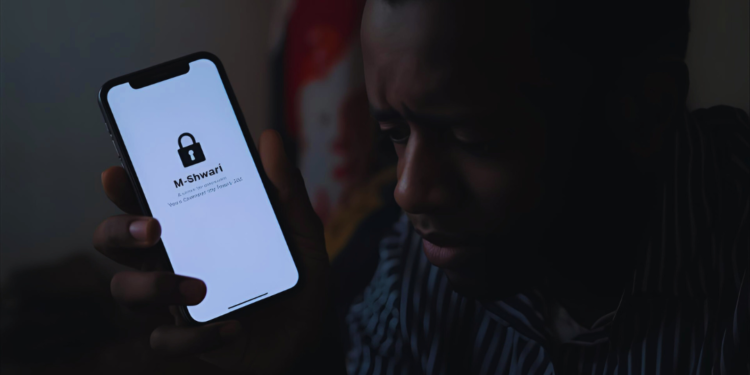

The M-Shwari crisis in Kenya has left thousands of savers locked out of their money. For over a decade, M-Shwari has been synonymous with convenient mobile savings and loans in Kenya. However, the M-Shwari crisis Kenya experienced in October 2025 exposed critical vulnerabilities in the platform. Technical outages, zero loan limits, and withdrawal problems have plagued M-Shwari users, leaving savers questioning whether their money is truly safe with this Safaricom-NCBA Bank partnership.

Understanding the M-Shwari Crisis Kenya: October 2025 Technical Outage

In late October 2025, M-Shwari users across Kenya experienced significant disruptions after a technical outage hit the service on October 30 and 31. The outage prevented customers from accessing their funds, sparking widespread frustration as users took to social media demanding answers.

The incident wasn’t just an inconvenience—it was a wake-up call. Users documented repeated failed withdrawal attempts, with some reporting deposits that failed to reflect in their locked savings accounts. Many Kenyans who rely on M-Shwari for daily transactions, including payments at restaurants and small businesses, found themselves stranded without access to their money.

One frustrated user, Eugine Meel, shared on social media: “Why do you have to close down M-Shwari services during the day without notifying your customers @Safaricom_Care I was almost beaten in some eatery.”

While Safaricom eventually confirmed the issue had been resolved and began account reconciliation, the damage to user confidence was already done. The outage persisted despite earlier assurances, with customers continuing to report difficulties accessing funds well into Friday night. The crisis highlighted a fundamental problem: when technical glitches occur with M-Shwari, savers have no alternative way to access their money.

Beyond October 2025: A Pattern of Recurring Outages

The October 2025 crisis wasn’t an isolated incident. M-Shwari has experienced multiple service disruptions over the years:

August 2024 Outage

In August 2024, M-Shwari customers experienced another major service disruption, with users taking to social media in panic. One user lamented: “M-Shwari has eaten my money,” while another wrote: “Shida ni gani na M-Shwari… ama leo mnataka nilale njaa?” (What’s wrong with M-Shwari… or do you want me to go hungry today?)

December 2017 Christmas Crisis

Perhaps the most devastating outage occurred during Christmas 2017, when customers experienced more than 48 hours of service disruption. The timing was catastrophic—many users had locked savings accounts with maturity dates between December 20-24, planning to withdraw their funds for Christmas celebrations.

One customer told Business Today: “I had to lie to my wife that I had forgotten my ATM in Nairobi and borrow money from a friend.” The incident underscored how dependent Kenyans have become on M-Shwari, and how vulnerable they are when the system fails.

These recurring patterns reveal systemic reliability issues that go beyond occasional technical glitches.

The Persistent Problem: Zero Loan Limits and Frozen Accounts

Beyond the technical outages, M-Shwari has been plagued by ongoing eligibility issues that have frustrated users for years:

The Zero Limit Mystery

Countless Kenyans have found themselves locked out of borrowing despite meeting what they believed were the requirements. Users report having zero M-Shwari loan limits even after:

- Using their M-Pesa lines for over 10 years

- Saving consistently on the platform

- Maintaining active Safaricom services

- Having clean repayment histories

One frustrated customer, Anitah Cee, lamented on Safaricom’s Facebook page: “My line is over 15 years now and active in M-Pesa…but I can’t even get M-Shwari loans, why?”

Safaricom has explained that simply having an M-Pesa line for years doesn’t qualify one for M-Shwari loans. The company requires customers to transact via M-Shwari accounts, save frequently without withdrawing for extended periods, maintain positive credit scores, and use other Safaricom services like airtime.

The Savings Trap

Perhaps most concerning is what happens when users try to grow their savings. One Kenyan questioned why their M-Shwari limit remained zero despite saving regularly. Safaricom responded that saving alone isn’t enough—users must also retain savings for extended periods, pay OKOA Jahazi loans promptly, and maintain clean Credit Reference Bureau status.

In one particularly frustrating case, Atuti Tiberius revealed that after delaying his M-Shwari loan repayment by just two days and paying it off, he has been unable to access M-Shwari loans for years, maintaining a zero limit despite his efforts.

