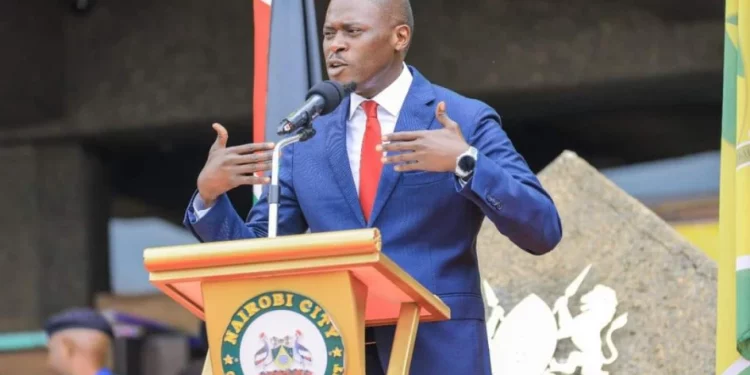

Nairobi County Governor Johnson Sakaja has announced a significant change in the revenue collection approach for the city. Speaking at City Hall Annexe on January 3rd during the inauguration of a new Customer Service Center, the governor declared a complete halt to cash payments in revenue collection.

Governor Sakaja underscored the importance of adhering to the new policy, stating that from now on, no cash payments would be accepted.

“I would like to inform Nairobians that going forward, we shall not accept any cash payment. If any of my Revenue team members ask for payment in cash, please report them to 020 2224281, and we will take immediate action. Legitimate County staff members will not do so,” he said

However, Governor Sakaja clarified that enforcement actions by County staff would be suspended until February 2024. He elaborated that January would serve as a transitional period, allowing businesses and entrepreneurs to adjust to the new payment system.

During this transitional phase, the governor encouraged businesses to utilize the time to acquire Unified Business Permits (UBP) or convert existing Single Business Permits to the new UBP, which became effective on January 1st. UBP consolidates business, fire, food, health, and advertising licenses into a single document, accessible through the county’s online NairobiPay Revenue service.

“With the activation of the UBP issuance on the NairobiPay portal, the county government is now on course to generate and reach its target of KES 20 billion in Own Source Revenues to fund development projects in the city,” stated the Governor.