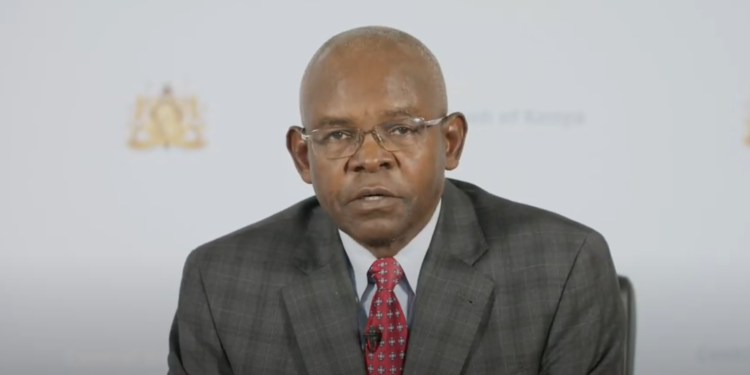

A German company has been contracted to print new Kenyan banknotes, the Central Bank of Kenya (CBK) governor Kamau Thugge revealed on Wednesday, marking a shift from the country’s previous reliance on British firm De La Rue.

The move comes after De La Rue suspended its Kenyan operations in March 2023 due to low demand and economic challenges. Speaking at a press conference following the Monetary Policy Committee meeting, Dr Thugge said the decision to engage a German printer was necessitated by the aging of current banknotes and potential shortages.

“The notes that we have are getting old and therefore we need to get new notes,” Dr Thugge stated. He added that the central bank had projected a potential stock-out of 1,000 shilling notes around July or August, prompting the urgent need for replacement.

The governor emphasized that this was “just the normal business of the Central Bank,” indicating a routine update of currency rather than a major overhaul. He described the German firm as “one of the best,” though he did not disclose its name.

This development comes amid broader economic challenges for Kenya. The country’s GDP growth is projected at 5.4% for 2024, down from 5.6% in 2023. Dr Thugge cited subdued performance in manufacturing and construction sectors as contributing factors, partly due to higher production costs.

On monetary policy, the CBK lowered its benchmark interest rate from 13.5% to 12.75%. Dr Thugge expressed confidence that this reduction would be transmitted to commercial lending rates through the risk-based credit pricing framework.

“We do expect that now that rates are a bit lower… we would expect through the risk-based pricing model for the banks to continue to lower their rates,” he said.

The governor also addressed concerns about recent credit downgrades potentially weakening the Kenyan shilling. “So far we are seeing more foreign exchange coming into the economy than going out,” Dr Thugge stated, suggesting limited impact on the currency’s stability.