Kenya’s insurers have urged lawmakers to reject a proposed new tax on motor vehicles, warning it could severely disrupt the industry and reduce government tax revenues by driving customers away from comprehensive coverage.

In a press release on Thursday, the Association of Kenya Insurers (AKI) called on MPs to scrap the “motor circulation tax” outlined in the Finance Bill, 2024, which would levy a 2.5% charge on vehicle values up to a maximum of KES 100,000.

The new tax would significantly increase the cost of motor insurance, the industry body warned, potentially driving many customers to opt for cheaper third-party liability policies that provide minimal cover.

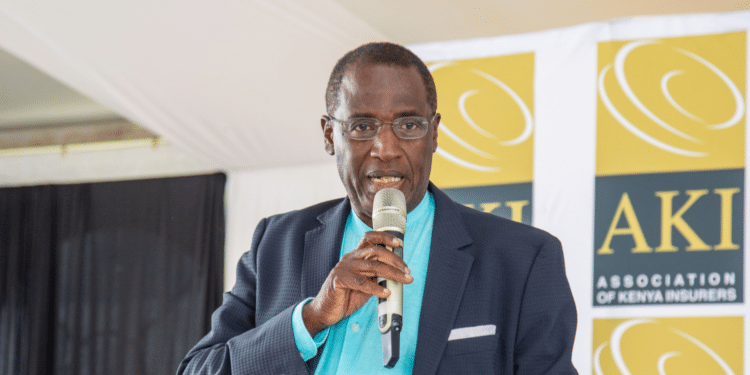

“With motor vehicle insurance being compulsory in Kenya, we anticipate a major shift towards Third Party motor insurance if this tax is implemented,” said Tom Gichuhi, AKI’s executive director. “Consequently, motorists will face higher risks, as they will essentially only be covered for third-party liabilities, leaving their own vehicles unprotected.”

Currently, comprehensive motor insurance policies in Kenya typically cost around 5% of a vehicle’s value. The new 2.5% tax would push the total premium rate to 7.5%, a 50% increase that could prove unaffordable for many drivers.

Reduced income for insurers from a shift away from comprehensive coverage would in turn translate to lower corporate tax payments and potential job cuts in the industry, according to Mr Gichuhi.

“A reduction in insurers’ income will prompt downsizing the workforce subsequently reducing employee tax revenues to the Government,” he said.

The AKI called on MPs to focus instead on fostering a business environment conducive to economic growth, arguing that could yield greater tax receipts through expansion rather than new levies that could undermine key sectors.

The Finance Bill is currently undergoing public partcipation ahead of the new fiscal year beginning in July.