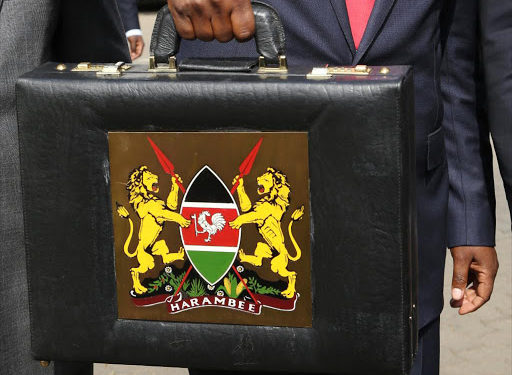

A supplementary budget is a financial adjustment made during the fiscal year to accommodate unforeseen or emergent expenses that were not initially accounted for in the original budget. These adjustments address critical needs, such as emergencies, policy changes, or unanticipated events. In Kenya, supplementary budgets are governed by Article 223 of the Constitution, and FY’2023/24 recorded two supplementary budgets, highlighting the continued uncertainty in Kenya’s fiscal space.

In the context of Kenya, the supplementary budget for 2024 is crucial due to the withdrawal of the Finance Bill 2024 by President William Ruto. This withdrawal means that the estimated revenues of KES 346 bn from the bill will not be collected, leading to a significant fiscal challenge for the current financial year. Consequently, the deficit is estimated to increase to KES 943.7 bn (4.6% of GDP), from KES 597.0 bn (3.3% of GDP), posing fiscal challenges for the current financial year FY’2024/25.

In response, the Kenyan government is reorganizing the budget, seeking alternative revenue sources to finance its projects, as well as cutting the budget, with the president announcing a KES 177 bn cut on expenditure. The nation will operate under the Finance Act 2023 starting July 1, 2024, while policymakers grapple with the implications of this unprecedented decision

The key points related to Kenya’s expected Supplementary Budget I for 2024 include:

- Budget Reorganization: With the Finance Bill 2024 no longer in play, the Kenyan government must reorganize its budget. Alternative revenue sources are being explored to finance critical projects, which we expect to increase the net domestic and net foreign borrowing targets from the current KES 263.2 bn and KES 333.8 bn, respectively.

- Projected Fiscal Deficit: The deficit is expected to increase from KES 597 bn to KES 943.7 bn, reflecting the revenue shortfall caused by the bill’s withdrawal. To note, the estimated revenues for the initial budget had taken into consideration the expected revenues from the implementation of the Finance Bill 2024.

The Finance Bill 2024 had proposed significant tax changes, including motor vehicle tax, eco-levy, VAT registration thresholds, and international tax adjustments which led to public protests leading to the withdrawal of the proposed bill. As Kenya navigates these challenges, policymakers must balance fiscal responsibility with the nation’s development goals. The supplementary budget process ensures that critical needs are met while maintaining financial stability.

Supplementary budgets play a vital role in adjusting financial plans to address unforeseen circumstances, and Kenya’s 2024 supplementary budget will be closely watched as the country adapts to changing economic dynamics and revenue constraints.