The Institute of Certified Public Accountants (ICPAK) has launched the Unique Document Identification Number (UDIN) system, a major technological milestone aimed at strengthening transparency, accountability and authenticity in Kenya’s accountancy profession. The move follows a Council resolution passed on 16th May 2025 and a communiqué issued on 10th June 2025, with the system officially activated in August 2025 and full enforcement set for 1st October 2025.

Established under the Accountants Act, Cap 531, ICPAK is the statutory body mandated to develop and regulate the accountancy profession in Kenya. As a member of both the Pan African Federation of Accountants (PAFA) and the International Federation of Accountants (IFAC), the Institute aligns its standards and practices with global best practices. Through these affiliations, ICPAK adheres to IFAC’s Statements of Membership Obligations including SMO 1, on Quality Assurance, which emphasizes the integrity and reliability of audit and assurance engagement.

The UDIN initiative is a direct response to one of the most persistent challenges facing the accounting profession in Kenya, the presence of unqualified or unregistered individuals masquerading as professional accountants. These fraudulent actors often engage in unethical or illegal practices such as manipulating financial records or issuing false audit opinions, undermining the credibility of genuine practitioners and weakening public confidence in financial reporting.

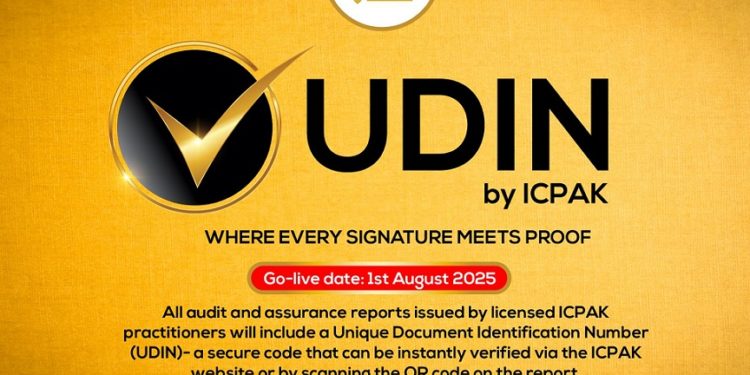

By introducing the UDIN system, ICPAK seeks to safeguard the profession from such malpractice. Each UDIN, consisting of a unique serial number and QR code will be appended to every audit opinion signed by a licensed practitioner. This allows users, including regulators, investors, banks, development partners and the public to independently verify the authenticity of financial statements and confirm the identity of the signing auditor through ICPAK’s verification portal. In effect, the system eliminates the misuse of practitioners’ names and signatures on documents they did not authorize.

Following pilot testing with 150 practitioners between June and July 2025, ICPAK conducted six nationwide sensitization forums to train licensed members on generating and verifying UDIN codes. The Institute has announced that all licensed practitioners in Category A (Assurance) and Category C (Composite) must obtain a UDIN for every audit opinion issued after 1st October 2025. Failure to do so will constitute professional misconduct under Section 30(1)(h) of the Accountant Act, which defines non-compliance with professional, technical or ethical standards as an offense.

The system will allow users to verify audit opinions by simply scanning the QR code or entering the UDIN serial number on the ICPAK website. The portal will display key details such as the client’s name, auditor and reporting date, providing instant confirmation of authenticity.

ICPAK’s introduction of UDIN, marks a significant leap forward for Kenya’s accounting profession. It aligns the country with global standards on audit, transparency, deters fraud and enhances trust in financial reporting. For investors and other users of financial statements, this development represents a crucial safeguard, one that reinforces the credibility of Kenya’s financial ecosystem and the accountability of its licensed professionals.