Safaricom clarified that “Loan limits are automatically reviewed by the system and are at the discretion of the bank. This depends on how regularly you have been saving, repaying your loans (including Okoa Jahazi) on time, and using other Safaricom services like voice, data, and M-Pesa.”

This creates a troubling catch-22: to qualify for loans, you must save without withdrawing. But savings platforms should provide liquidity, not lock your money away indefinitely.

What Went Wrong: Understanding the Root Causes

1. Lack of True Liquidity

Unlike regulated money market funds where you can withdraw within 24-48 hours, M-Shwari’s technical infrastructure can fail completely, leaving you with zero access to your money. There’s no backup system, no alternative withdrawal method—just hope that the technical issues resolve quickly.

2. Opaque Eligibility Criteria

The algorithm determining loan limits and savings benefits remains a black box. Users who believe they’ve met all requirements suddenly find themselves with zero limits, with little explanation or recourse.

3. Regulatory Gaps

While NCBA Bank is regulated by the Central Bank of Kenya, the M-Shwari platform operates in a gray area between banking and mobile money services. This creates confusion about investor protection and recourse when things go wrong.

4. No Deposit Insurance

Unlike traditional bank accounts with deposit insurance, or money market funds regulated by the Capital Markets Authority with CDSC investor protection, M-Shwari offers limited safeguards if something catastrophic occurs.

Why Money Market Funds Like Cytonn Offer a Safer Alternative

The M-Shwari crisis has driven many Kenyans to seek more reliable savings alternatives. Money Market Funds (MMFs), particularly those regulated by the Capital Markets Authority, present a compelling solution.

Superior Returns

As of January 2025, the Cytonn Money Market Fund delivered an annualized return of 16.6%—significantly higher than M-Shwari’s lock savings interest rates. This means your money works harder for you while remaining accessible.

Real Liquidity

For Cytonn Money Market Fund withdrawals below KES 150,000, funds are automatically transferred to M-PESA or bank accounts and received within 3 minutes. Even during technical issues, you have multiple channels to access your money.

Regulatory Protection

The Cytonn Money Market Fund is regulated by the Capital Markets Authority (CMA) and aims to provide investors with current income while preserving capital and maintaining liquidity. This regulatory oversight provides a layer of investor protection absent from digital lending platforms.

Low Entry Barriers

The Cytonn Money Market Fund requires a minimum initial investment of just KES 1,000, with no minimum top-up amount required—making it accessible to everyday savers who previously relied on M-Shwari.

Professional Management

Cytonn Money Market Fund’s strategy focuses on outperforming returns from traditional savings accounts by investing in interest-bearing securities, short-term government instruments, and bank deposits. As of September 2025, the fund’s asset allocation comprised 62.4% in fixed and demand deposits, 24.6% in collective investment schemes, 11.5% in government securities, and 1.5% in cash.

Building Financial Stability Through the Cytonn Money Market Fund

What Savers Should Do Now

1. Diversify Your Savings

Don’t put all your money in one platform. Spread your savings across regulated money market funds, traditional bank accounts, and only keep minimal amounts in digital lending platforms like M-Shwari.

2. Understand Withdrawal Terms

Before depositing money anywhere, confirm:

- How quickly can you access your funds?

- Are there technical issues that could block access?

- What happens during system outages?

- Is there a backup withdrawal method?

3. Prioritize Regulated Institutions

Choose savings vehicles regulated by the Central Bank of Kenya, Capital Markets Authority, or other government regulatory bodies. Regulation provides recourse when things go wrong.

4. Check Your Credit Report

If you’ve had M-Shwari issues, verify your credit status with Kenya’s Credit Reference Bureaus:

Technical glitches and system errors can sometimes incorrectly impact your credit score. Learn more about how CRBs work in Kenya to protect your financial reputation.

5. Consider Money Market Funds

For short-term savings with high liquidity and better returns, regulated money market funds offer a superior alternative to digital lending platforms. You get professional fund management, regulatory oversight, and proven track records.

The Bottom Line

The M-Shwari crisis timeline reveals a pattern of technical failures, opaque processes, and limited investor protection that should concern any serious saver. While the platform pioneered mobile banking in Kenya and served millions, recent events demonstrate that convenience shouldn’t come at the cost of security and reliability.

Money Market Funds like Cytonn offer the accessibility Kenyans need with the professional management and regulatory protection they deserve. With higher returns, faster withdrawals, and Capital Markets Authority oversight, MMFs represent the evolution of how Kenyans should think about saving and investing.

Useful Resources for Kenyan Savers

Regulatory Bodies:

- Central Bank of Kenya – Banking sector regulation

- Capital Markets Authority – Investment funds regulation

- CMA List of Licensed Fund Managers

Credit Information:

Financial Education:

- Cytonn Research Reports – Weekly market insights

- CMA Investor Education

- CBK Financial Inclusion Resources

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with licensed financial advisors before making investment decisions. Past performance is not indicative of future results.