The government plans to expand the Hustler Fund and introduce a new product aimed at borrowers who consistently repay their loans on time.

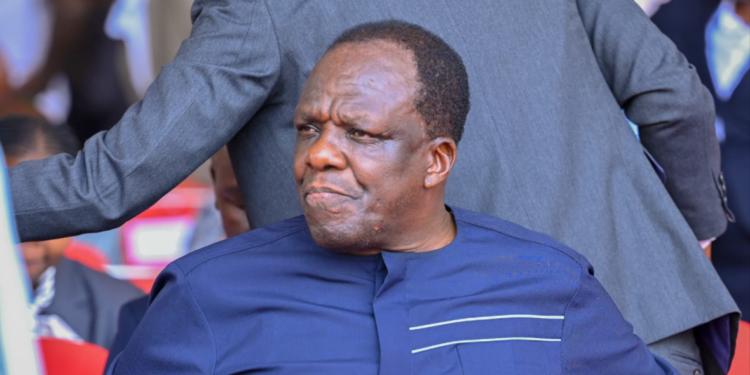

Wycliffe Oparanya, Cabinet Secretary for the Ministry of Co-operatives and MSME Development, announced that a new product called the Savings-Loan Portfolio which will be rolled out for two million Kenyans who have demonstrated consistent borrowing and repayment from the Hustler Fund. This initiative will help these borrowers’ transition to commercial banks, where they can access larger loans.

“Two million Kenyans are regularly borrowing from the fund daily, benefiting from its purpose of providing financing to those at the grassroots level who previously had no access to credit. These individuals are now able to borrow and grow their small businesses,” Oparanya said.

He further explained that as these businesses expand, borrowers can secure larger loans from various government institutions such as Kenya Industrial Estates, offering loans of up to Kshs 20.0 million at a 10.0% interest rate, along with Kenya Development Corporation (KDC) and the Agricultural Finance Corporation (AFC).

Speaking at the rebranding event of Safaricom Investment Co-operative to SIC-Investment Co-operative, Oparanya highlighted that the Hustler Fund has so far disbursed Kshs 57.0 billion to 22 million Kenyans, of which Kshs 44.0 billion has been repaid, with approximately Kshs 13.0 billion still outstanding translating to 77.2% repayment rate.

In collaboration with service providers, Oparanya noted that the government is developing new strategies to ensure borrowers repay their loans so that more Kenyans can benefit from the fund. He mentioned that the minimum repayment amount was reduced from Kshs 500.0 to Kshs 100.0 after noticing repayment difficulties.

“This year, the government has allocated KSh 3 billion for the Hustler Fund,” Oparanya added.

The Cabinet Secretary emphasized the vital role that cooperative societies play in areas such as produce aggregation, processing, transportation, marketing, savings mobilization, and financial inclusion, with a notable impact across all sectors of the economy.

“As reported by the International Cooperative Alliance (ICA) and the Cooperative Alliance of Kenya (CAK), there are around three million cooperatives globally. Kenya alone has over 25,000 registered cooperatives with a membership of over 14 million people. These cooperatives contribute around 30.0% of Kenya’s annual savings and generate direct employment for over 500,000 people, with an additional two million indirectly employed,” Oparanya elaborated.

He further stated that the Kenyan government recognizes the cooperative sector as a key player in driving the country’s socio-economic growth, equity, and sustainable development. Cooperative societies are central to advancing the financial inclusion goals outlined in the Bottom-Up Economic Transformation Agenda (BETA).

The government’s efforts to expand the Hustler Fund and introduce innovative financial products highlight a strong commitment to empowering grassroots entrepreneurs and promoting financial inclusion. By rewarding consistent borrowers with access to larger loans and facilitating their progression to commercial banking, the government is fostering economic growth and business development at the micro and SME levels. The collaboration with cooperative societies and investment co-operatives like SIC further solidifies the role of cooperative institutions in driving Kenya’s socio-economic progress, particularly through savings mobilization, affordable housing initiatives, and financial inclusion. These initiatives align with the broader Bottom-Up Economic Transformation Agenda, positioning Kenya on a path toward equitable and sustainable development.