In a pioneering move for Kenya’s capital markets, the Capital Markets Authority has approved the issuance of the country’s inaugural Sukuk bond to help finance affordable housing projects, officials announced Thursday.

The KES 3 billion Sukuk bond, named the Linzi Sukuk, will have an internal rate of return of 11.13% and aims to develop 3,069 institutional housing units, according to a statement from the Capital Markets Authority. Sukuk bonds comply with Islamic finance principles, making the new instrument a unique socially responsible investment opportunity in Kenya.

Read more: Kenya, Korea hail successful conclusion of Konza partnership phase

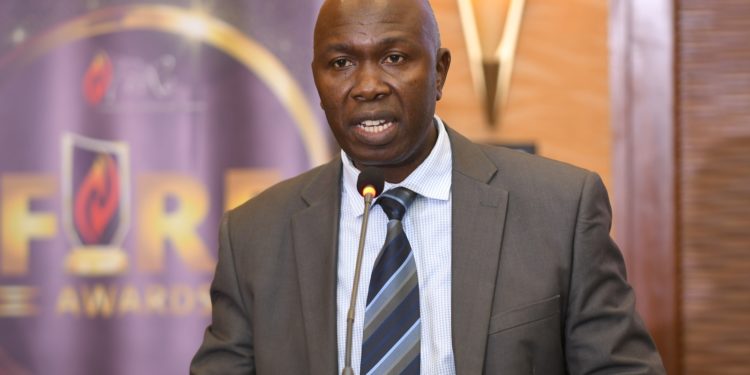

The bond’s approval marks a “groundbreaking development” for Kenya’s capital markets landscape, said CEO Wyckliffe Shamiah of bond issuer Linzi Finco Trust. He said the Sukuk bond will support the government’s goal of expanding affordable housing options for citizens.

“We are thrilled to embark on this pioneering journey with the issuance of the first Sukuk bond,” Shamiah said. “This financial initiative represents not only a new investment opportunity but also a significant step towards addressing the housing deficit in Kenya.”

Government statistics estimate Kenya’s housing demand at 250,000 new units per year, with only 50,000 built annually. The government aims to enable construction of 200,000 new affordable housing units each year through public-private partnerships.

Read more: How to check if your passport is ready for collection

The Linzi Sukuk will help mobilize financing for affordable housing projects to make progress toward closing Kenya’s housing gap, Shamiah said. It also expands the range of capital markets tools available for development funding.

The fixed-income Sukuk instrument complies with Islamic finance principles, including prohibitions on interest and pure monetary speculation. Kenya seeks to tap growing investor appetite with its inaugural Shariah-compliant bond.