Uganda’s Ministry of Energy has recently introduced a proposal aimed at reducing its reliance on petroleum products from Kenya. This development has taken Kenya by surprise, given that over 90% of its fuel imports are channeled through the Port of Mombasa in Kenya, with the remainder coming via the Dar es Salaam port in Tanzania.

The proposed bill is being framed as a form of protest against Uganda’s exclusion from a government-to-government agreement with Gulf nations. The Ministry of Energy argues that Uganda’s fuel supplies have become vulnerable due to its absence from the deal with Middle Eastern oil-producing countries. A statement from the Ministry highlights the resulting challenges, including increased costs and their subsequent impact on retail fuel prices.

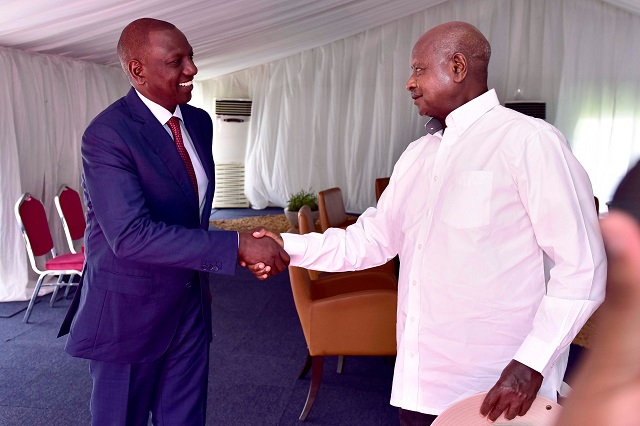

If the bill garners approval, it is scheduled to take effect in January 2024. Consequently, Uganda intends to restrict Kenya’s oil marketers from exporting oil to its territory in favor of the Uganda National Oil Company. The Ugandan government is actively engaged in discussions with the Kenyan government to ensure a seamless implementation of this policy change, emphasizing both nations’ commitment to regional stability and economic growth.

The ban will significantly limit Kenyan oil marketers to supplying solely within Kenya, posing an imminent financial threat as they face substantial losses due to diminished business opportunities. This rift between the two trade partners will also lead to a decrease in the inflow of U.S. dollars into Kenya, as these dollars are obtained through the sale of petroleum products to Uganda.

Given Kenya’s reliance on imports, a shortage of dollars will impact the procurement of other commodities, particularly fuel, leading to further increases in fuel prices and disruptions to the country’s supply chain.

This shortage will hinder the importation of essential goods, including food and medicine, potentially deteriorating the quality of life for Kenyans. Furthermore, due to insufficient dollar reserves, both small-scale and major traders will encounter difficulties in importing goods.

With dwindling stock and no means to replenish supplies for sale, businesses across the country will be severely affected.

Given the potential crippling consequences of this ban on the Kenyan economy, it is imperative that Kenya takes this as an opportunity to resolve the conflict before it exacerbates. This situation underscores the importance of consulting with stakeholders before implementing new policies, serving as a valuable lesson for the nation.