The Kenyan shilling has this year hit a historic low against the dollar, with one dollar being equivalent to KES153 from KES123 when former president Uhuru Kenyatta left office. Many discussions in the Kenyan scene have seen accusations exchanged between the present administration and its predecessor.

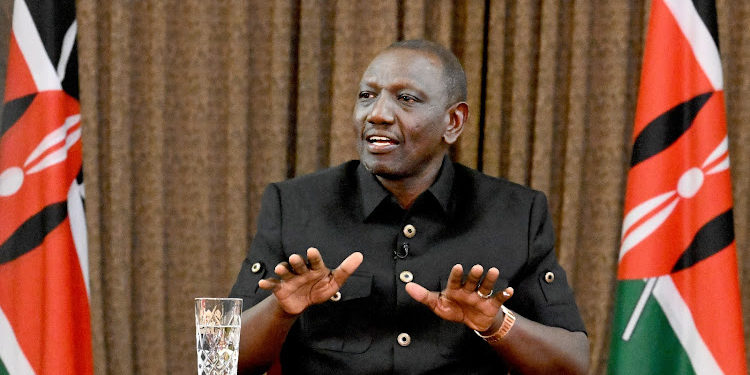

While speaking during the roundtable discussion with Kenyan journalists, President William Ruto elaborated on several factors impacting the rate.

The first reason as to why the Kenyan shilling is depreciating, he said, was that the former administration, (Uhuru Kenyatta’s regime) “artificially” suppressed the value of the dollar against the Kenyan shilling.

This, he explained, was done by selling Kenya’s dollar reserves to the market so that they could increase the supply of dollars at a rate that was not the actual price, a form of subsidized price.

“The then government spent 2.6 billion US dollars (almost KES 400 billion) to support the Kenyan shilling so that it did not go to its actual exchange rate,” Ruto said.

He termed this unsustainable and consequently discontinued the ”artificial” supply of dollars to the market.

An additional element contributing to the depreciation of the Kenyan shilling, according to him, was the increased interest rates by the US federal reserve. The Federal Reserve has raised interest rates 11 times since March 2022, making this the fastest pace of tightening since the early 1980s.

This caused a lot of dollars to leave Kenya and other countries and go to the US. Meaning there was a reduction in the supply of dollars in the local market.

The head of state also insisted that, as a country, we import a lot of commodities, including cement, furniture, metal, and agricultural products, hence sending more dollars out of the state rather than retaining them through exports.

A solution to this would be his government’s plan to invest in factories and human capital locally to enable the production and manufacturing of commodities locally. To further avert the weakening of the shilling, the government will introduce policies that will make it less lucrative to import goods that can be produced locally.

Ruto also addressed the question of the government-to-government oil deal that, he said, would help strengthen the value of the shilling against the US dollar.

He came to the deal’s defense, insisting that if it were not made, the shilling would be exchanging at KES 250 today. Kenya entered into an oil supply agreement with three Gulf-based companies to manage demand for dollars.

The ripple effects of the Kenyan shilling steadily depreciating are being felt first by Kenyans, who are crying foul about the rising costs of living, lack of employment, high taxes, and an unstable business environment.