The release of a third supplementary budget for the 2023/24 fiscal year, with an eye-watering addition of KES 187.3 billion to government spending, is less a display of economic savvy and more a testament to a government’s indecisiveness and misplaced fiscal priorities.

The recurrent revision of the budget by the Kenyan government has become a worrying ritual that raises eyebrows more than it garners applause. While supplementary budgets are, by their nature, tools for governments to respond to unforeseen economic circumstances, the frequency of Kenya’s budget overhauls is setting a dangerous precedent. Such fiscal flip-flops cast a long shadow over the executive’s ability to plan effectively and manage public resources prudently.

This most recent budget inflation is reserved predominantly for servicing external debt interest payments — a clear indication of the heavy financial burden that the weakening shilling has placed on the nation’s shoulders. It begs the question: When did ’emergency’ budget alterations become the norm for coping with currency fluctuations and debt management?

Moreover, the current reshuffling of funds from infrastructure and housing projects to seemingly more pressing sectors reflects a quick-fix approach to governance that neglects long-term development plans. It seems the Ruto administration is content to sacrifice the pillars of sustainable growth on the altar of immediate needs, showcasing a short-sighted perspective that may win some battles, but risks losing the war on economic stability and growth.

The parliamentary angst over this budgetary behavior is more than justified. Their call for more stringent control mechanisms is an echo of public sentiment that seeks to guard against the potential for financial misconduct that such budgetary practices can produce. It is incumbent upon our legislators to uphold Article 223 of our constitution, not as a mere guideline but as an inviolable protocol for fiscal responsibility.

The additional budgets indeed reflect a government in reactive mode, constantly shifting its fiscal stance to the next pressing issue, be it a pandemic response or a security fix. While adaptability is a desirable trait in governance, there is a fine line between being adaptable and exhibiting a lack of fiscal discipline.

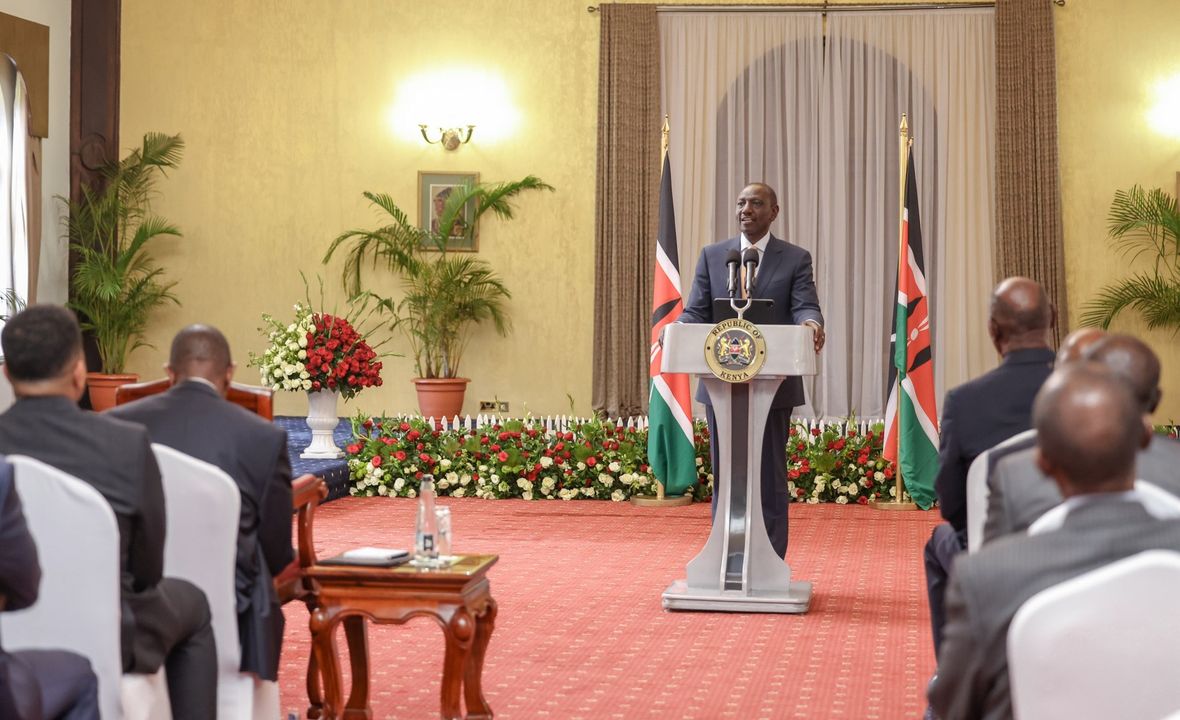

The debate is not just a fiscal one; it’s a moral one. The Kenyan public is left to grapple with the implications of these decisions: a government quick to adjust its financial belt at the expense of the continuity of progress in sectors that directly affect the welfare and future of its citizens. As the government of President William Ruto seeks to recalibrate its fiscal compass, it must remember that good governance is characterized by consistency, transparency and foresight — qualities that seem to be in short supply in the current administration’s approach to budget management.

As we venture into this new era of Kenyan economic policy under Ruto, one thing becomes increasingly clear: the necessity for a balance between nimble governance and the essentials of rigorous fiscal oversight has never been greater. The tug-of-war between the executive and legislative arms of government over budgetary matters is a drama that Kenyans can ill afford to become a regular programming feature. It’s time for the administration to step up and demonstrate that it can manage the country’s purse strings with the gravity and foresight that Kenyans deserve.