The national government is considering dismissing some of the outstanding payments owed by East African Portland Cement (EAPC) as a short-term revival measure for the cement firm. The firm’s debts amount to almost Kshs13 billion to both the government and private suppliers. This has led the firm to be unable to deliver its salary and tax obligations to its employees, amounting to almost Kshs1.5 billion, according to a report presented before the Public Investments Committee on Commercial Affairs and Energy.

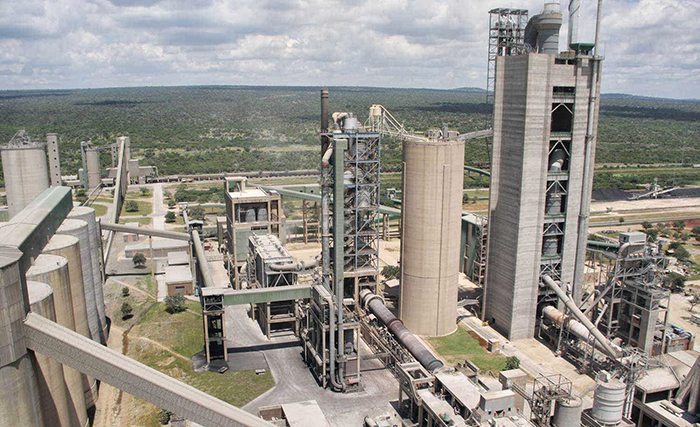

Read more: East African Portland Cement Resumes Manufacturing

The Industrialization Principal Secretary, Juma Mukwana, said before the committee that there is a six-point plan underway that will help revive the company and bring it back to operation. He added that there are engagements underway with the Treasury and other shareholders on securing strategic investors to inject funds into the firm. It was also noted that the company would require not less than Kshs 20 billion to be able to resume full operations.

EAPC has been making losses; its gross loss witnessed a five percent drop to Kshs782 million from Kshs821 million between the June 2021 and June 2022 financial periods. Its liabilities were more than its current assets by Kshs 10.7 billion. This was an indication of a weakening financial status for the cement manufacturer. The company continues to operate below capacity amid working capital constraints, a lack of essential spare parts, and a loss of market share to competitors.

Email your news TIPS to editor@thesharpdaily.com