The affordable housing initiative though not entirely new was launched in 2017 in order to provide citizens with low-cost decent homes while also reducing Kenya’s housing deficit which is currently at two million and growing at 250,000 against a supply of 50,000, and, increasing home ownership rates currently low at 21.3% in urban areas. This comes amidst the current government’s plan to deliver 200,000 housing units annually for the next five years, a total of one million units.

According to the Kenya National Bureau of Statistics (KNBS), 74.4% of Kenyan employees in the formal sector earn a monthly median gross income of Ksh50,000 or less, implying that a large percentage of these individuals would benefit from the plan.

Using the UN-Habitat definition of Affordable housing, assuming one is able to spend 30.0% of their income on housing, at a commercial mortgage rate of 12.0% and for a 25-year mortgage, it means an affordable house is a house that is valued at Ksh1 million for a single income household and Ksh2 million for a double income household. This is in line with the government’s plan which caps the housing units’ prices between Ksh1 million and Ksh4 million. However, it is worth noting that the objectives of the initiative have not been fully met with approximately only 1.0% of the housing units delivered so far. This has been primarily on the back of various setbacks such as;

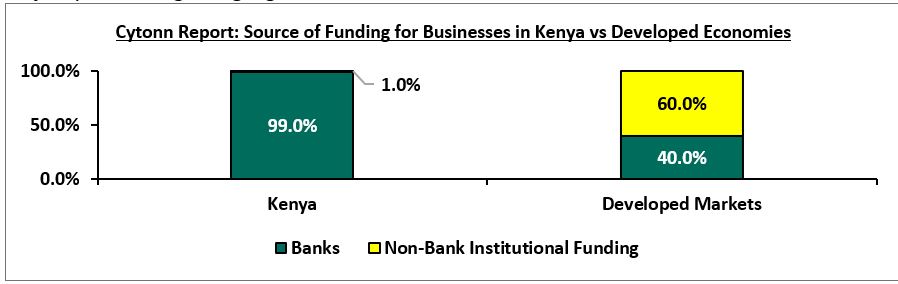

1. Inadequate Funding: Assuming the average production cost for a house will be Ksh2 million, to produce 200,000 houses per year will cost the government Ksh400 billion yet only Ksh20.3 billion was allocated to the housing sector with the affordable housing initiative only getting Ksh2.3 billion in the FY’22/23 budget. If the initiative is taken seriously, it would mean allocating 12.1% of the Ksh3.3 trillion budget to housing, and it’s not clear from which budget allocation it would be taken from. Consequently, funding continues to be a major challenge. This has further been fuelled by the overreliance on banks for funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding as highlighted below;

2. Increasing cost of construction: According to Integrum 2022 Construction Index, the average cost of construction per SQM in Kenya has risen by 3.6% to Kshs 34,650 in 2022 from Kshs 33,450 in 2021. This is attributable to rise in prices of key construction materials such as cement and steel which in turn increased the cost of development hence projects stalling,

3. Rising demographics surpassing the existing supply: Kenya has a high urbanization and population growth rates at 4.0% and 2.3%, respectively, compared to global averages of 1.6% and 1.2%, respectively, as at 2021. This increases the demand for housing amidst an existing under supply,

4. Inadequate supply of development land due to high cost of land: There is scarcity of affordable land for development due to rising land prices in urban areas with the average land prices in the NMA coming in at Kshs 130.42 mn as at Q3’2022, a 1.6% increase from Kshs 130.41 mn recorded in Q3’2021,

5. Challenging access to construction finance loans due to adverse financial terms: There has been rising loan default rates which has seen financial institutions ask for more collateral from borrowers,

6. Ineffectiveness of Public-Private Partnerships (PPPs) for affordable housing development owing to setbacks such as extended PPP timelines and lack of clarity on returns and revenue-sharing, among others,

7. Longer transaction timelines: It takes 44 days to register a property in Kenya with the average cost to register the property standing at 5.9% of the property price. This is higher when compared to some African countries like Ghana, which takes 33 days, with the average cost coming in at 4.1%, illustrating the generally slow processes in Kenya,

8. Unaffordable and inaccessible mortgages for those willing to be homeowners: Accessing mortgage by low income earners is a difficult task, given that mortgages require decent formal employment, a piece of land or property to act as collateral, as well as the rising cost of construction making prices of developments high and in turn causing low mortgage accounts.

