The economic impact of aging populations in Kenya is a multifaceted issue that has significant implications for the country’s socio-economic landscape. As of 2024 according to the Kenya National Bureau of Statistics, Kenya’s population is approximately 56.4 mn, with around 3.4 mn people aged 60 and above, constituting about 6.0% of the total population. This demographic shift is expected to continue, with the proportion of older people projected to more than double by 2050. The aging population presents both challenges and opportunities for Kenya’s economy.

One of the primary economic impacts of an aging population is the increased pressure on the healthcare system. Older individuals typically require more medical care and long-term care services, which can strain the already limited healthcare resources in Kenya. The government has introduced policies such as the Older Persons Bill in March 2024, to address these challenges by providing a framework for the empowerment and protection of older persons, including access to healthcare and social support.

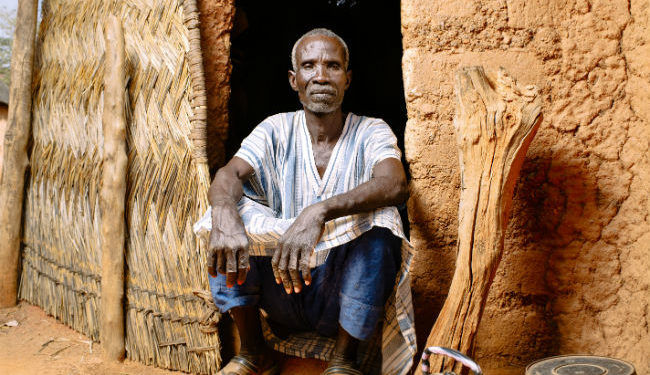

Another significant impact is on the labor market. As the working-age population shrinks relative to the dependent population, there may be a decrease in the labor force participation rate, which can lead to reduced productivity and economic growth. This demographic shift can also result in a higher dependency ratio, meaning fewer working-age individuals are available to support the non-working population, including children and the elderly. To mitigate these effects, the government has implemented social protection programs such as the Inua Jamii 70+ project, which provides cash transfers to older persons to improve their income security and access to healthcare.

The aging population also has implications for social security and pension systems. With more people reaching retirement age, there is an increased demand for pensions and other retirement benefits. The government has introduced a universal pension scheme to ensure that older persons receive adequate financial support. However, funding these programs can be challenging, especially given the high levels of poverty and inequality in the country. The GINI coefficient, a measure of income inequality, was 40.8 in 2015, indicating significant disparities in income distribution.