Jubilee Holdings has been ranked as the most attractive insurance company in Kenya, supported by a strong franchise value and intrinsic value score. This is according to Cytonn Investments Insurance Sector Report for 2021.

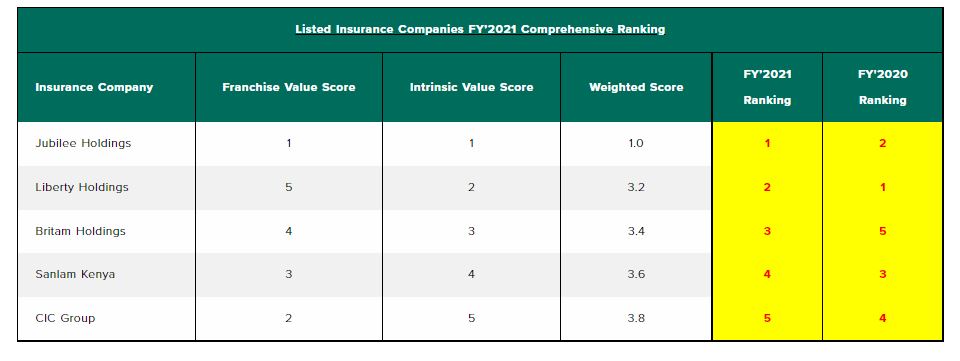

The franchise score measures the broad and comprehensive business strength of Insurance companies across eight different metrics, while the intrinsic score measures the investment return potential.

The report themed “High Loss Ratios Continue to Impair Insurance Sector’s Earnings” analysed the FY’2021 results of the listed Insurance Companies excluding Kenya Re Insurance Corporation Ltd. “The Net Premiums grew by a weighted average of 8.9% in FY’2021 which was faster than the 1.6% growth in FY’2020 mainly attributable to the continued economic recovery from the economic shocks occasioned by the COVID-19 pandemic. Loss and Expense Ratios slightly eased, and consequently, the weighted average Combined Ratio improved marginally to 147.4% in FY’2021, from 151.1% in FY’2020. Insurance uptake in Kenya remains low with the insurance penetration coming in at 2.3% as at December 2021, mainly attributable to the fact that insurance is still seen as a luxury and is mostly taken when it is necessary or a regulatory requirement. We expect a steady growth in premiums as underwriters come up with products suited to the planning for unforeseen events like COVID-19, mainly in the medical and life businesses. Claims are also expected to grow aggressively with full resumption of economic activities, particularly due to an expected increase in motor claims as travel restrictions ease and medical claims which have been on a constant increase.” said Justin N Mwangi, Senior Investments Analyst at Cytonn Investments.

Read: Kenya To Host African Insurance Conference In June

“We are of the opinion that insurers have to aggressively look into portfolio optimization by re-evaluating their products and services in-order to sustain post-pandemic growth and remain profitable. Insurers will have to focus on their core and profitable offerings and disposing non-core offerings. We expect this portfolio optimization to extend into offloading or reducing stake in non-profitable subsidiaries and associates. We further expect the sector to continue to leverage on adaptation of technology (Insurtech) and personalization of insurance policies in order to increase uptake, in a bid to increase the paltry insurance penetration of 2.3% and to ensure high customer penetration.” said Kevin Karobia, Investments Analyst at Cytonn Investments.

