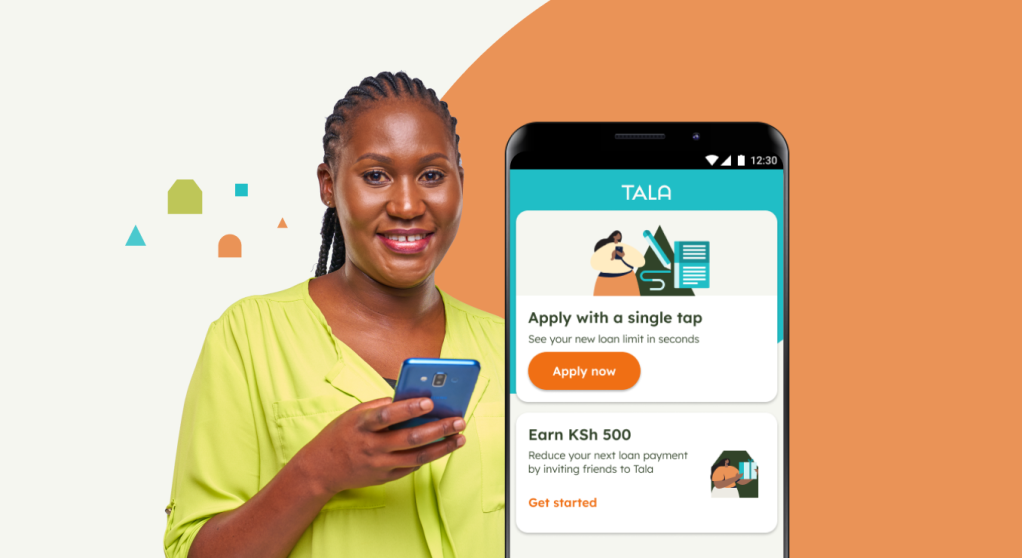

Tala has introduced a new feature enabling users to seamlessly access additional loans up to their pre-approved limit. The “top-up loan” feature eliminates the need for borrowers to undergo the reapplication process, streamlining the lending experience and saving valuable time.

Previously, users seeking new loans were required to fully repay existing ones before submitting fresh loan applications. Tala emphasized that this innovative solution aims to assist clients in managing day-to-day financial needs, such as expenses for school supplies and utility bills.

Annstella Mumbi, Tala’s General Manager, described the move as a strategic initiative to restore autonomy and control over customers’ financial lives while aligning with the company’s commitment to responsible lending principles. She explained, “Now, a customer can borrow a specific amount for a particular need without exhausting their full credit limit in one transaction, offering a more flexible borrowing experience.”

Mumbi highlighted that every repayment made by a customer contributes to replenishing their available credit, providing them with flexibility to utilize it whenever needed.

With a track record of disbursing over USD 2.7 billion in loans to 8.0 million customers across Kenya, India, the Philippines, and Mexico, Tala aims to address financial challenges faced by individuals across various socio-economic levels.

“At Tala, we recognize the ongoing financial hardships experienced by Kenyans at all social strata, and we are committed to collaborating with them to eliminate credit barriers that have hindered access to affordable credit for customers, including small businesses,” emphasized the General Manager.

Mumbi further expressed, “Our true success lies in transforming Kenya’s financial landscape through the improved lives of our customers and fostering shared growth and prosperity with every financially underserved Kenyan.”

“As part of our ongoing commitment, we will continue to introduce features and flexible products tailored to individual needs, ensuring that no Kenyan is left behind in the pursuit of financial inclusion,” she concluded.