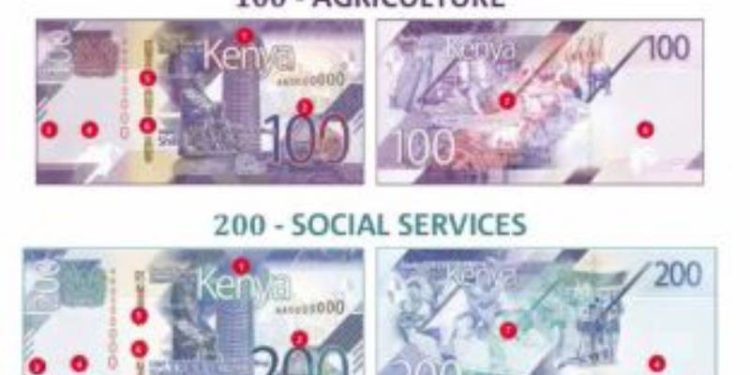

In a bid to uphold constitutional standards, the Central Bank of Kenya (CBK) has announced significant changes to the Kenyan currency notes. These updates, detailed in a recent statement by CBK, will affect the KES 50, KES 100, KES 200, KES 500, and KES 1,000 denominations.

The CBK clarified that these updates are an enhancement of the previous versions and will circulate concurrently with the existing notes. The new banknotes feature four major changes designed to improve security and compliance with constitutional requirements.

The first change is the inclusion of the signature of the current Governor of the Central Bank of Kenya, Dr. Kamau Thugge. This update ensures that the banknotes reflect the current leadership of the CBK. Dr. Thugge, who has been instrumental in steering the bank’s policies, emphasized the importance of this update: “This is a significant step in maintaining the integrity and trust in our currency system.”

Additionally, the new banknotes will bear the signature of the Principal Secretary of the National Treasury, Dr. Chris Kiptoo. Dr. Kiptoo’s signature on the currency notes signifies the collaboration between the Central Bank and the National Treasury in the management of Kenya’s monetary policy. “The inclusion of my signature alongside that of the CBK Governor is a testament to our unified effort in ensuring the stability and security of our currency,” Dr. Kiptoo remarked.

The third change is the year of print, which will be updated to 2024. This update will make it easier for the public to identify the new series of notes and distinguish them from older versions.

Perhaps the most significant change is the introduction of new security threads with color-changing effects specific to each denomination. These advanced security features are designed to combat counterfeiting and ensure the authenticity of Kenyan banknotes. According to CBK, these security threads will provide a higher level of protection and make it easier for the public to verify genuine notes. “The new security features are a leap forward in safeguarding our currency against counterfeiting,” Dr. Thugge explained.

The rest of the features on the banknotes will remain the same as those issued in 2019, ensuring a degree of continuity and familiarity for the public. “All banknotes currently in circulation remain legal tender and will circulate alongside the newly released banknotes,” the CBK statement confirmed.

The rollout of the updated currency notes will begin with the KES 1,000 denomination, followed by the other denominations in the coming months. This phased approach is intended to ensure a smooth transition and minimize any potential disruption to the economy.