On Wednesday, October 12, 2022, President William Ruto showed up at the Nairobi Stock Exchange (NSE) with an inspiring message that “It is time to unlock the potential that exists in the Capital Markets”, even as he seeks to revive the ailing sector.

NSE, which controls over Ksh2 trillion investors’ wealth bled over Ksh182.45 billion between September 5 and September 30, even as foreign investors withdrew to more gainful markets in the world.

The withdrawals are a signal that the capital market sector in Kenya is ailing and needs urgent and well-thought-out interventions to rescue the industry from total collapse.

The market can be salvaged, but not with the current state and leadership in the sector, which is even willing to lie to the President about some obvious issues. For instance, the leadership fronted the Nairobi International Financial Centre (NIFC) as a new organisation, a bait that the President failed to swallow. Unknown to many, NIFC has been in existence for over seven years gobbling up taxpayers’ money, with little or nothing to show.

Read: President Ruto Meets Development Partners In Response To Drought Crisis

There was also a lie that there were no listings in the last decade because there have been no privatizations of public companies. However, a deeper look into the market will reveal tens of private companies that want to go public but cannot because of massive red tape and obstacles. In fact, listed companies are exiting the NSE, reducing from 60 to 50 over the last 10 years. The issue is not just privatization, the issue is cartels, exclusion, and red tape which has made entrepreneurs shy of listing. Other than Safaricom, banks and foreign corporates, everyone else is pretty much locked out of the capital markets.

Even with the introduction of Public Offers Regulations (draft), unless we address the issue of cartels, regulatory capture, incompetence and exclusion culture in capital markets, nothing much will change.

The government also plans to rely on Real Estate Investment Trust Schemes (REITs) to raise money for the affordable housing agenda. However, according to official data, there is only one listed REIT since regulations came into being 10 years ago. Unless the bad regulations are repealed nothing will change.

Read: Lessons Kenyans Can Learn From William Ruto’s Ascension To Presidency

A promise was also made that we shall have five privatizations in the next 12 months. It takes at least one year for investment bankers and lawyers to prepare a well-functioning company to come to market, how will we prepare and list a parastatal in 12 months?

The convention also failed to address a number of crucial issues.

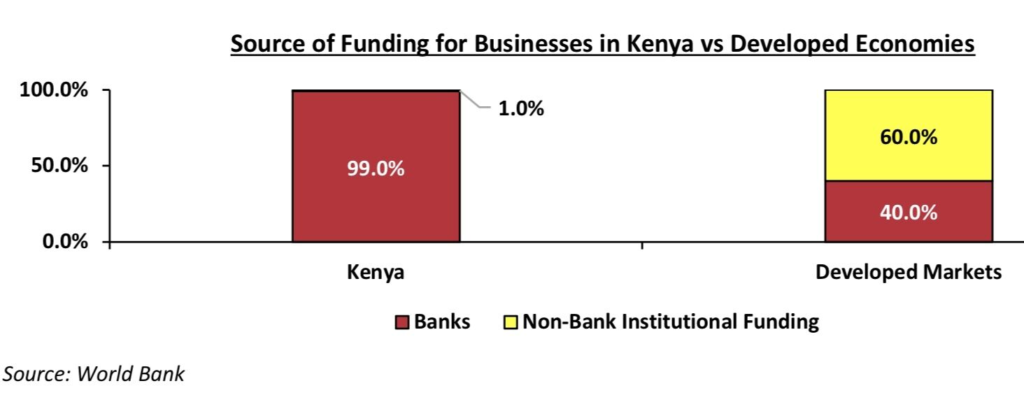

- In well-functioning markets, banks provide only 40 percent of business funding, with the majority of 60 percent from capital markets, however in Kenya capital markets provide only one percent with 99 percent coming from banks. We need to address bank monopoly, urgently.

- The cost of trading at four percent for plain vanilla products like equities is too high as compared to other markets charging as low as 0.1 percent.

- Yes, Unit Trust Fund (UTF) market is growing, but at Ksh115 billion, it’s a pittance compared to banking markets at Ksh4.5 trillion. The UTF market should be in the trillions.

- Investor losses in regulated markets have totalled around Ksh200 billion in the recent past, how will they trust the markets without addressing the root of the losses?

- Suppressing local private capital to the benefit of foreign private capital.

We need to be honest about what went wrong in our capital markets, only then can we find correct and lasting solutions. How did we get here? President Uhuru, like any other president, did a lot of good things, but also a lot of bad things. One such bad thing was a conflict of interest and regulatory capture in the Capital Markets. He appointed his buddy to Chair the CMA. Over that period, his buddy did very well in capital markets. NIC merged with CBA to form the now formidable NCBA, acquired Stanlib asset managers, and acquired the only listed REIT. Cronies did very well, but nothing else happened in capital markets over the last 10 years.

Read: To Meet Job Creation Goal, President Ruto Will Need To Reform Capital Markets

So, what should be done? I will suggest 13 action points that should be addressed:-

- Amend the CMA Act to bring the appointment of the Chairman of CMA and the CEO under parliamentary scrutiny. The current process is very opaque, that is how Uhuru ended up appointing his friend, who in turn appointed completely incompetent management with zero experience in capital markets to do their bidding.

- After amending the CMA Act, let’s then appoint competent management. We can’t grow the market if it’s run by people who have never issued or traded any shares, never issued or traded any debt, or never done any merger or acquisition. How do we expect these guys to oversee reviving the Capital Markets yet they were responsible for its death? The same opinion is held by investment analyst Aly-Khan Satchu who says that the right people are needed to plug the gap in the market. “I liked what I heard from (President) William Ruto and I think the missing piece in the equation is Personnel who understand how a market works,” Satchu tweeted on Wednesday, October 12.

- The market is operating with 20-year-old regulations, essentially CMA board and management never saw it fit to update the rules for 20 years, and worst still what has been proposed has serious issues and should not proceed to gazettement. New management with experience should then proceed to overhaul the Act and Regulations.

- Stimulate capital markets as a competitor to the banking sector and to the telecoms sector.

- Reduce the minimum investment for development REITs from Ksh5 million to Ksh100,000.

- Remove the requirement that a Trustee must be a bank, it’s very stifling.

- Increase the number of service providers – Trustees and Custodians needed to incorporate funds so that a few players don’t remain in control of the market.

- Allow investment funds to open as many bank accounts as convenient for their customers; the requirement that an investment fund must have only one bank account is archaic and stifling to the market.

- Require disclosure of portfolio contents so that there is transparency.

- Introduce an investment compensation scheme for Unit Trust Funds, funded by levies on UTFs.

- Stop the stifling of local Private Offers for the benefit of foreign Private Offers.

- Diversify entrepreneurs in the capital markets, beyond just a few cronies and connected individuals.

- Stop the culture of threats, blackmail and intimidation in capital markets where criticism and dissent are met with harassment of individuals and ideas that the cartels and cronies don’t like.

In short, we need new leadership that is committed to the removal of the huge systemic obstacles to capital markets if we are to turn around our moribund markets. Over the next 13 days, I shall expound on each of these 13 points.

Edwin Dande is the CEO of Cytonn Investments and a senior analyst with The Sharp Daily

Email your news TIPS to editor@thesharpdaily.com