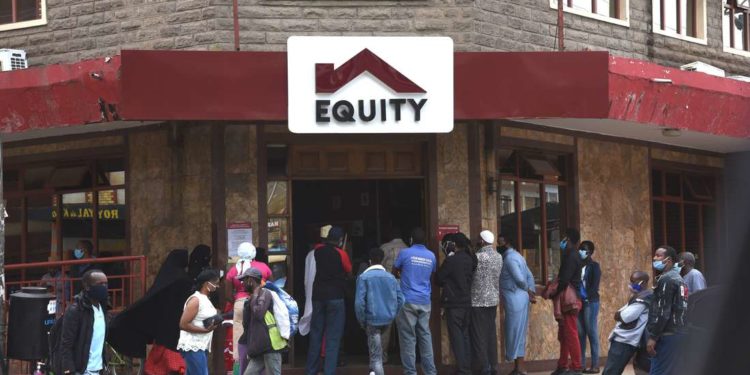

Equity Group Holdings has been ranked as the most attractive bank in Kenya, supported by a strong franchise value and intrinsic value score, according to the Cytonn Investments H1’2022 Banking Sector Report released on Monday, September 12, 2022.

The franchise score measures the broad and comprehensive business strength of a bank across 13 different metrics, while the intrinsic score measures the investment return potential.

The report themed “Earnings Growth Signify Banking Sector Resilience” analysed the H1’2022 results for the listed banks.

“The Core Earnings per Share (EPS) for the listed banks recorded a weighted growth of 34.0% in H1’2022, from a weighted growth of 136.0% recorded in H1’2021 when the sector was recovering from a lower base. Additionally, the Asset Quality for the listed banks deteriorated, with the gross NPL ratio increasing marginally by 0.3% points to 13.0% in H1’2022, from 12.7% in H1’2021. The listed banks’ management quality on the other hand improved, with the Cost to Income ratio increasing by 3.5% points to 53.6%, from 57.1% recorded in H1’2021, as banks continued to reduce their provisioning levels,” Stellah Swakei, Investment Analyst at Cytonn Investments, said.

Read: Ecobank Group Announces Jeremy Awori As Incoming CEO

Four key drivers shaped the Banking sector in H1’2022, namely regulation, regional expansion through mergers and acquisitions, asset quality, and capital raising.

“In H1’2022, listed banks continued to borrow from international institutions to not only strengthen their capital position but also boost their ability to lend to the perceived riskier Micro Small and Medium Sized Enterprises (MSMEs) segment. In the period under review, Equity Group received USD 165.0 mn (Kshs 18.6 bn) facility from the International Finance Corporation (IFC) in January 2022. Additionally, the International Finance Corporation (IFC) disclosed a plan to extend USD 150.0 mn (Kshs 18.0 bn) to KCB Group in form of a senior unsecured loan in August 2022. As for mergers and acquisitions, there was only one activity in H1’2022, but we expect to see Kenyan banks undertake more consolidation and continue diversifying into other African regions as they look to reduce their reliance on the Kenyan Market and distribute risks as well. In light of the above, KCB Group PLC, announced that it had entered into a final agreement with shareholders of Trust Merchant Bank (TMB) to acquire an 85.0% stake in the Democratic Republic of Congo (DRC)- based lender,” Kevin Karobia, Investment Analyst at Cytonn Investments, said.

Equity Group maintained its rank at position one while KCB Group’s rank declined to position four in H1’2022 from position two in Q1’2022, mainly due to an increase in the bank’s NPL ratio to 21.4%, from 16.9% in Q1’2022. However, Co-operative Bank’s rank improved to position two in H1’2022 from position four in Q1’2022 attributable to the improvement in its Net Interest Margin to 8.4%, from the 8.3% recorded in Q1’2022, leading to an increase in the bank’s franchise value score.

Listed Banks Franchise and Intrinsic Ranking

The table below ranks banks based on franchise and intrinsic ranking which compares metrics for efficiency, asset quality, diversification, growth, and profitability, among other metrics:

| Bank | Franchise Value Rank | Intrinsic Value Rank | Weighted Rank | Q1’2022 | H1’2022 |

