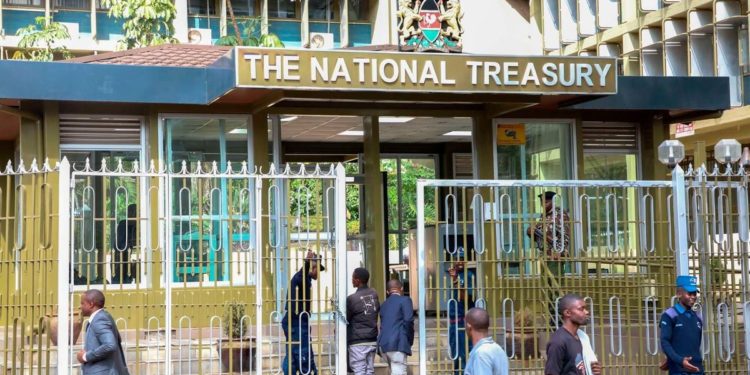

In a bid to reduce public debt and support ongoing projects, the national government has intensified efforts to bolster the financial stability of state corporations. The National Treasury Cabinet Secretary, John Mbadi, recently issued a circular urging these corporations to implement stringent financial management practices and adopt robust cost control measures in line with the Kenya Kwanza’s Bottom-Up economic transformation agenda.

The circular highlights the need for state corporations to operate in a highly cost-effective manner, ensuring that resources are maximized for optimal service delivery. “State corporations must embrace disciplined financial practices to ensure efficient service delivery while contributing positively to the country’s economic growth,” said Mbadi. He also emphasized that the role of state corporations in supporting the national budget through consistent revenue generation and dividend payments is crucial for the country’s fiscal health.

One key directive from the circular is the reminder to executive and accounting officers in state corporations that expenditures made without prior approval from the relevant ministry and the National Treasury are considered irregular. “Incurring expenditures without prior approval is a violation of the Public Finance Management (PFM) Act of 2012, and those found responsible will be held personally liable,” the circular warned.

State corporations are also being urged to increase their contributions to the national exchequer, which will, in turn, enhance public service delivery. To achieve this, the circular mandates that all state corporations must generate reasonable returns, declare profits, and pay dividends to the exchequer and other stakeholders. In particular, commercial state corporations are now required to revise their dividend policies, ensuring that at least 80 percent of their profit after tax is directed towards dividend payments.