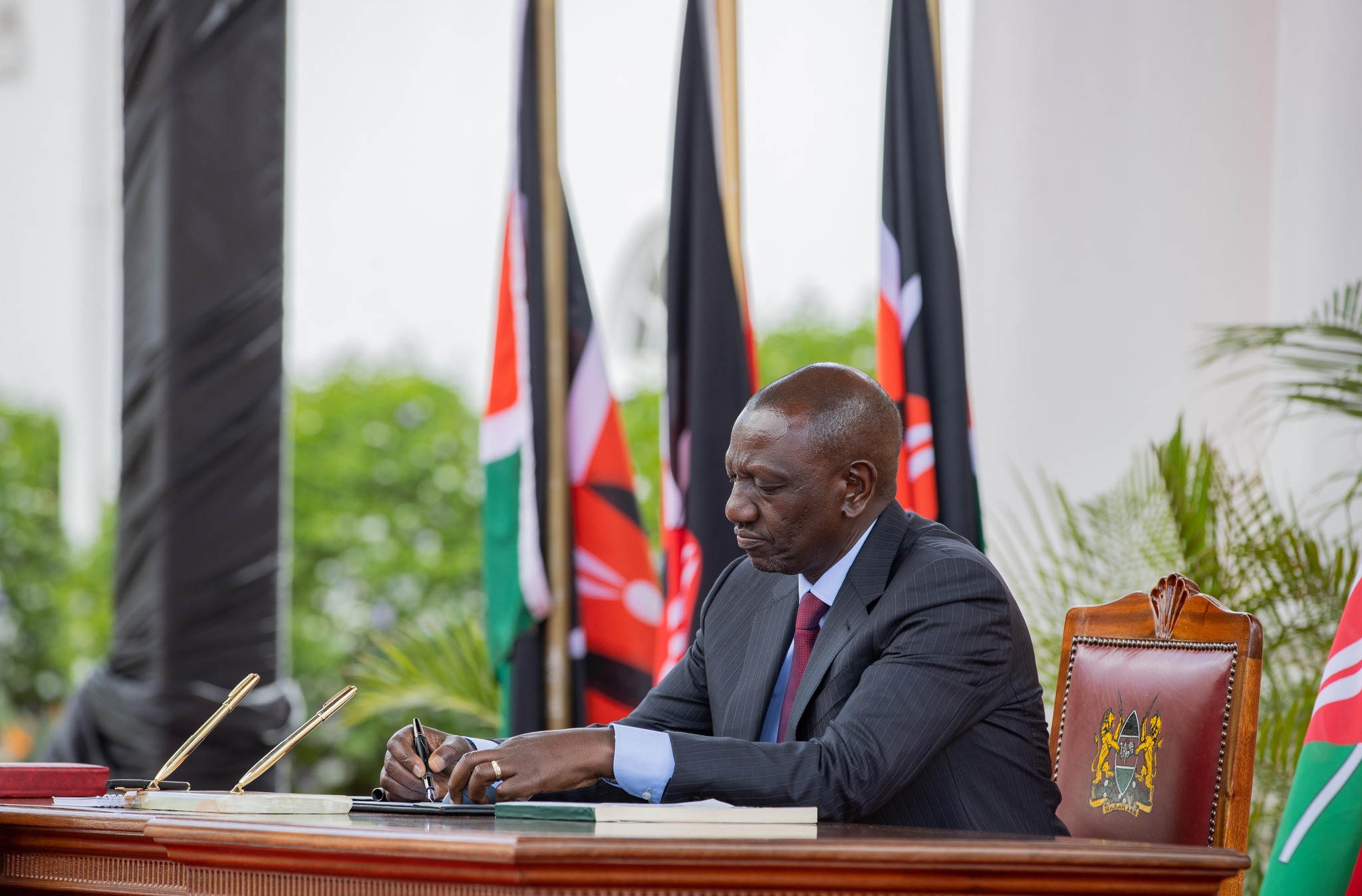

On Friday, October 13, 2023, President William Ruto, in a significant development, signed the Debt Anchor Bill into law. This bill, which aimed to replace the fixed values of the country’s debt ceiling with a proportional representation tied to the Gross Domestic Product (GDP), received sponsorship from the Majority Leader, Kimani Ichungwa, who set this anchor at 55%, with the expectation of achieving this target by 2028.

This alteration in fiscal policy represents a welcomed shift, as it clearly demonstrates the government’s commitment to maintaining sustainable levels of debt. There are several advantages associated with this approach to debt management.

Firstly, linking the debt ceiling to the GDP provides flexibility in response to economic fluctuations. During periods of economic growth when the GDP expands, the debt ceiling can naturally rise, enabling the government to meet increased spending demands without breaching the ceiling immediately. Additionally, it can serve as a counter-cyclical measure. During economic downturns, the debt ceiling relative to GDP may decrease, thereby encouraging fiscal responsibility and preventing excessive borrowing during challenging economic times. Lastly, a GDP-based ceiling offers a relative measure of the country’s debt burden, recognizing that a growing economy can support a higher level of debt without severely impacting debt sustainability.

However, achieving the established target may pose a formidable challenge when considering the current state of affairs. According to the most recent data from the National Treasury, Kenya’s debt as a percentage of GDP has reached a record high of 70.2%. The last time the debt-to-GDP percentage was below the 55% target was in 2017 when it closed at 53.8%. The decision to delay the implementation of the new law until 2028 appears to acknowledge the magnitude of the task at hand.

Kenya’s debt has been a source of concern among its citizens for nearly a decade. A major contributing factor to the escalating debt has been the government’s consistent presentation of budgets to parliament with substantial deficits that necessitate borrowing, a practice that parliament has routinely endorsed. For example, the budget for the fiscal year 2023/24 is projected to be Kshs 3.7 trillion against a targeted revenue collection of Kshs 2.9 trillion, requiring additional domestic borrowing of Kshs 0.3 trillion and external borrowing of Kshs 0.5 trillion. The depreciation of the Kenyan shilling has further exacerbated the costs of servicing existing debts.

To transition from this unfavorable outlook to achieving the Debt Anchor law’s set target, stringent fiscal discipline is paramount. This primarily involves addressing government expenditures. The government must identify essential components of recurrent expenditure and ensure they are adequately funded while reducing non-essential expenses. The President has initiated budget cuts in cabinet travel expenses, a positive step, but further measures are essential.

Radical reductions in the size of the government and a streamlining of budgets to align with revenue collections, even if it entails curtailing development expenditure, are required. These measures, combined with a determined fight against corruption, may pave the way for achieving the ambitious 2028 anchor target.

It is worth noting that anchoring debt to the GDP comes with certain disadvantages, most notably unpredictability. Economic growth rates can be volatile, and an abrupt economic downturn may lead to a reduced debt ceiling even when additional borrowing is necessary to manage crises, such as recessions or pandemics. Nonetheless, Kenya’s Debt Anchor Law demonstrates the government’s resolve to address the nation’s escalating debt.

This goal is undeniably ambitious and will necessitate a comprehensive change in our approach to succeed. With concerted efforts, responsible fiscal policies, and an unwavering commitment to transparency and accountability, we can make progress toward this target. The extent of our willingness to make sacrifices and take the higher road will ultimately determine the success of this plan.