Debt sustainability has been a cause for concern within the Sub-Saharan Africa (SSA) region and has been aggravated by a slow post-pandemic recovery, elevated inflationary pressures, and a backdrop of depreciating currencies in 2022.

Debt distress in the SSA has been mainly on the back of poor fiscal and monetary policies, as well as borrowing to deal with the adverse effects of the COVID-19 pandemic in most economies resulting in its debt-to-GDP ratio almost doubling to 57.0%, 7.0% points above the IMF recommended threshold for developing economies at the end of 2021 from 28.5% recorded in 2011.

Ghana, like many other developing countries, has accumulated high levels of public debt to a point of unsustainability, with its debt-to-GDP ratio coming in at 77.5% as of May 2022. As a result, the government of Ghana initiated a debt restructuring in December 2022, in order to restore its capacity to service its public debt as well as improve its local business environment;

Ghana’s Macroeconomic Environment

The following is a summary of Ghana’s major macroeconomic indicators;

- Economic Growth- According to the World Bank, Ghana’s Gross Domestic Product grew by a 9-year CAGR of 7.3% to USD 77.6 bn in 2021 from USD 41.3 bn recorded in 2012. Additionally, the economy expanded by 5.4% in 2021 from the 0.5% expansion in 2020 mainly due to the post-pandemic economic recovery. However, due to the adverse developments in both global and internal environments that have led to high global fuel and food prices leading to elevated inflation, Ghana’s GDP growth is forecasted to slow to 3.6% in 2022 and decline further to 2.8% in 2023,

- Inflation-Ghana’s y/y inflation hit a record high of 50.3% in the month of November 2022, a 9.9% points increase from 40.4% recorded in October 2022 driven by the 79.1% increase in the prices of housing, water, gas, and electricity, 65.7% furnishings and household equipment and 63.1% increase in the prices of transport and fuel, respectively, leading to a sharp increase in the cost of living to Ghanaians,

- Currency- In 2022, the Ghanaian Cedi has depreciated by 42.8% to close at Ghc 8.6 recorded on 30th December 2022 from Ghc 6.0 recorded against the U.S dollar on 4th January 2022 to become the worst performing currency in Sub-Saharan Africa, due to high debt servicing costs and import reliance,

- Interest Rates– With Ghana’s Inflation rate at 50.3% in November 2022, the Bank of Ghana met on 28th November 2022 and decided to raise the interest rates by 250.0 bps to the highest of 27.0% ever recorded in the last 10 years, from 24.5% in September 2022. However, the move did not cool the inflation rate due to high global commodity prices due to imported inflation,

- Current Account- Due to the high import reliance and lack of value addition on its exports, coupled with the local currency depreciation, Ghana’s current account deficit is projected to widen further to 5.2% by end of 2022 from 3.2% in 2021, and this is expected to continue weighing down Ghana’s economy, and,

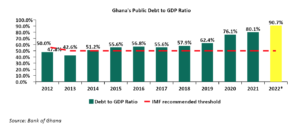

- Public Debt- Ghana’s total public has grown with a 10-year CAGR of 14.3% to USD 58.6 bn at the end of 2021, from USD 15.4 bn recorded in 2011, on the back of rising debt appetite to cover its fiscal deficit against low revenue collections. As such, its public debt to GDP ratio came in at 80.1% in 2021 and is projected to end 2022 at 90.7%, 40.7% points above the IMF recommended threshold of 50.0% debt to GDP ratio for developing economies.

Read: Former US Treasury Secretary Calls For Debt Restructuring For African Countries

Evolution of Ghana’s Public Debt

Ghana’s public debt has been on the rise, having grown with a 10-year CAGR of 14.3% to USD 58.6 bn in 2021 from USD 15.4 bn at the end of 2011, representing 80.1% debt to GDP ratio, above the 70.0% debt to GDP ratio threshold recommended by the Economic Community of West Africa States (ECOWAS) and the IMF recommended threshold of 50.0% for developing economies.

The Graph below shows the evolution of Ghana’s public debt for the last 10 years;

Additionally, due to high borrowing levels that outweigh economic growth, Ghana’s debt-to-GDP ratio is projected to grow to 90.7% by the end of 2022, as shown in the chart below;

The high levels of debt distress in Ghana led to a continued downgrading of Ghana’s economic outlook which resulted in a decline in investors’ confidence in its economy. Additionally, the deteriorated credit ratings have continued to limit Ghana’s access to international sources of financing, increasing trading yields on Eurobonds, and therefore translating to high external debt servicing costs.

Domestic Debt Restructuring

On 4th December 2022, the Government of Ghana, through its Ministry of Finance announced the new Domestic Debt Restructuring Plan, named the Domestic Debt Exchange Programme (DDEP) which came into effect on 5th December 2022. The Program involved;

- Domestic Debt Exchange-The programme involved the exchange of domestic bonds with new bonds with maturities in 2027, 2029, 2032, and 2037 and annual coupons for the new bonds set at 0.0%, in 2023, 5.0% in 2024, and 10.0% from 2025 till maturity. The allocation ratio was set at 17.0%, for the short bonds maturing in 2027 and 2029, 25.0% and 41.0% for the bonds maturing in 2032 and 2037, respectively,

- Financial Sector Impact Minimization– The Government also called for all regulatory bodies such as the Bank of Ghana, The Ghana Securities and Exchange Commission, the National Insurance Commission, and the National Pensions Regulatory Authority to put measures to reduce the impact of the programme on the sector, and,

- The Financial Stability Fund (FSF)- Additionally, the government would establish a Financial Stability Fund (FSF) that would act as a last resort to the financial sector, and would back up the liquidity to all financial institutions, which had a target of USD 1.2 bn to be raised from the World Bank and other financial institutions.

