In classical economic theory, unemployment is largely viewed as voluntary or temporary. If wages adjust freely, the labor market should clear, ensuring that everyone willing to work at the prevailing wage finds employment. The idea rests on the assumption of flexible wages and perfect labor mobility, where unemployment reflects a worker’s choice not to accept the going wage rather than a systemic failure.

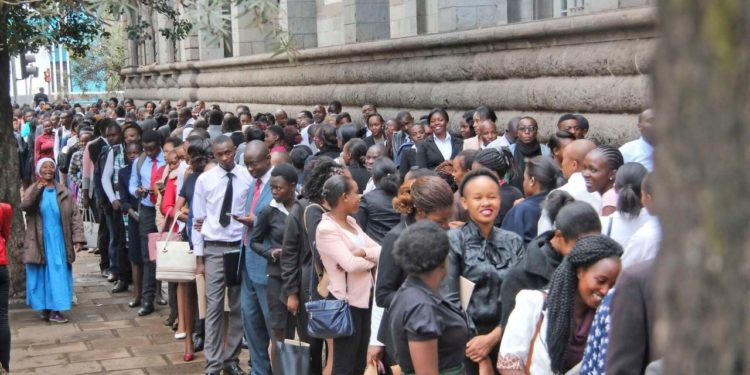

Kenya’s labor market, however, challenges this neat picture. A large share of employment, over 80.0% according to recent statistics, lies in the informal sector, encompassing small-scale traders, casual laborers, and unregistered enterprises. Classical models tend to understate this reality because they treat unemployment as a simple imbalance between labor supply and demand at a given wage. But in Kenya, the existence of a vast informal labor market reveals that the problem is not simply about wage flexibility, it is about the quality and security of employment.

For instance, many workers unable to find stable, formal jobs in sectors like manufacturing or financial services end up in informal activities such as street vending, boda boda transport, or casual construction work. In classical terms, these individuals are “employed,” since they have accepted available wages. Yet in practice, they often earn below a living wage, face no job security, and lack access to social protections such as pensions or healthcare. This raises the question: does classical theory misrepresent underemployment as employment?

Moreover, the informal labor market reflects structural issues that go beyond wage adjustment. Education mismatches, low levels of industrialization, and weak enforcement of labor standards mean that many Kenyans cannot access higher productivity jobs even if they are willing to work for lower wages. In this sense, unemployment and underemployment in Kenya are endogenous outcomes of structural constraints, not simply the result of workers pricing themselves out of the market.

The classical wage-subsistence link also breaks down in the informal economy. Many informal workers earn less than what is required for subsistence, forcing households to pool multiple low-paying jobs to survive. Unlike the classical model, where wages are pegged to a fixed subsistence bundle, the reality is that millions of Kenyan workers live below this threshold.

At the same time, the informal sector plays a stabilizing role. It acts as a shock absorber during economic downturns, absorbing workers laid off from the formal economy. This flexibility allows Kenya to avoid massive open unemployment, but at the cost of widespread precarity and low productivity.

The classical view of unemployment as voluntary, eliminated by flexible wages, does not hold in Kenya’s context. The informal labor market shows that the issue is not the absence of jobs per se, but the lack of decent, secure, and productive employment. Recognizing this distinction is crucial for designing policies that move labor from survival-level informal activities into higher value-added sectors.