Kenya has successfully made a crucial debt payment, underscoring the country’s commitment to meeting its financial obligations and maintaining a strong credit rating, the national treasury said Thursday.

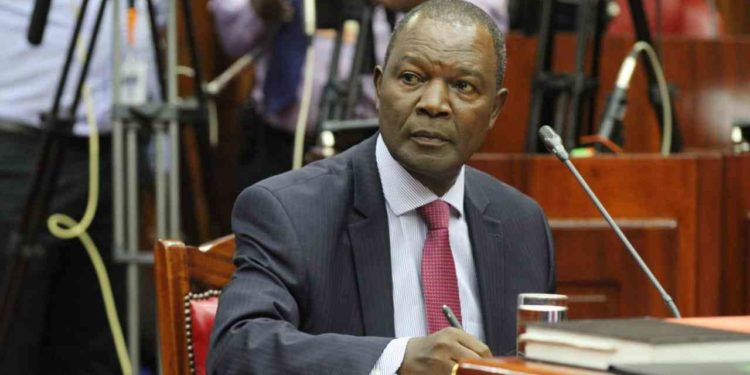

Kenya paid $68.7 million in interest on its $2 billion Eurobond, equivalent to KES 10.8 billion, Cabinet Secretary for the National Treasury Prof. Njuguna Ndung’u said in a statement. The payment sent “a positive signal to investors” and reduced yields on Kenya’s Eurobonds on global markets, he said.

“In its unwavering commitment to upholding a resilient sovereign credit rating and facilitating access to new development financing, Kenya remains dedicated to fulfilling all debt obligations with international lenders,” Ndung’u said.

The interest payment was made on time through “prudent use of revenue collections,” he said. The final interest payment on the Eurobond is due in June 2024, alongside repayment of the $2 billion principal.

Since July, Kenya has been implementing a plan combining revenue and concessional financing to pay down high-cost debt, Ndung’u said. Significant external inflows from lenders like the World Bank and IMF are expected from January to March 2024 to boost foreign exchange reserves.

Ndung’u also cited “an impressive turnaround” in revenue collection in the last six months due to tax reforms.

Kenya maintains a “robust economic outlook” supported by policy reforms and partnerships with multilateral lenders, he said. The fiscal plan aims to reduce borrowing and debt levels to improve Kenyans’ well-being.