Kenya has reached a preliminary trade agreement with China that could significantly reshape the country’s export landscape, with proposals to grant duty-free access for approximately 98.2 percent of Kenyan exports to the Chinese market. If finalized and implemented, the deal is expected to enhance Kenya’s export earnings, support local industries, and help narrow the long-standing trade imbalance between the two countries.China is Kenya’s largest source of imports, supplying machinery, electronics, construction materials, and manufactured goods. However, Kenyan exports to China have historically lagged far behind, consisting mainly of raw or semi-processed products such as tea, coffee, leather, and agricultural commodities. The new agreement aims to reverse this pattern by making Kenyan goods more competitive in the vast Chinese market through preferential tariff treatment.

Under the proposed arrangement, most Kenyan products would enter China duty-free, reducing costs for Chinese importers and improving price competitiveness for Kenyan exporters. This could create new opportunities for sectors such as agriculture, agro-processing, textiles, leather, and light manufacturing. For small and medium-sized enterprises, the deal may open access to one of the world’s largest consumer markets, potentially stimulating production, job creation, and value addition at home.From a macroeconomic perspective, the agreement aligns with Kenya’s broader strategy to diversify export markets and boost foreign exchange inflows. By expanding exports to China, Kenya could ease pressure on its current account deficit and strengthen the shilling through improved trade receipts. Policymakers also view the deal as a way to complement ongoing industrialization efforts by encouraging manufacturers to scale up production for export.

However, analysts caution that duty-free access alone may not be sufficient. Kenyan exporters will need to meet China’s strict quality, phytosanitary, and regulatory standards, which can be costly and complex, particularly for smaller firms. Investment in quality assurance, certification, logistics, and supply chain efficiency will be critical if Kenyan businesses are to fully capitalize on the agreement.There are also concerns about ensuring the deal delivers balanced benefits. Trade experts emphasize the importance of safeguarding local industries from unfair competition and avoiding an overreliance on raw commodity exports. Encouraging value-added exports and supporting domestic manufacturing capacity will be key to achieving sustainable gains.

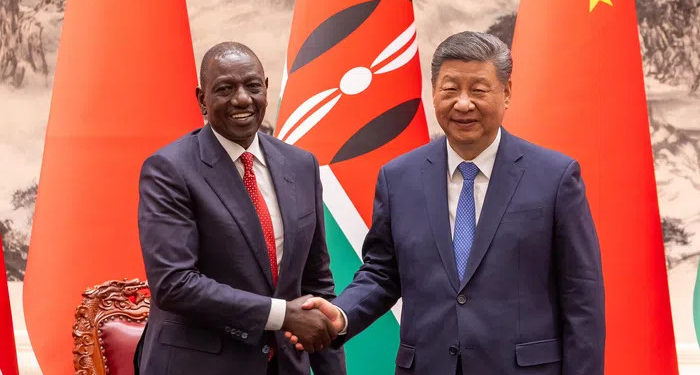

The preliminary deal is expected to undergo further negotiations, technical reviews, and domestic approval processes before full implementation. If successfully concluded, it could mark a significant milestone in Kenya–China economic relations, shifting the partnership toward more reciprocal trade and offering Kenya a stronger foothold in global markets.Overall, the proposed duty-free access represents a promising step toward correcting trade imbalances, boosting exports, and supporting Kenya’s long-term economic growth agenda—provided supportive policies and private sector readiness move forward in tandem.