Naivas International is eyeing to bag Kshs 5.8 billion (USD 41.7 million) from an extra sale of 11.0% of its stake to Mambo Retail. The founder of the supermarket chain, Peter Mukuha Kago, through the family’s investment vehicle, Gakiwawa Family Investments, is looking to offload 11.0% of its current 60.0% stake ownership of the supermarket chain to Mambo Retail Limited. Mambo Retail Limited currently owns a 40% stake in Naivas International. Mambo Retail is the investment vehicle comprising IBL, French fund Proparco, and German fund DEG, with IBL owning 65.8% of Mambo Retail, translating to 26.32 percent ownership in Naivas International.

Read more: Naivas Set To Open 3 More Branches Before Christmas

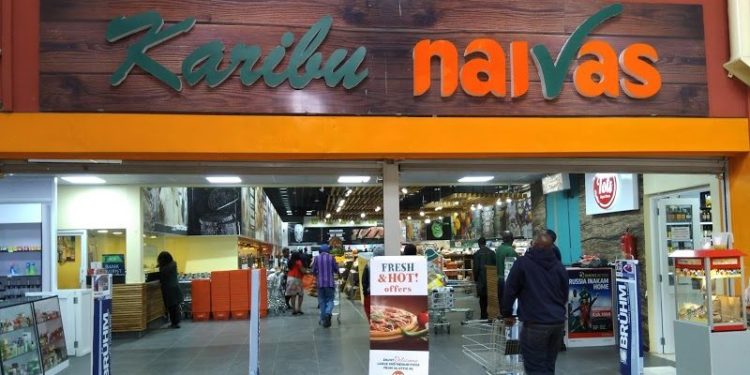

Naivas was established in 1990 and has grown to be the biggest supermarket chain in Kenya. Other close competitors in Kenya are Quickmart and Carrefour. Gakiwawa Family Investments owned 100% of Naivas International until 2020 when it decided to offload a 31.5% stake for Sh6 billion to a consortium comprising the International Finance Corporation (IFC), DEG, and private equity firms Amethis and MCB Equity Fund. However, in June last year, the IBL-led group reached a deal to buy the 31.5 percent stake held by IFC and its co-investors at the cost of Ksh16.8 billion (USD 119.68 million).

Read more: Naivas Opens 87th Outlet In Kahawa Sukari

The culmination of the current deal will see a decline in Gakiwawa Family Investments’ ownership of Naivas drop to 49.0% from 60.0%, while the stake will rise to 51.0% from 40.0% for Mambo Retail. This will automatically give Mambo Retail a controlling interest in Naivas. This, in turn, gives foreign investors control of the largest supermarket chain in Kenya.

Read more: China Square And The Potential For Low-Cost Retail In Kenya

Naivas Supermarket chain has been attracting investors due to its high profits and growth in market share. The chain recorded outstanding performance in the nine months leading up to March 2023, posting a net profit of Kshs 2.1 billion. In addition, the chain has an estimated market capitalization of Kshs 53.5 billion, making it one of the most valuable privately held companies.

The additional funds raised from the new share subscription are expected to increase the chain’s coverage in terms of increased retail outlets as well as solidify its position as a key player in the Kenyan Retail market. The retailer plans to add six more outlets to the existing 92 as it races to record 100 outlets, a record for any supermarket chain in Kenya.

The decision to offload more shares by Naivas founder can be attributed to the collapse of once dominant supermarket chains in Kenya like Nakumatt, Uchumi, and Tuskys, which either went bankrupt through large debts or mismanagement woes. Additionally, IBL’s future performance and prospects are largely dependent on the performance of Naivas; hence, prudent decision-making is advised while investing in IBL shares.

Email your news TIPS to editor@thesharpdaily.com