M‑Shwari, Safaricom’s mobile banking platform, has transformed financial access in Kenya, reaching millions who previously struggled to access formal banking. The platform allows users to open an account instantly via M‑PESA, deposit even the smallest amounts, earn interest, and access small loans—all without visiting a bank. This mobile-first approach has removed traditional barriers such as paperwork, minimum balances, and distance from bank branches, making M‑Shwari a key driver of financial inclusion in Kenya. Over 20 million Kenyans now rely on the platform for everyday savings and borrowing needs.

A major advantage of M‑Shwari is its instant loan facility. Users can borrow amounts starting from as little as KSh 100 to tens of thousands, depending on their transaction and repayment history. Repayments are typically due within 30 days, and the platform uses digital credit scoring based on M‑PESA activity. In contrast, Money Market Funds (MMFs) also provide opportunities to save and earn returns, but they generally require a bank account, minimum investment amounts, and formal registration procedures. MMFs are often less accessible for low-income earners who need flexible, on-the-go banking solutions.

When comparing interest and returns, M‑Shwari offers modest but immediate interest on savings, making it suitable for short-term goals and emergency funds. MMFs usually provide higher returns, but the money may be tied up for longer periods, reducing liquidity. While MMFs appeal to medium- and long-term investors seeking stable returns, M‑Shwari prioritizes flexibility, instant access, and convenience, which are critical for everyday financial management among low- and middle-income users.

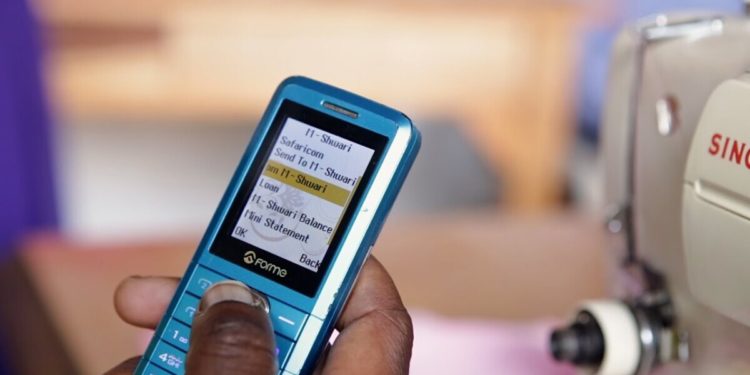

Beyond loans and interest, M‑Shwari encourages a saving culture among Kenyans. Users can monitor balances, set lock-savings targets, and manage loans in real time, all from their phones. MMFs, while regulated and safe, do not offer the same immediacy, ease, or personalized experience that a mobile platform provides. In this way, M‑Shwari not only makes banking more accessible but also empowers Kenyans to save and borrow responsibly, demonstrating how mobile technology can drive financial inclusion and transform the way people manage money in the digital era.