Starlink, the satellite internet service owned by Elon Musk’s SpaceX, has already captured 0.5% of Kenya’s broadband market despite being launched just earlier this financial year, according to the latest data from the Communications Authority (CA) for Q4 2023/24.

The Q4 Sector Statistics Report shows that Starlink, licensed this year, reported 8,063 subscriptions, accounting for 0.5% of the total fixed data subscriptions in Kenya by June 2024. This marks significant early growth for the satellite provider, as the country’s overall satellite subscriptions skyrocketed by 1,955.3% over the financial year, rising from just 405 subscribers in June 2023 to 8,324 in June 2024.

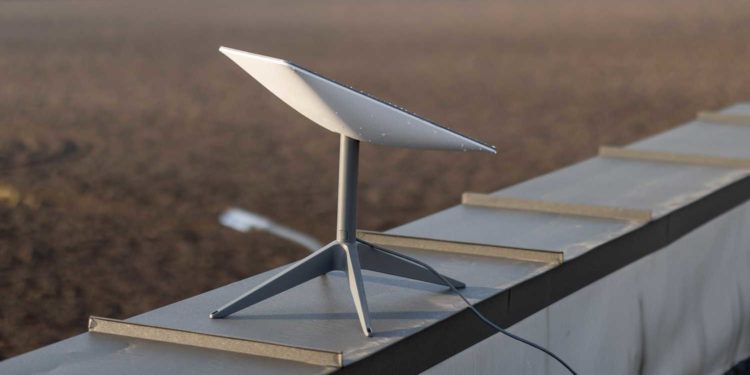

Starlink’s success lies in its high-speed internet, which appeals to customers in areas with limited connectivity options. Of Starlink’s users, 96.9% were subscribed to data speeds between 100 Mbps and 1 Gbps. This positions the service as a strong alternative for regions where conventional broadband is unavailable or unreliable, further accelerating internet adoption across the country.

“The entry of Starlink into the Kenyan market has spurred satellite internet growth significantly, with more users opting for the service due to its high-speed capabilities, particularly in underserved regions,” the CA report stated.

Kenya’s fixed broadband market saw an overall growth of 7.4% in the same quarter, with total subscriptions reaching 1.5 million by the end of June 2024. Fibre optic services continue to dominate the market, with 939,553 subscriptions, marking a 28.2% year-on-year increase. Safaricom PLC holds the largest market share, accounting for 36.4% of total subscriptions, followed by Jamii Telecommunications at 24%, and Wananchi Group at 17.5%.

Despite the growing competition, Starlink’s market share reflects the increasing importance of satellite broadband. The report highlights that satellite services saw the most dramatic growth among all fixed internet technologies, positioning Starlink as a key player in expanding internet access in rural and hard-to-reach areas.

“Starlink’s satellite technology provides a much-needed solution for many remote parts of Kenya, where traditional fibre and cable broadband services struggle to reach. This surge in adoption underscores the importance of alternative technologies in bridging the digital divide,” the report noted.

In parallel with the increase in broadband subscriptions, Kenya’s international bandwidth capacity also expanded. The total available international internet bandwidth grew by 2.4% to 21,244 Gbps by June 2024, driven by increased demand for faster internet speeds and higher data consumption. SEACOM Ltd, one of the largest undersea cable providers, added additional capacity to meet the growing needs of users.

Starlink’s impact on the market was also evident in the sharp rise in satellite internet capacity utilization. The report shows that satellite internet capacity usage jumped from 48.4 Gbps to 840.4 Gbps in just one quarter, an astonishing 1,635.1% increase, largely attributed to the entry of Starlink. The report indicates that the majority of satellite bandwidth users were subscribing to high-speed packages between 100 Mbps and 1 Gbps.

While Starlink dominated the satellite internet headlines, the mobile sector also experienced steady growth. The total number of mobile SIM subscriptions reached 68.9 million by June 2024, reflecting a penetration rate of 133.7%. Mobile broadband subscriptions continued their upward trend, with a 3.3% increase from the previous quarter, bringing the total to 38.5 million.

Smartphone usage also climbed, with 35.2 million smartphones connected to mobile networks, up 3.1% from the previous quarter. However, feature phones saw a decline, dropping by 1.1% to 30.8 million. This shift highlights Kenya’s ongoing transition toward more advanced mobile technologies as users increasingly adopt smartphones and mobile broadband services.

The report showed continued reliance on mobile data for internet access, with mobile data volumes reaching 448.2 GB during the quarter, representing a 2.5% rise compared to the previous period. Safaricom remained the leading mobile operator, with a market share of 36.4%, followed by Airtel Networks at 24%.