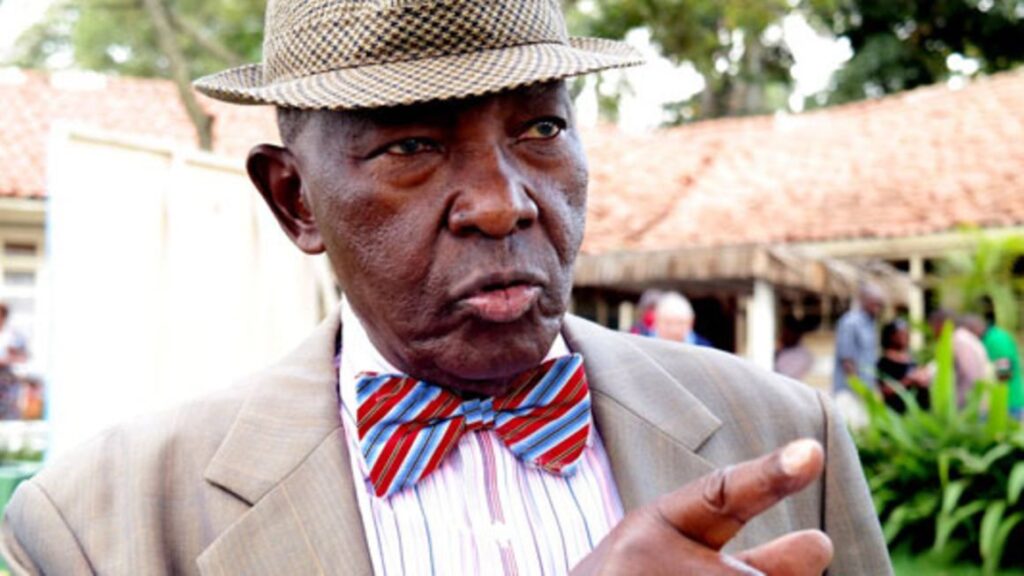

Billionaire businessman Joe Wanjui has moved to court seeking to block Unilever from selling its 52 percent stake in Limuru Tea to a private equity fund.

Wanjui, who owns a 25.48 percent stake in the firm, wants the Capital Markets Authority (CMA) to block sale arguing that minority shareholders were not offered a chance to participate.

Alongside Wainaina Kenyanjui, another minority shareholder, they accuse Unilever of rejecting their offer to buy the 52 percent stake and instead sold the shares to private equity fund CVC Capital Partners.

Read: Mitumba Ban? Here’s What Raila Promised On Textile

Wanjui joined Unilever East Africa (formerly East African Industries (EAI)) as technical director in1968 and rose through the ranks to become the managing director and eventually executive chairman before retiring in April 1996.

Unilever announced in November 2021 that it had agreed to sell its global tea business to CVC Capital Partners for Ksh596.7 billion ($5.1 billion), which included its stake in Limuru Tea.

“The shareholders were denied an opportunity to understand and participate in the proposed transaction which would result in a wholly new entity holding the beneficial interest in Limuru Tea,” court papers read.

The deal will see the special purpose vehicle registered in the Netherlands, Puccini Bidco B.V, take up the 52 percent stake in Limuru Tea, a deal valued at Ksh443 million.

Read: Kendi Ntwiga Appointed Global Head Of Misrepresentation At Meta

Limuru Tea registered a net loss of Ksh9.5 million in 2021 compared to Ksh3.6 million loss registered in 2020.

The two local shareholders have asked the court to prevent the CMA from approving the acquisition and separately petitioned the regulator to probe the transaction and claims of impropriety in Limuru Tea.

They say Unilever has undue influence on the board of Limuru tea in breach of CMA corporate governance rules that require a third of board members to be independent directors.

Mr Wanjui started making money trading food coupons near Nairobi’s Khoja Mosque in the 1940s when he was 11 years and today has interests spread in hospitality, insurance, real estate, equity, agribusiness and horticulture.

He later credited his success to receiving an American education and a successful career that saw him rise to executive positions at Unilever East Africa and Industrial and Commercial Development Corporation (ICDC).

Read: Sanlam Posts Ksh413.6 Million Loss