Jubilee Holdings improved to position 1 in FY’2021 from position 2 in FY’2020 mainly due to the improvement in the franchise score, with the expense ratio declining to 41.3% in FY’2021, from 56.3% in FY’2020. As a result, the combined ratio also declined to 149.7% in FY’2021, from 157.6% in FY’2020. Liberty declined to position 2 in FY’2021 from position 1 in FY’2020 mainly due to declines in the franchise score in FY’2021, driven by the deterioration in the loss ratio to 78.3%, from 55.2% in FY’2020 while the expense ratio increased to 79.3%, from 45.9% in FY’2020. Britam Holdings improved to position 3 from position 5 in FY’2020 mainly due to an improvement in its loss ratio to 69.4% in FY’2021, from 85.7% in FY’2020. Sanlam declined to position 4 in FY’2020 from position 3 in FY’2020 mainly due to deterioration in the franchise score, driven by deterioration in loss and combined ratios to 93.3% and 139.0%, from 83.7% and 137.9%, respectively. CIC Group declined to position 5 in FY’2021, from position 4 in FY’2020, on the back of weaker franchise and intrinsic scores driven by deterioration of its loss ratio to 71.6% in FY’2021, from 71.4% in FY’2020, and combined ratio to 123.8% in FY’2021, from 121.5% in FY’2020.

The table below ranks Insurances based on franchise and intrinsic ranking which compares metrics for efficiency, growth, and profitability, among other metrics:

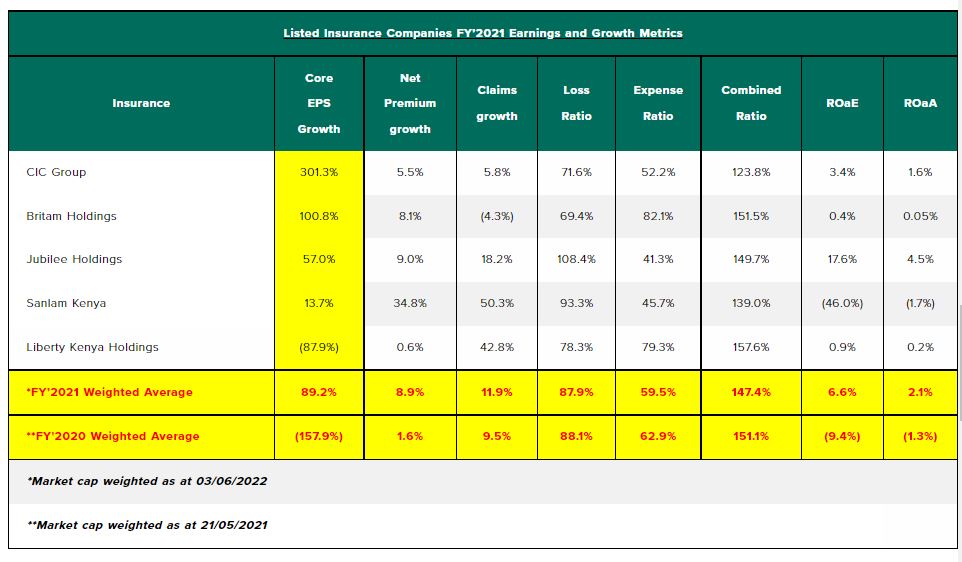

Table 2: Cytonn’s FY’2021 Listed Insurance Companies Earnings and Growth Metrics

Key takeaways from the table above include:

- Core EPS growth recorded a weighted growth of 89.2%, compared to a weighted decline of 157.9% in FY’2020. The increase in earnings was attributable to increased premiums during the period following robust recovery by the sector from the COVID-19 pandemic, coupled with gains recorded in the equities markets and higher yields from government papers,

- The premiums grew at a faster pace of 8.9% in FY’2021, compared to a growth of 1.6% in FY’2020, while claims grew at an aggressive faster rate of 11.9% in FY’2021, from the 9.5% recorded in FY’2020 on a weighted average basis,

- The loss ratio across the sector eased slightly to 87.9% in FY’2021, from 88.1% in FY’2020,

- The expense ratio eased to 59.5% in FY’2021, from 62.9% in FY’2020, owing to a decline in operating expenses, a sign of increased efficiency,

- The insurance core business still remains unprofitable, with a combined ratio of 147.4% as at FY’2021, compared to 151.1% in FY’2020, and,

- On average, the insurance sector delivered a Return on Average Equity (ROaE) of 6.6%, an increase from a weighted Return on Average Equity of (9.4%) in FY’2020.

Read: Why Nairobi Presents The Best Investment Opportunities – Report