Kenya’s debt level has been a point of discussion with institutions such as the World Bank and the International Monetary Fund (IMF) stressing on the need for Kenya to focus on fiscal consolidation on the back of the high risk of debt distress.

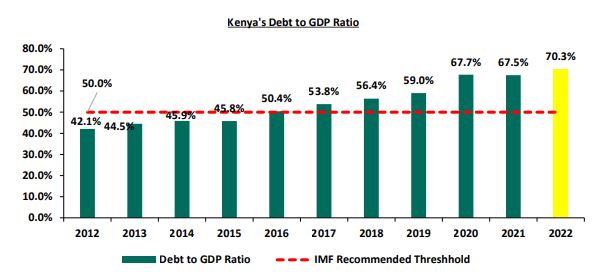

As of May 2022, Kenya’s debt to GDP ratio stood at 69.1%, 19.1% points above IMF’s recommended threshold of 50.0% for developing countries.

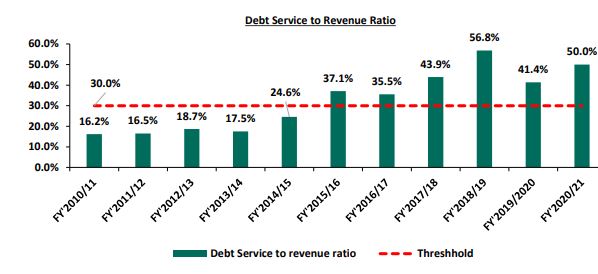

Similarly, Kenya’s debt service to revenue ratio continues to increase, coming in at 50.0%, 20.0% points above IMF’s recommended threshold of 30.0% as of December 2021. The sustained level of debt service to revenue ratio above the recommended threshold is elevating the refinancing risk following shocks arising from the pandemic and global supply disruptions accelerated by the ongoing Russian-Ukrainian conflict.

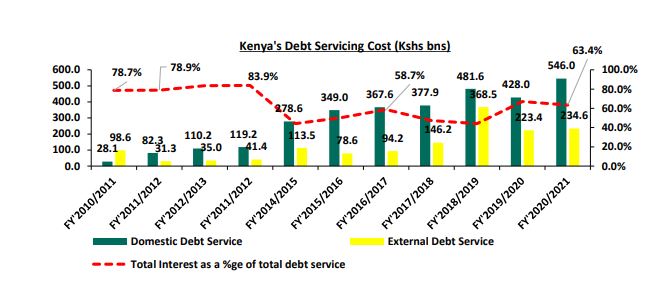

Kenya’s debt servicing costs have grown at a 10-year CAGR of 23.0% to Kshs 780.6 bn in FY’2020/2021, from Kshs 98.6 bn in FY’2010/2011. Notably, the debt servicing costs represented 40.7% of the total expenditure in FY’2020/2021.

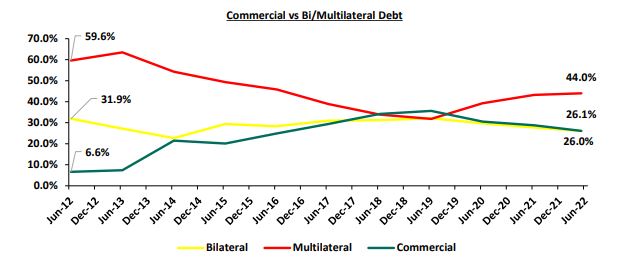

Kenya’s exposure to bilateral and multilateral loans has been declining in favour of a much more commercial funding structure comprising of Eurobonds and syndicated loan facilities. Concessional loans have increased by a 10-year CAGR of 16.6% to Kshs 3.0 tn in May 2022 from Kshs 0.7 tn in June 2012 while commercial loans, which are deemed more expensive, have grown at a 10-year CAGR of 36.3% to Kshs 1.1 tn as at May 2022 from Kshs 50.5 as at June 2012.

Going forward, the ongoing global shocks continue to present economic challenges such as the rising global energy and commodity prices, which are expected to create new spending needs thus affecting any fiscal consolidation efforts. However, we note that a strong fiscal outlook is essential for a growing and thriving economy.

Read: Defaulters Of Safaricom’s Interest-free Faraja Loans To Face Auction

As such, we expect the government to work on strategies to reduce the economic consequences of high debt levels and increased risk of debt distress. We however commend the government on the continuous efforts to boost revenue collection but we believe a lot needs to be done.

Below are some actionable steps that the government can take to reduce the debt overhang;

i. Enhance Fiscal Consolidation – High fiscal deficit attributable to higher expenditure as compared to revenue collections is the main driver of the high borrowing levels. The government can bridge the deficit gap by implementing robust fiscal consolidation through expenditure reduction by introducing austerity measures and reducing amounts extended to recurrent expenditure. The strategy would also enable the Government to refinance other essential sectors such as agriculture which would raise more revenues. Additionally, the government can also limit capital expenditure to projects with either high social impact or have a high Economic Rate of Return (ERR), and high economic benefits outweighing costs,

ii. Promote Capital Markets – The government should channel efforts towards strengthening the Capital Markets structure to ease the pooling of funds by investors to undertake development projects. Key to note, our capital markets remain dormant with banking markets having mobilized Ksh4.7 trillion in deposits compared to Collective Investment Schemes at only Ksh0.1 trillion, hence the need to increase support to the sector.

iii. Improving the Country’s Exports – The government should formulate export and manufacturing favourable policies to improve the current account while lowering imports to preserve our foreign exchange reserves. This would stabilize the exchange rate and stop our foreign denominated debt from increasing as the shilling depreciates.

Read: Tribute To The Late RBA CEO Nzomo Mutuku

iv. Diversification of Funding of Projects – The government should fully operationalize and remove bottlenecks to Private Public Partnerships (PPPs) and joint ventures to attract more private sector involvement in funding development projects such as infrastructure instead of borrowing.

v. Enhancing Parliament’s Oversight Role – Parliament is an independent body mandated to oversee the operations of the executive. Therefore, it should ascertain that future debt uptake is well interrogated, is feasible and will bring economic benefit to the country. Legislators should ensure that fiscal deficits are sustainable at the budget approval stage to reduce the need for borrowing.

vi. Spur Economic Growth – it is critical that the government implement policies that will spur economic growth such as enhancing ease of doing business, promoting tourism, entrepreneurship and innovation so that there is more revenue to growth the economy and pay down debt.

vii. Addressing Financial Weaknesses of Parastatals – The government should revive economic performance of parastatals or privatize poorly performing ones to release capital, lower debt and also to prevent the widening of debt from losses and inefficiencies.

Email your news TIPS to editor@thesharpdaily.com