Kenya’s public debt has increased by nearly Sh500 billion in the four months leading up to January this year, indicating a continued borrowing trend by the new government. This has raised concerns about the country’s potential for a significant debt crisis, especially as the National Treasury struggles to balance its debt portfolio, with commercial debts now occupying over 60.0% of tax revenues.

Central Bank of Kenya’s data shows that the country’s debt rose by Sh481 billion between September 2022 and January 2023, bringing it closer to the Sh10 trillion borrowing cap that Parliament established in June 2022. Despite this increase in public debt, the Central Bank of Kenya has issued a disclaimer, stating that the January data provided by the banking regulator and the National Treasury is provisional and that higher debt levels may emerge when accounting for February and March.

Read: Treasury Given Powers to Privatize Public-Owned Enterprises

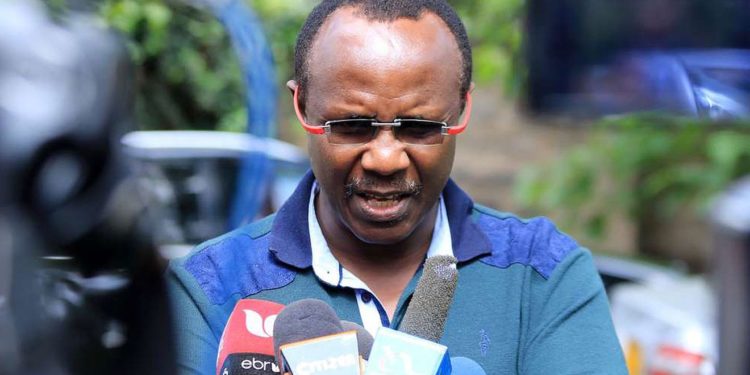

As a result of significant debt repayment, Kenya is now exposed to higher interest rates, which have tightened global loan market conditions, reducing the country’s borrowing opportunities as the shilling continues to depreciate against the dollar and other major currencies. Moreover, State House’s top economic advisor, David Ndii, has indicated that the government is facing an acute cash crunch due to the more substantial debt obligations.

Dr Ndii revealed that the government had avoided a default on its sovereign debt obligations, but he did not elaborate on the economic risks. However, the government’s delay in paying March salaries for most of its public sector workers has signaled a significant cash crunch, with civil servant unions threatening to go on strike from next week. Dr Ndii stated that the government has been forced to prioritize other essential state expenditures, such as honoring debt obligations, over paying salaries.

President William Ruto’s administration, which came into power in September last year, has put forward plans for Parliament to replace the current public debt limit of Sh10 trillion with a debt anchor linked to the Gross Domestic Product (GDP).

Read: ‘Brace For Tough Times’- Prof. Njuguna Ndung’u Says

The Commission for Revenue Allocation (CRA) has recently warned that the country is on course to exceed its Sh10 trillion debt ceiling, with Kenya’s financial stability at stake. If the debt ceiling is not raised after breaching it, further borrowing will not be possible, hampering the new government’s plans to raise debt to fund national programs.

The Kenya Kwanza administration aims to borrow Sh3.6 trillion in its first five-year term, with the National Treasury Cabinet Secretary Prof Njuguna Ndung’u saying that the government would seek direct concessional budget funding from multilateral lenders rather than expensive domestic and foreign commercial debts. The Treasury plans to borrow at favorable rates, negotiate stress-free repayment periods, and invest in projects with good socio-economic returns.

Global Growth Deferred By Rising Debts-IMF

The government intends to rely on institutions such as the International Monetary Fund (IMF) and the World Bank in the medium term to bridge the budget deficit, which will help reduce debt vulnerabilities.

Email your news TIPS to editor@thesharpdaily.com