On April 7, 2022, the National Treasury presented Kenya’s FY’2022/2023 National Budget, to the National Assembly two months earlier than the usual June date in a bid to provide Parliament with ample time to discuss and approve the Budget, before it winds down ahead of the upcoming August 9 elections.

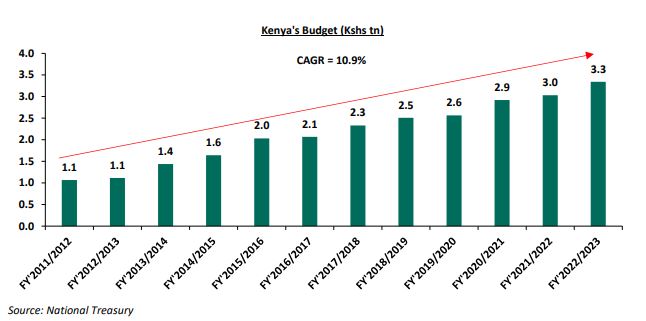

Notably, the total budget estimates for FY’2022/23 are expected to increase by 10.3 percent to Ksh3.3 trillion, from Ksh3.0 trillion in the FY’2021/2022 while the total revenue will increase by 20.0 percent to Kshs 2.4 trillion from the Ksh2.0 trillion in the FY’2021/2022 budget estimates.

The increase is mainly due to a 25.4 percent increase in ordinary revenue to Ksh2.1 trillion for FY’2022/2023, from the Ksh1.8 trillion in FY’2021/22 budget estimates. Over the years, the Kenyan Government budget has been on the rise on the back of an ever-increasing recurrent expenditure.

Recurrent expenditure is set to increase by 7.9 percent to Ksh1.4 trillion in FY’2022/23, from Ksh1.3 trillion in the FY’2021/22 budget estimates, while Consolidated Funds Services (CFS) expenditure is expected to increase by 21.0 percent to Ksh869.3 billion, from Ksh718.3 billion in the FY’2021/2022 budget estimates.

Read: CBK Retains Base Lending Rate At 7 PC For The 13th Consecutive Time

Development expenditure increased by 8.6 percent to Ksh711.5 billion from Ksh655.4 billion in the FY’2021/2022 budget estimates. Development expenditure has continued to lag behind, contributing only 21.3 percent of the FY’2022/2023 expenditure estimates in comparison to the 67.5 percent allocation to recurrent expenditure, an indication that we are not investing much for the future. As such, development projects need to be more prioritized and better planning incorporated to match fund availability to project execution, and measures taken to improve the public procurement process.

Allocation to infrastructure remains the highest, taking 58.5 percent of the development expenditure. In the FY’2022/2023, infrastructure expenditure is set to increase by 8.6 percent to Ksh416.4 billion, from Kshs 383.3 billion in FY’2021/2022 in line with the government’s agenda of increasing the development of critical infrastructure in the road, rail, energy, and water sectors in a bid to facilitate the movement of people and goods, lower the cost of doing business, improve access to social amenities, and increase Kenya’s competitiveness.

The total public debt requirement for the FY’2022/23 is set to reduce by 7.2 percent to Kshs 862.4 billion, from Ksh929.7 billion, in FY’2021/22 budget estimates. The public debt mix is projected to comprise of 32.5 percent foreign debt and 67.5 percent domestic debt, from 29.2 percent foreign financing and 70.8 percent domestic financing as per the FY’2021/2022 budget estimates.

Read: Bolt Hikes Fares Over Increased Fuel Prices

The debt servicing costs are set to rise by 17.7 percent to Ksh659.2 billion in FY’2022/23, from Ksh560.3 billion in the FY’2021/22 budget. The rise in debt servicing expenses is partly attributable to the depreciation of the Kenyan shilling given that 67.5 percent of the debt was denominated in US dollars as of December 2021.

Kenya’s GDP is estimated to have grown at a rate of 7.6 percent in 2021 and is expected to grow at a rate of 6.0 percent in 2022. The performance is pegged on the global recovery, reduced COVID-19 infections and increased vaccination. With the expected rebound in economic activity, the government projects increased revenue collections, which shall be supported by tax measures aimed at reducing funding from debt.

However, the Kenyan budget is expansionary as the government intends on spending more in the coming financial year to accelerate economic recovery and improve the livelihoods of Kenyans. The key concern remains on how the government will be able to meet its revenue collection targets given the already high cost of living, the resurgence of COVID-19 infections in the country’s trading partners and the fact that the budget will be implemented in an electioneering period.

Additionally, the country’s borrowing appetite remains elevated with its public debt burden at 66.2 percent as of December 2021. As such, it is expected the government to perform a balancing act on the expenditure and revenues collected to ensure that we do not rely too much on borrowings to finance our expenditure. The government can also seek alternative ways of funding rather than concentrating solely on domestic borrowing to ensure that it does not crowd out the private sector as banks will prefer lending to the government to minimize their risks of losses.

Read: Region’s Top 41 Brands Crowned In Post-pandemic Awards Gala