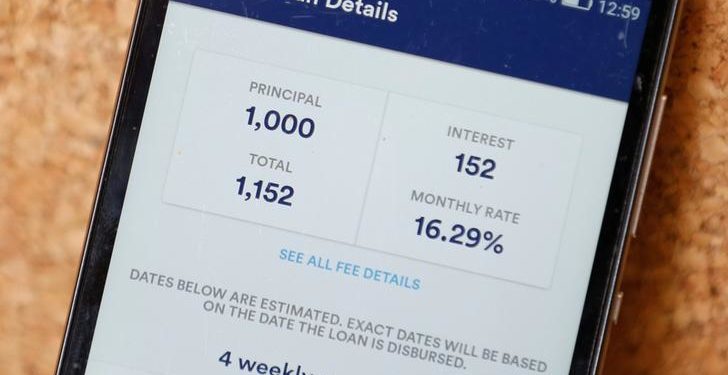

Commercial banks had 3.9 million mobile loan accounts as of April 2021 and about Ksh50.6 billion borrowed, according to CBK.

The unsupervised lending accounts for less than 1% of the banking sector’s Ksh3.2 trillion loan book, about two million people use them, and on average eight times a year.

Read: Absa Bank Renews Its Focus On Real Estate

The changes come at a time mobile digital lending apps in Kenya are facing accusations of money laundering, illegal mining of customer private data and shaming of borrowers who default on repayment.

On April 15, 2021, CBK withdrew the approvals granted to unregulated digital (mobile-based) and credit-only lenders as third-party credit information providers to Credit Reference Bureaus (CRBs).

The withdrawal was in response to numerous public complaints about misuse of the Credit Information Sharing System (CIS) by the unregulated digital and credit-only lenders, and particularly their poor responsiveness to customer complaints.

Read: Equity Bank Earns Billions From Diaspora Remittances

According to FSD, there were approximately 110 mobile loan apps on the two main app stores from 74 unique developers as of September 2018. As of April 2019, 65 of these apps had been pulled down while 47 new ones developed by 43 unique developers.

It is estimated that there were 92 digital loan apps as of April 2019.

Read: NCBA Reaps Billions From Fuliza, M-Shwari