Unemployment is one of the biggest challenges facing third-world countries, Kenya included, keeping poverty levels and dependency high in such countries.

As a result, everyone who wants to be elected into government promises to tackle the menace, but close to 60 years since independence, Kenya is still struggling to do away with high unemployment levels.

According to the 2019 census data, it was estimated that 5,341,182 or 38.9 per cent of the 13,777,600 young Kenyans are jobless, painting a sorry picture of joblessness in the country.

Read: Tribute To The Late RBA CEO Nzomo Mutuku

In his inaugural speech on September 13, 2022, Kenya’s new President Dr William Ruto said that at least 800,000 youths join the workforce every year, with only 200,000 being able to find jobs.

“Jobs is our other priority. It is time for us to stem the tide of youth unemployment. Every year, 800,000 young people join the workforce and over 600,000 of them do not find opportunities for productive work. Moreover, our young people in cities and towns face very hostile environments, many times treated as a nuisance and their hustles criminalized. Those who seek to set up formal businesses are faced with the bureaucratic monster that is multiple licences,” Dr Ruto said.

Despite the promises, the new administration needs to understand that we cannot create jobs without growing enterprises. We cannot grow enterprises without businesses accessing funding.

One of the best ways of growing enterprises is restructuring the policies in the banking and capital markets, to enable the free flow of funds in all sectors, without having to stifle one sector to grow another one.

Read: Why World’s Most Powerful Passports Have The Least Travel Freedom

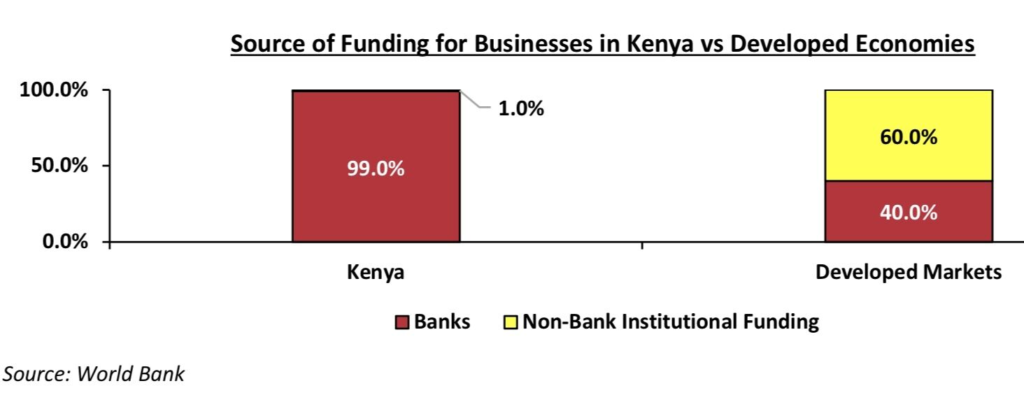

According to World Bank data, in well-functioning economies, banks provide only 40 per cent of business funding with a majority of 60 per cent coming from capital markets. However, in Kenya due to our moribund capital markets, banks provide 99 percent of business funding leaving only 1 percent of funding from capital markets. That is why financing for businesses is hard to access and when accessed it’s expensive.

Kenyan banks are the most profitable globally – with a return on equity of about 23 percent because there is no competition from capital markets.

The problem is not banks, the problem is dead capital markets.

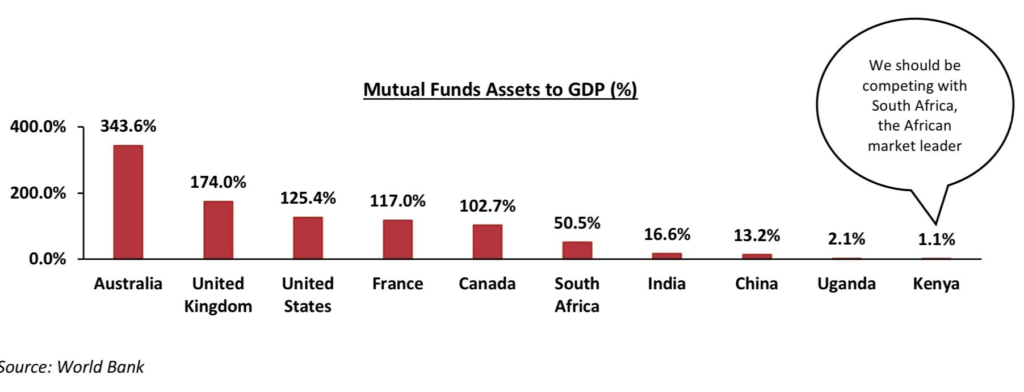

The Ruto administration will need to focus on reforming our Capital Markets if they want to grow businesses and create jobs.

Capital Markets, being a catalyst for economic growth, also enable the business community to raise long-term capital funds that are used to purchase capital goods, thereby propelling their growth and supporting the country’s economic growth.

According to the Capital Markets Roundtable for Kenya, the key reforms needed to catalyze capital markets growth is to open the markets to more participants, infuse the management of the Capital Markets Authority with staff that has capital markets business experience, allow unit trust funds to have more than one bank account to receive investor funds, and free unit trust funds from the control of banks as the sole trustees by allowing for corporate trustees.

Edwin Dande is the CEO of Cytonn Investments and a senior analyst with The Sharp Daily

Email your news TIPS to editor@thesharpdaily.com