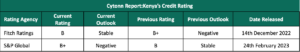

On 24th February 2023, S&P Global downgraded Kenya’s credit outlook to negative from stable and followed a downgrade of the Long Term Foreign Currency issuer default ratings by Fitch Ratings on 14th December 2022. Below is a table showing Kenya’s previous credit ratings;

Source: Fitch Ratings Agency, S&P Global

The downgrade comes at a time when the country is struggling with its liquidity position as a result of high debt service obligations and consequently being at high risk of debt distress.

Kenya is also facing elevated inflationary pressures with inflation having increased to 9.2% in February 2023 from 9.0% in January 2023 mainly driven by high food and fuel prices.

Kenya’s inflation has remained above the Central Bank of Kenya’s target range of 2.5%-7.5% with the 2022 average coming in at 7.6% reflecting the increased cost of living, which has also greatly impacted the business environment.

The Kenyan business environment deteriorated in the month of February 2023 with the Purchasing Managers Index (PMI) significantly declining to 46.6 from an 11-month high of 52.0 in January 2023. The deterioration was mainly attributable to low consumer demand consequently leading to low purchasing power because of the tough economic situation.

The Kenyan shilling is also rapidly depreciating against the United States Dollar, having depreciated by 4.4% in 2023, adding to further depreciations of 9.0% and 3.6% in 2022 and 2021, respectively. Balance of Payment also recorded a deterioration of 283.9% to a deficit of Kshs 112.7 bn from a deficit of Kshs 29.3 bn as recorded in Q3’2021. This was also a major drop from Ksh. 10.9 bn surplus recorded in Q2’2022 mainly on the back of widening of the current account deficit by 5.5% to Kshs 193.4 bn in Q3’2022 from Kshs 183.4 bn in the same period in 2021.

Below are some of the important actionable steps that the government should consider to optimize the various economic drivers;

- Anchoring Inflation – Anchoring the runaway inflation back to the CBK’s target range will involve boosting local food production and reducing the cost of fuel since these are the key factors driving inflation. The government should improve local food production by reforming the agricultural sector by offering farm inputs at subsidized prices and encouraging irrigation to mitigate against erratic weather conditions in the country. The government has also come up with a short-term strategy to improve food security by allowing for the importation of duty-free maize, rice, and sugar expected to stabilize food prices. The government should also address the rising cost of fuel by ensuring competitiveness in the sector and reducing a lot of tariffs involved in fuel importation to reduce the overall cost of products. Reduced fuel prices will have a ripple effect of lowering the cost of production in all sectors of the economy hence price moderation,

- Enhancing Currency Performance – The government should continue implementing fiscal and monetary policies to improve macroeconomic conditions such as inflation and balance of payments as this will allow for the exchange rate to adjust itself. It is also essential for the government to reduce imports and its exposure to external debt denominated in foreign currencies. For the short term, the government is trying to preserve forex reserves by importing oil on credit through the government-government deal. We expect this to manage the situation since oil imports take up a huge portion of forex reserves. The government has also turned to its multilateral lenders such as IMF and World Bank to get loans to boost the forex reserves and reduce the risk of dollar shortage, and,

- Improving Business Environment (PMI index) – The government can improve the business environment by anchoring the runaway inflation to improve consumer demand as a result of accommodative prices. Further, the government should come up with business-friendly policies that will lower the cost of production thus lowering the prices for the final products consequently increasing demand. It is also essential for CBK to manage liquidity in the industry through monetary policies such as reverse repos with the objective of ensuring price stability,

- Reducing Public Debt and Debt Servicing Cost – One way to reduce the government debt burden is to ensure fiscal consolidation to reduce the estimated fiscal deficits of 5.7% in the revised FY’2022/2023 budget and 4.3% in FY’2023/2024 budget. This will consequently reduce the need for borrowing to bridge the fiscal gap and reduce the high debt service to revenue. For consolidation to be realized, it is imperative for the government to seal corruption and tax loopholes, reduce recurrent expenditure and prioritize projects of key economic and social benefits. The government should also continue shunning expensive bilateral debts and concentrate more on multilateral debts offered at lower rates. The government should also prioritize internal borrowing to reduce its exposure to forex exchange risks since more than half of our debt is currently foreign currency denominated,

- Interest Rates – To manage the increasing interest rates in the markets, the government should reduce its borrowing appetite as this will increase its bargaining power with investors in the market. Further, it is prudent to improve the business environment and key macroeconomic indicators such as inflation and currency depreciation to boost investor confidence and investor sentiments concerning risks. Notably, reduced risks in the economy will lead to investors demanding moderate rates while borrowing as they are confident of full redemption at the time of maturity,

- Enhancing Private Sector Credit Growth – Promoting capital markets remains one of the significant ways towards the objective of achieving at least 100.0% domestic credit to the private sector as a percentage of GDP. Capital markets still remain under-developed contributing about 1.0% of total funding to businesses compared to 99.0% by banks. This scenario can be changed by educating the masses about the markets and revising its regulations to reduce the red-tape measures and ease the process of accessing it. Improving the sector will promote new businesses and diversify the economy thus supporting economic growth. Besides, the government should also significantly increase the amount of credit extended through its programs such as Financial Inclusion Fund and Women Enterprise Fund to have a significant impact in bridging the 67.9% private sector credit to GDP gap,

- Improving Balance of Payment (BOP) – The government can improve the current account deficit and BOP position by ensuring self-sufficiency by reducing imports of commodities that can be produced locally. The government should also adopt policies that will ensure the diversification of exports through promotion of value addition on agricultural produce and encouraging manufacturing. This can be achieved by concentrating on formulating tax policies and reforms that are aligned with economic goals and do not impede productivity. The government can also attract Foreign Direct Investments (FDIs) by coming up with actions such as offering incentives, reduced bureaucracies, and improved infrastructure,

For more information, please see our topical on Kenya Economic Updates-2023

Email your news TIPS to editor@thesharpdaily.com