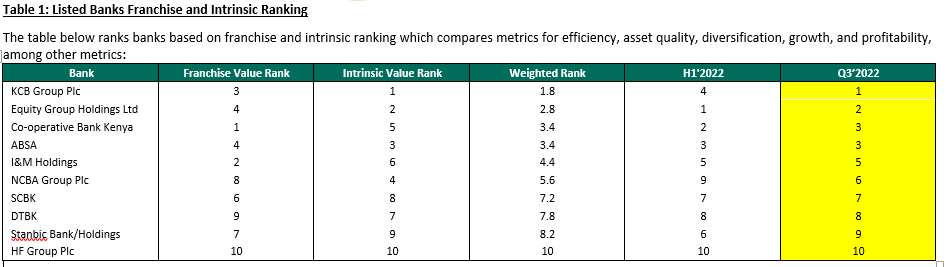

KCB Group Plc has been ranked as the most attractive bank in Kenya, supported by a strong franchise value and intrinsic value score, according to the Cytonn Investments Q3’2022 Banking Sector Report.

The franchise score measures the broad and comprehensive business strength of a bank across 13 different metrics, while the intrinsic score measures the investment return potential.

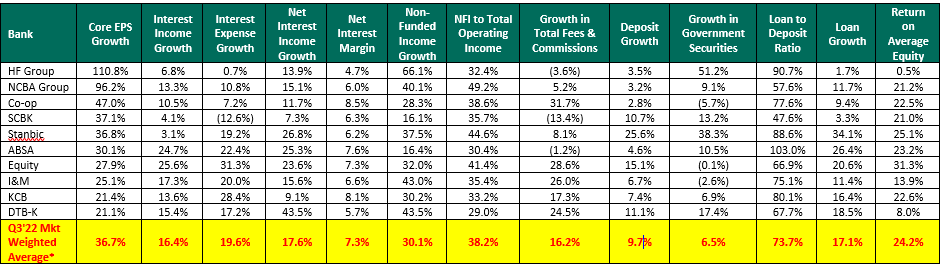

The Core Earnings per Share (EPS) for the listed banks recorded a weighted growth of 36.7% in Q3’2022, compared to a weighted growth of 102.0% recorded in Q3’2021, indicating the banking sector’s continued resilience despite the tough operating business environment occasioned by elevated inflationary pressures.

The performance in Q3’2022 was mainly attributable to a 30.1% growth in non-funded income coupled with a 17.6% growth in net interest income. Additionally, the listed banks’ operational efficiency improved, with the Cost to Income without LLP ratio declining by 3.9% points to 45.1%, from 49.0% recorded in Q3’2021, mainly as a result of continued adoption of alternative distribution channels that have seen banks to reduce their operating expenses. H

“The Asset Quality for the listed banks deteriorated, with the gross NPL ratio increasing marginally by 0.1% points to 12.3% in Q3’2022, from 12.2% in Q3’2021,” said Kevin Karobia, Lead Investment Analyst at Cytonn Investments.

Four key drivers shaped the Banking sector in Q3’2022, namely; Regulation, Regional Expansion through Mergers and Acquisitions, Asset Quality, and Capital Raising.

Read: Former KCB Boss Joshua Oigara Appointed Stanbic Bank CEO

“In Q3’2022, conversations around credit growth intensified, with the Central Bank of Kenya rolling out a Credit Repair Framework which will see commercial banks, microfinance banks and mortgage finance companies provide a discount of at least 50.0% of the non-performing mobile phone digital loans outstanding as at end October 2022, and update the borrowers credit standing from non-performing to performing. Additionally, the CBK is looking towards entirely shifting to the Risk Based Pricing framework, with 23 banks having their models approved as at November 2022. As for mergers and acquisitions, there were two activities in Q3’2022, but we expect to see Kenyan banks undertake more consolidation and continue diversifying into other African regions as they look to reduce their reliance on the Kenyan Market and distribute risks as well. In light of the above, KCB Group PLC, announced that it had entered into a final agreement with shareholders of Trust Merchant Bank (TMB) to acquire an 85.0% stake in the Democratic Republic of Congo (DRC)- based lender. Additionally, Equity Group Holdings Plc through Equity Bank (Kenya) Limited, announced that it had entered into an Assets and Liabilities purchase agreement with Spire Bank Limited for purchase of certain assets and liabilities”, said Sang Gideon, Investment Analyst at Cytonn Investments.

KCB Group’s rank improved to position one in Q3’2022 from position four in H1’2022, majorly driven by a strong intrinsic score as well as an improvement in the group’s management quality. On the other hand, Equity Group’s rank declined to position two in Q3’2022 from position one in H1’2022 attributable to a deterioration in operational efficiency and asset quality during the quarter as compared to H1’2022, coupled with a reduction in the Gross NPL Coverage which led to a decline in the bank’s franchise value score.

NCBA Group’s rank also improved to position six in Q3’2022, from position nine in H1’2022, mainly attributable to improvement in the asset quality during the quarter, coupled with an increase in the Group’s Net Interest Margin which increase to 6.0%, from the 5.9% recorded in H1’2022.

The listed banks recorded a 36.7% weighted average growth in core Earnings per Share (EPS), compared to a weighted growth of 102.0% recorded in Q3’2021 when the sector was recovering from a lower base. The performance during the period was mainly attributed to a 30.1% growth in non-funded income coupled with a 17.6% growth in net interest.

The listed lenders continued to implement their revenue diversification strategies as evidenced by non-funded income growth of 30.1% in Q3’2022 compared to 14.3% growth recorded in Q3’2021. The performance was mainly driven by 16.2% growth in total fees and commissions, which was an increase from 11.4% growth recorded during the same period last year.

The Banks recorded a weighted average deposit growth of 9.7%, slower than the 14.3% growth recorded in Q3’2021, an indication of reduced investment risk in the business environment.

Interest income grew by 17.6% in Q3’2022, compared to a growth of 16.9% recorded in Q3’2021 while the weighted average Yield on Interest Earning Assets (YIEA) remained relatively unchanged at 9.9%, similar to what was recorded in Q3’2021 for the listed banking sector. On the other hand, the Net Interest Margin (NIM) also remained unchanged at 7.3%, as was recorded in Q3’2021 for the whole listed banking sector.

Email your news TIPS to editor@thesharpdaily.com