Read: Inside President Ruto’s Promise To Provide 200,000 Housing Units Per Year

The table below shows the number of affordable housing units delivered so far in the respective case study countries;

| Cytonn Report: Summary of number of affordable housing units delivered in 2021 in the respective case study countries | |

| Name | Number of Units Completed |

| Singapore | 10,400 |

| Estonia | 6,735 |

| Canada | 56,207 |

| South Africa | 6,000 |

| Average | 7,578 |

N/B: Average done exclusive of Canada

It is worth noting that the number of housing units constructed per year in the selected countries is significantly higher than that in Kenya, with only 431 units having been completed in 2021. This is due to a number of factors in these countries, such as long-lasting government initiatives, ready monetization of housing assets, higher government subsidies and, better sector government regulation. However, the average number of units on an annual basis for each of the countries is way below the 200,000 housing units targeted by the Kenyan government, hence calling into question the feasibility of the 200,000 units per year target.

The following can be implemented to accelerate the affordable housing initiative in Kenya;

- Set a Housing Goal that Is Credible: It is not clear how the 200,000 units per year were arrived at, but it does not seem achievable looking at what other select countries have done given an average of 7,578 units per year, and these are more advanced economies. For the initiative to gain traction, it needs to be taken seriously, and to be taken seriously the target needs to be something that is credible,

- Focus on Demystifying Capital Markets: Lack of funding is the biggest obstacle to the provision of housing and for the housing agenda to be achieved, the majority of the capital has to come from Capital Markets. As discussed above, it would require about Ksh400 billion per year to meet the government target, yet in the latest financial year only Ksh2.7 billion was allocated to the sector, leaving a huge gap,

- Increase Financing By Improving PPP Operation: Currently, the Kenyan government is employing PPPs to undertake the development of infrastructure and affordable housing projects in the country. However, various challenges hamper their optimal operation leading to slowed delivery of projects. The government should address these challenges by increasing budgetary support for PPPs, decentralizing PPPs to the county level, and continually streamline the PPP Bill 2021,

- Reduce Construction Costs Through Innovation: Industry participants should seize the chances for the development of affordable housing through technologies that implement standardized building designs, components, and alternative materials such as prefabricated concrete panels to make a difference in the housing situation in Kenya. This is in order to increase the affordability of units through reduced costs, and further speed up the completion of projects,

- Create a Better Quality-Control Policy Framework: There is a need for a policy framework to ensure that developers comply with sustainable standards and that the units are affordable for low and middle-income households. There is also a need for a policy framework to guide the standards the affordable housing units to ensure there is no deterioration over time and that developers do not abandon or compromise the quality of housing they provide,

- Increase Serviced Land for Development: There is a need for the government to set up measures to increase the supply of serviced land, through increased investment in physical and social infrastructure especially in still developing areas of the country. The government should also encourage the construction of infrastructure by private developers through incentives such as rebates,

- Devolve the Management of Housing Assets: To ensure that even residents can easily acquire and maintain homes, the government should concentrate more on creating an environment that is favourable to owners and investors, by promoting the management of housing through the private sector. This can reduce the burden on the government from continually maintaining housing units once developed, and diverting the funds towards initiation of other projects, and,

- Creation of a Housing Finance Company to finance the supply side of Real Estate development, the same way we have KMRC to finance the demand side through the provision of mortgages for potential home buyers.

In conclusion, the Kenyan government’s affordable housing initiative is a welcome and necessary intervention in the provision of adequate housing for all Kenyan citizens. The initiative, if successful, will go a long way in addressing the housing crisis in the country and improving the lives of many Kenyans, even as it will create many jobs.

However, 200,000 housing units annually is way ambitious given the existing challenges; without radical action to remove the systemic obstacles to capital formation. As such, the government should execute comprehensive solutions to these challenges by taking lessons from other affordable housing initiatives, thereby allowing the affordable housing initiative to at least keep up with the other countries.

Email your news TIPS to editor@thesharpdaily.com