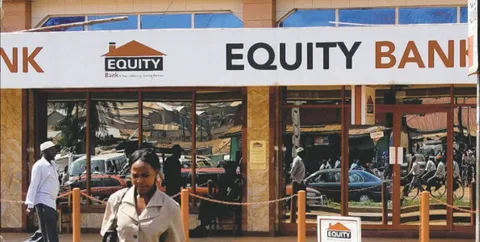

The banking sector in Kenya has been characterized by dynamic and rapid transformation, driven largely by mobile money platforms such as M-Pesa. Sadly, such technological strides have opened doors to fraudsters who are taking advantage to steal money from unsuspecting customers. Recently, Equity Bank has dismissed several employees across its branches who were involved in suspicious transactions through their bank and M-Pesa accounts. This outlines the harsh reality, where even well-established banks are vulnerable to internal breaches. While Equity Bank acted decisively to protect its operations and customers, how can other financial institutions minimize the risk of internal breaches and foster a culture of integrity within their workforce.

One of the lessons that can be learnt from the Equity Bank scandal is that integrity must be integrated into every aspect of a company. Many organizations talk about integrity, but few operationalize it. Integrity should be part of decision-making, team expectations, and business goals. It must guide both customer service roles and internal processes like verification, and digital approvals. Second, employees should be encouraged to embrace ethics in all their tasks. A common mistake among companies is delegating ethics to a specific department. This may be viable in theory; however, it is realistic for every employee to be encouraged to be more ethical. Ethics should be part of onboarding, performance reviews, and daily conversations. This can be enforced by using team meetings to discuss recent ethical cases and dilemmas either real or hypothetical. This will make ethics a shared responsibility. Third, platforms like M-Pesa have made transactions fast and accessible. But without real-time monitoring and layered access controls, insiders can exploit those same systems. Fraud is gradually evolving where it’s no longer just about stealing physical money, but manipulating digital workflows. The solution to this can be investing in intelligent fraud-detection systems that flag unusual behaviours, such as multiple new accounts created by one staff ID or high-volume transfers just below reporting thresholds.

Companies can foster a culture of integrity by encouraging senior officials to lead by example. This is because when senior officials act ethically, they set the tone for the whole company. Integrity must be demonstrated in actions and not just in their policy statements. If leaders cut corners, their subordinates will also follow them. Second, companies should reinvent their ethics training programs to include real-life case studies, interactive role-plays, and industry-specific scenarios such as digital fraud. Employees should also be rewarded if they demonstrate ethical behavior since if employees are only rewarded for hitting financial or operational targets, they may feel pressured to cut corners. Recognize employees who do the right thing, even when it slows things down or goes unnoticed by customers.

Equity Bank’s M-Pesa scandal is not unique. Similar incidents have affected banks across the region and globally. But this case is a reminder that no amount of innovation can replace basic ethical foundations. Creating a culture of integrity takes time. It requires leadership commitment, honest conversations, and employee involvement. But the cost of inaction in terms of money, reputation, and trust is much higher