The Central Bank of Kenya (CBK) maintained its benchmark lending rate at 13.00 percent on Wednesday, citing stable inflation and a resilient economy as the key factors behind the decision.

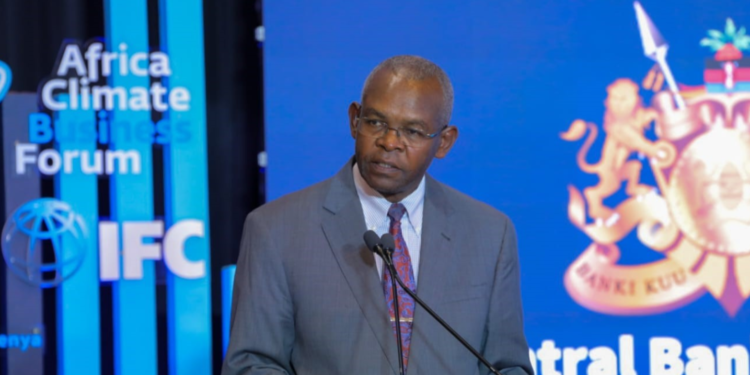

In a press release following the Monetary Policy Committee (MPC) meeting, CBK Governor Dr. Kamau Thugge noted that overall inflation remained “broadly unchanged at 5.1 percent in May 2024, compared to 5.0 percent in April, which is the mid-point of the target range.”

“The Committee decided to retain the Central Bank Rate (CBR) at 13.00 percent,” Dr. Thugge stated, adding that the current monetary policy stance will “ensure that overall inflation remains stable around the mid-point of the target range in the near term, while ensuring continued stability in the exchange rate.”

The decision to hold rates comes amid an improved global outlook for growth, according to the MPC. “Global growth continues to recover, supported by stronger than expected growth in the United States, and resilient growth in some large emerging market economies, particularly India,” the committee noted.

However, it acknowledged that risks to the global growth outlook persist, citing “further escalation of geopolitical tensions and interest rates remaining higher for longer” as potential threats.

On the domestic front, the Kenyan economy recorded strong growth of 5.6 percent in 2023, driven by robust performance in the agriculture and service sectors. “Leading indicators point to continued strong economic performance in the first quarter of 2024,” the MPC said.

The committee also highlighted the stability of the banking sector, with strong liquidity and capital adequacy ratios, though it noted an increase in non-performing loans (NPLs) in sectors such as agriculture, real estate, and tourism.

To enhance the effectiveness of its monetary policy implementation framework, the MPC approved a recommendation to review the width of the interest rate corridor around the Central Bank Rate (CBR) from ±250 basis points to ±150 basis points. Additionally, the applicable interest rate on the Discount Window was adjusted from 400 basis points above CBR to 300 basis points.

“The MPC will closely monitor the impact of the policy measures as well as developments in the global and domestic economy and stands ready to take further action as necessary in line with its mandate,” Dr. Thugge concluded.

The committee’s next meeting is scheduled for August 2024.