| Equity Group Holdings Ltd | 3 | 1 | 1.8 | 1 | 1 |

| Co-operative Bank of Kenya | 1 | 4 | 2.8 | 4 | 2 |

| ABSA | 4 | 3 | 3.4 | 5 | 3 |

| KCB Group Plc | 7 | 2 | 4.0 | 2 | 4 |

| I&M Holdings | 4 | 5 | 4.6 | 8 | 5 |

| Stanbic Bank/Holdings | 1 | 8 | 5.2 | 3 | 6 |

| SCBK | 4 | 7 | 5.8 | 7 | 7 |

| DTBK | 10 | 6 | 7.6 | 6 | 8 |

| NCBA Group Plc | 8 | 9 | 8.6 | 9 | 9 |

| HF Group Plc | 9 | 10 | 9.6 | 10 | 10 |

*Market Cap Weighted as at 9th September 2022

Cytonn’s H1’2022 Listed Banks Earnings and Growth Metrics

| Bank | Core EPS Growth | Interest Income Growth | Interest Expense Growth | Net Interest Income Growth | Net Interest Margin | Non-Funded Income Growth | NFI to Total Operating Income | Growth in Total Fees & Commissions | Deposit Growth | Growth in Government Securities | Loan to Deposit Ratio | Loan Growth | Return on Average Equity | |

| ABSA Bank | 13.0% | 21.3% | 25.1% | 20.3% | 7.6% | 10.8% | 31.0% | (10.0%) | 6.7% | (0.4%) | 92.9% | 19.5% | 21.4% | |

| KCB | 28.4% | 15.7% | 30.3% | 11.5% | 8.5% | 29.9% | 32.1% | 24.4% | 15.6% | 30.4% | 80.4% | 20.3% | 23.2% | |

| Equity | 36.1% | 28.6% | 30.9% | 27.8% | 7.3% | 24.4% | 39.4% | 28.5% | 18.5% | 16.9% | 67.0% | 28.9% | 31.9% | |

| NCBA | 66.9% | 10.9% | 12.0% | 10.2% | 6.0% | 32.5% | 48.9% | (2.2%) | 7.1% | 17.0% | 53.5% | 4.5% | 17.3% | |

| Standard | 10.9% | 4.4% | (21.4%) | 9.9% | 6.4% | 10.9% | 35.6% | (6.2%) | 3.1% | 2.1% | 44.8% | (1.3%) | 17.7% | |

| Stanbic | 36.9% | 14.8% | (2.2%) | 20.9% | 5.4% | 25.1% | 45.1% | 11.1% | (0.7%) | (36.1%) | 94.5% | 17.5% | 20.1% | |

| I&M | 15.9% | 19.3% | 20.2% | 18.7% | 6.4% | 28.2% | 32.5% | 30.1% | 13.2% | 17.2% | 73.8% | 13.0% | 13.3% | |

| DTBK | 25.6% | 12.5% | 11.4% | 13.3% | 5.2% | 17.8% | 26.0% | 9.4% | 10.4% | (4.3%) | 67.4% | 14.3% | 7.8% | |

| Cooperative | 55.7% | 10.0% | 5.5% | 11.8% | 8.4% | 28.8% | 38.7% | 36.8% | 3.8% | 0.7% | 78.0% | 9.6% | 21.8% | |

| HF Group | 114.4% | 4.6% | (1.3%) | 11.4% | 4.5% | 53.2% | 32.7% | 13.2% | 3.4% | 87.8% | 89.2% | (1.1%) | (2.4%) | |

| H1’22 Mkt Weighted Average* | 34.0% | 18.0% | 18.6% | 17.7% | 7.3% | 24.4% | 37.1% | 17.9% | 11.3% | 11.6% | 72.7% | 17.7% | 23.4% | |

| H1’21 Mkt Weighted Average** | 136.0% | 15.0% | 10.8% | 17.6% | 7.4% | 19.2% | 35.6% | 16.6% | 18.4% | 12.4% | 68.8% | 11.7% | 16.9% | |

| *Market cap weighted as at 9th September 2022 | ||||||||||||||

| **Market cap weighted as at 9th September 2021 | ||||||||||||||

The listed banks recorded a 34.0% weighted average growth in core Earnings per Share (EPS), compared to a weighted average increase of 136.0% in H1’2021 for the listed banking sector.

Read: Equity Bank Agrees To By Cash-strapped Spire Bank

The Banks have recorded a weighted average deposit growth of 11.3%, slower than the 18.4% growth recorded in H1’2021, an indication of reduced investment risk in the business environment.

Interest income grew by 18.0%, compared to a growth of 15.0% recorded in H1’2021 while the weighted average Yield on Interest Earning Assets (YIEA) decreased to 9.8%, from the 9.9% recorded in H1’2021 for the listed banking sector. On the other hand, the Net Interest Margin (NIM) stood at 7.3%, 0.1% points lower than the 7.4% recorded in H1’2021 for the whole listed banking sector.

Non-Funded Income grew by 24.4%, compared to the 19.2% growth recorded in H1’2021. This can be attributable to the faster growth in the fees and commission which grew by 18.0% outpacing 16.6% growth in H1’2021.

Email your news TIPS to editor@thesharpdaily.com