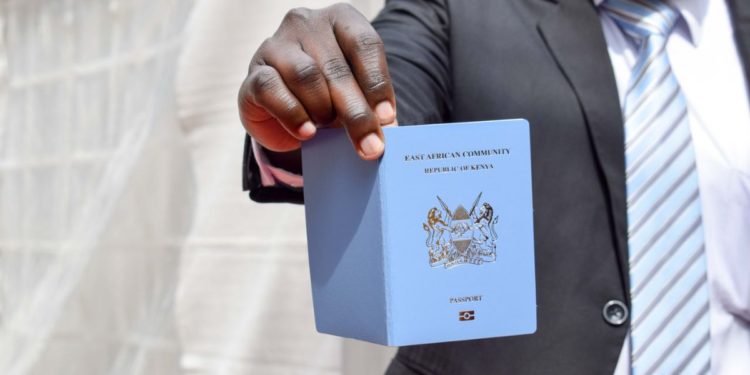

Kenya’s passport has secured the 136th spot in the global rankings, significantly impacting the nation’s real estate landscape. Passport scores, reflective of a country’s citizens’ visa privileges worldwide, have emerged as an unexpected yet crucial factor influencing various sectors, particularly the real estate market.

As of 2023, Kenya’s positioning in this ranking subtly shapes its attractiveness to foreign investors and expatriates, potentially altering the dynamics of the real estate sector.

The direct correlation between a passport score and a nation’s appeal to foreign investors and expatriates cannot be overlooked. Kenya’s lower ranking may indirectly cast a shadow over its real estate sector, as investors keen on hassle-free mobility and residency options may shy away from opportunities in the country. With limited visa-free access, Kenya faces the challenge of attracting investors who prioritize not only profitability but also seamless travel arrangements.

This restriction in global mobility could trigger a chain reaction in Kenya’s real estate market. International investors may exhibit reduced interest, leading to potential impacts on property demand and development. High-end properties, typically sought after by foreign investors, might experience a slower uptake or subdued growth due to restricted accessibility for potential buyers.

Moreover, the passport score is poised to influence the nature of foreign interest in Kenyan real estate. Investors hailing from countries with higher passport scores may redirect their focus to destinations offering better travel opportunities. Consequently, Kenya might witness heightened interest from investors originating from nations with comparable or lower passport scores, as opposed to those hailing from more globally mobile regions.

Despite the evident influence of the passport score on foreign investor interest and property demand, Kenya’s real estate market remains resilient. Local demand, coupled with economic growth, infrastructure developments, and government initiatives, continues to be pivotal in driving the market forward. The surge in middle-class Kenyans investing in real estate, supported by government policies promoting local ownership, significantly contributes to the stability and growth of the sector.