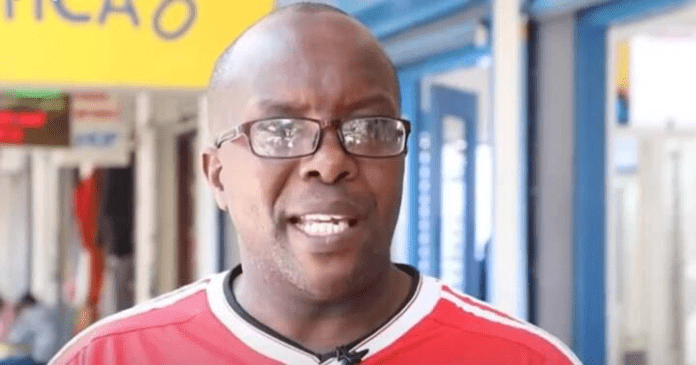

In his heydays, Robert Muthee could make up to Ksh1 million, and Ksh250,000 in his worst months. The story of Muthee is a story of grass to grace, and then back to grass.

Muthee started off as a casual labourer for Bidco limited, before leaving the manufacturer in 1998 to become a professional photographer, one of the few in Kenya in his time.

He developed a network of clients, who involved the who is who in the country, including politicians and company executives who paid handsomely which saw his meteoric rise to riches.

In an interview with an online publication, Muthee said that he charged at least Ksh25,000 which could go up to Ksh150,000 per shoot depending on the time and the clients needs.

Read: How To Reduce Stress While Working From Home

“I remember one time I was booked for 5 days to shoot a wedding in Mombasa and the client catered for everything including flights,” he told the publication.

“I have worked with very many big people in the industry. I have worked with industrial giants and billionaires like Manu Chandaria and Vimal Shah of Bidco.”

Business was good. He could drive the best car in town. And just like any other businessman, when the business is good and the clients are many, you expand.

Read: How Ezra Chiloba, Once Form Two Drop Out, Came To Manage Kenya’s Elections

Muthee decided to take a Ksh200,000 loan from a shylock to buy more equipment for his craft. The loan would attract an interest of Ksh40,000, according to the initial agreement. However, when the time to pay came, Muthee had only Ksh180,000 instead of Ksh240,000.

The shylock decided to treat the remaining Ksh60,000 as a new loan, which attracted interest of Ksh12,000. To avoid more debt with the shylock, Muthee took another loan, of Ksh100,000 to offset the first loan.

The debts were fast accumulating and he was forced to sell his car to reduce the debt burden. Shortly after, a company he was working for offered to buy him another car, that he would pay through his work. This meant that he would not earn for his work through the company, which sank him further into debt.

Read: The Rise And Rise Of Martha Karua

Sooner or later, he was forced to sell the second car due to mounting debts. His debts had reached a high of Ksh4 million, with lenders on his neck. At one time, the photographer says that a lender accosted him with a knife to an ATM machine, where his card was “swallowed”.

He says that he had two credit cards capped at Ksh250,000 and Ksh100,000 each.

“In a month I could spend Sh350,000 which was not my money. Credit cards attract high interest rates when you fall behind the payment schedule so I started to borrow money from friends and family to repay,” Muthee shared.

His troubles worsened in 2020 due to the Covid-19, which has forced him to start doing other jobs to eke a living. He started washing cars before he started hawking masks along Thika Road, which he says has enabled him to live through difficult times.

Email your news TIPS to editor@thesharpdaily.com