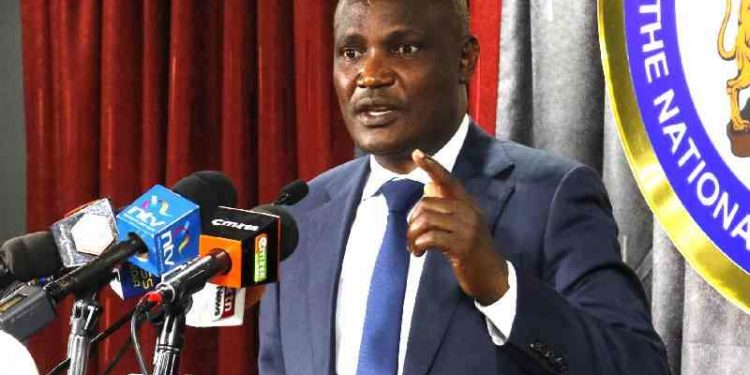

Treasury Cabinet Secretary John Mbadi has expressed strong support for further interest rate cuts by the Central Bank of Kenya (CBK), aiming to stimulate lending to the private sector and promote job creation.

Speaking on his 50th day in office, Mbadi emphasized that reducing the benchmark rate would increase market liquidity and strengthen the economy.

“The solution to the economy is to find ways to lower the lending rates that banks charge the private sector. We want interest rates to decrease so banks can provide more funds to private businesses, creating more job opportunities and putting money in people’s pockets,” said Mbadi.

This comes after the CBK’s Monetary Policy Committee (MPC) reduced the Central Bank Rate (CBR) by 75 basis points on October 8, 2024, lowering it from 12.75% to 12%. This marks the second consecutive cut this year, reflecting ongoing efforts to boost economic activity. The rate cut is expected to encourage banks to increase lending, particularly to businesses, which in turn could lead to job creation.

Private sector lending has seen mixed trends in response to the economic conditions. Credit from Savings and Credit Cooperative Organizations (Saccos) increased to 11%, up from 9.3%, as borrowers sought alternative funding sources. However, private sector credit from commercial banks dropped to 1.3% in August, down from 3.7%, partly due to the appreciation of the Kenyan shilling and earlier monetary tightening.

Dr. Kamau Thugge, the Governor of the Central Bank, explained that, adjusting for exchange rate impacts, private sector credit growth would have been 4.3%. “Even with these adjustments, there is a slowdown in credit growth, particularly with loans denominated in foreign currencies,” he noted.

In addition to supporting interest rate cuts, Mbadi highlighted government efforts to clear pending bills as part of enhancing liquidity and addressing unemployment. “We have started by paying off pending bills, which will inject more liquidity into the market,” he said.

Mbadi also announced the digitization of the Kenya Revenue Authority (KRA) to broaden the tax base and improve collection efficiency. The reforms are part of a broader fiscal consolidation strategy, aimed at increasing revenue from VAT, personal income tax, and rental income tax.