Most financial institutions that were going to be impacted by the exchange program had a negative reception from the majority of the bondholders and this presented a challenge to the government, and in a bid to ease the exchange programme the government has been updating the proposal as follows;

- Extension of the exercise duration– The government has extended the closing date of the exchange programme twice from the initial date of 23rd December 2022 to 30th December 2022 and later to 16th January 2023 in order to give more time to the financial sector institutions to secure the necessary approvals for their involvement in the exchange programme,

- Exempting Pension Funds from the programme– The government announced that it will drop pensions firms from the ongoing domestic debt exchange programme, and that, the parties involved would engage to prepare an alternative plan,

- Paying accrued and unpaid interest on eligible Bonds-The government announced that it would pay accrued and unpaid interest on eligible bonds and a cash tender fee payment to holders of eligible bonds maturing in 2023. Additionally, interest on the new bonds will not accrue until 2024, but will start paying the interest at a rate of 5.0% after 2024, increasing to 10.7% for the new bonds that will mature in 2038,

- Increasing the new bonds under the DDEP program to twelve from the initial four bonds-The government added 8 new bonds with one maturing every year from 2027 to 2038,

- A modification to the Exchange Consideration Ratios– The Exchange Consideration Ratio applicable to Eligible Bonds maturing in 2023 will be different than for other Eligible bonds,

- A non-binding target of 80.0%- The government set a non-binding target minimum level of overall participation of 80.0% of the aggregate principal amount outstanding of Eligible Bonds, and,

- Including Individual Bondholders– Rather than only applying the exchange to institutional bondholders, the government announced the expansion of the program to cover even individual investors.

Read: Ghana Suspends Debt Payments As Crisis Worsens

IMF Credit Package to Ghana

On 12th December 2022, the IMF announced that it had reached a staff-level Agreement on a 3-year program of the Extended Fund Facility (ECF) amounting to USD 3.0 bn (SDR 2.2 bn) which was subject to the IMF management and Executive approval, and after the receipt of the necessary commitments from Ghana’s partners and Creditors. The agreement followed the launch of the Domestic Debt Exchange Programme, which IMF noted that its progress would be needed before the approval of the facility.

Recommendations and Conclusion

The majority of Sub-Saharan countries continue to suffer from high debt levels that push their economies to levels of crisis. Therefore, governments should put in place measures that promote high revenue collection rather than relying on public debt to cover their fiscal deficits. Below are some of the measures that Sub-Saharan countries can put in place to evade high levels of risk distress;

- Enhance fiscal consolidation– The mismatch between higher public expenditure and lower revenue collections has continued to expand fiscal deficits necessitating borrowing. To offset such imbalances, the SSA countries need to either cut government recurrent expenditures or increasing revenue performance to promote fiscal consolidation,

- Addressing the structural and financing challenges faced by State Owned Enterprises (SOEs)- The majority of SOEs continue to record losses due to poor governance policies and depend heavily on government bailouts. One of the ways to reduce the burden from SOEs is to privatize them in order to bring them,

- Export Promotion- The SSA economy, which is majorly agriculturally and service driven, has for years lacked value addition to its exports, which results in low revenues from exports. The governments should promote export value addition structures such as Export Processing Zones and industrialization, as this would increase the value of its exports, boosting their foreign exchange reserves. This would not only improve the region’s GDP but also anchor currency depreciation and reduce the costs of servicing foreign currency-denominated loans,

- Encouraging alternative means of financing infrastructure such as Private Public Partnerships (PPPs)- Infrastructure projects are capital intensive and the majority have been funded through Public Debt. The governments should promote and streamline alternative means of financing such as PPPs and joint ventures in development projects,

- Putting in place measures that spur economic growth– Such measures that increase economic output include tourism, entrepreneurship, technology, and innovation, as well as easing regulations that encourage a favorable business environment, and,

- Restructure public debt early if need be Countries in SSA that have high debt levels should restructure their debts instead of waiting to fall into debt distress. The following three countries have initiated forms of debt restructuring;

- Kenya- In June 2020 and December 2022, the Kenyan Government offered switch bonds for holders of government T-bills to voluntarily switch to two Infrastructure bonds namely; IFB1/2020/6 and IFB1/2022/6, with tenors to maturity of 6 years each. The bonds received overall subscription rates of 82.7% and 60.3%, for IFB1/2020/6 and IFB1/2022/6, respectively, with the rest of the T-bill holders opting to hold and be paid upon maturity,

- Zambia– Initiated restructuring of its public debt in 2022 which involved forming a creditors committee that included all external lenders under the Common Framework for Debt Treatment of the G20. This after defaulting on its sovereign debt in 2020 and its debt to GDP ratio coming in at 140.2% in 2020 pointing towards debt distress. This came after the USD 1.3 bn IMF assistance in August 2022, in which the debt restructuring was needed for the credit assistance to be approved, and,

- Nigeria– In our 2022 annual markets review, we highlighted that Nigeria Government had sent a proposal to parliament for approval to allow for a restructuring of USD 54.0 bn, short-term loans owed to its Central Bank to a 40-year security at an interest of 9.0%. The debt was incurred through Ways and Means Advances to finance the government deficit as a result of delayed government receipts. The Nigerian Executive also requested for a three-year moratorium on interest payments on existing debts and asked for another USD 2.2 bn (N1.0 tn) debt from the Central bank on similar terms.

For more information, kindly see our topical on Ghana’s Debt Restructuring

Email your news TIPS to editor@thesharpdaily.com