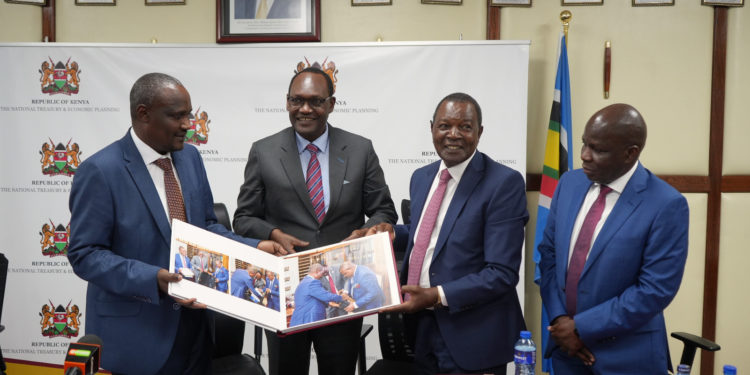

Outgoing Treasury Cabinet Secretary Njuguna Ndung’u painted a grim picture of Kenya’s economic landscape during his handover to the incoming CS, John Mbadi, emphasizing the persistent shocks, policy inconsistencies, and unsustainable debt burden that have plagued the country over the past 22 months.

In a candid speech, Ndung’u outlined the challenges facing the nation, including significant liquidity issues, unsustainable debt levels, and the adverse effects of government intervention on the private sector.

During the handover ceremony, Njuguna Ndung’u did not shy away from addressing the myriad of challenges Kenya has faced under his tenure. He acknowledged the “layers of persistent shocks” and “policy inconsistencies” that have left the economy in a precarious state, with the government becoming the main economic driver—a role he warned was unsustainable.

“The national treasury and economic planning struggled extremely well to sustain stability due to layers of persistent shocks, some of which were negative and persistent,” said Ndung’u. He noted that these challenges have had significant effects on Kenya’s economy, particularly in reversing poverty reduction and inequality efforts by over 20 years.

One of the key issues highlighted by Ndung’u was the unsustainable level of public debt. He pointed out the alarming gap between revenues and expenditures, with revenues standing at 16.5% of GDP, compared to expenditures at 22.1% of GDP. “Debt levels and debt burden cannot be sustained by the current revenues,” he emphasized, cautioning that the country’s fiscal gap is “quite unsurmountable.”

Ndung’u’s concerns over the debt situation were compounded by liquidity challenges caused by short-term debt, particularly bills and bonds. These challenges, he revealed, had even affected the government’s ability to meet its payroll obligations in a timely manner. “It took up to three weeks to clear the payroll because of that liquidity challenge,” he admitted, adding that the issue is not solely a government problem but requires strategic options to avoid creating a solvency challenge.

In addition to the fiscal issues, Ndung’u pointed to deeper, systemic problems that have contributed to the economic distress. He identified the high cost of living and ongoing taxation debates as symptoms of persistent poverty and inequality, as well as youth unemployment. “What we hear is actually not just high cost of living or taxation—it’s actually poverty that has hit the country so hard after so many layers of negative shocks,” he remarked.

Despite the bleak outlook, Ndung’u highlighted some government initiatives that have provided relief, particularly in reducing food and fuel prices. He credited efforts to increase food production and the implementation of government-to-government (G2G) petroleum product purchases for helping to stabilize prices in the face of global challenges. “The government created and developed the G2G petroleum products purchases, which was a very important PPP [Public-Private Partnership] and helped reduce fuel prices,” he noted.

Looking ahead, Ndung’u outlined key areas of focus for the future, urging the incoming CS to prioritize employment generation through domestic manufacturing and exports. He stressed the importance of implementing industrial and agricultural policies driven by a value chain approach, which he believes will produce superior outcomes. “The bottom-up economic transformation agenda has put this framework very clearly,” he said, expressing confidence in the potential for these strategies to drive economic growth.

A significant portion of Ndung’u’s speech was dedicated to the ongoing tax policy and instruments review, supported by the Danish government. He highlighted the critical need to increase the tax-to-GDP ratio from the current 13.7% to between 22% and 25%, a target that he argued was achievable with the right reforms. “We need to study how we can optimize each tax instrument,” he urged, emphasizing the importance of understanding the informal market to raise taxes without distorting the economy.

Ndung’u also addressed the need for a predictable tax environment for businesses, arguing that high tax rates do not necessarily lead to higher revenue. “High taxes cannot bring you high tax revenue,” he stated, calling for a shift in focus towards creating a tax policy that is predictable and does not distort the market. He underscored the importance of ensuring that taxes do not change frequently, which would allow the manufacturing and production sectors to plan effectively.

In his concluding remarks, Ndung’u expressed his commitment to leaving behind detailed notes and strategic insights for his successor, John Mbadi. He stressed the importance of continuity and the need for a strong signaling approach to navigate the challenges ahead. “These liquidity constraints require strategic options to avoid them creating a solvency challenge,” he advised.