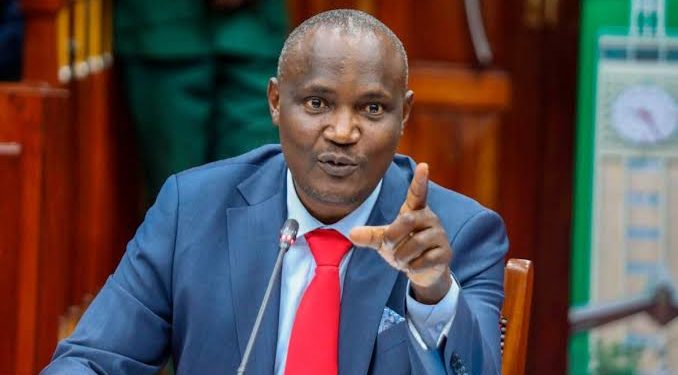

Treasury Cabinet Secretary John Mbadi has sought to reassure Kenyans that fuel prices will not rise following the planned privatisation of the Kenya Pipeline Company, saying government control over pricing and regulation will remain firmly in place.

Speaking during a parliamentary briefing on January 22 2026, Mbadi said fuel prices in Kenya are determined through a regulated pricing framework and not by ownership of pipeline infrastructure. He emphasised that the Energy and Petroleum Regulatory Authority (EPRA) will continue to set and review fuel prices even after private investors are introduced into KPC.

“Privatisation of Kenya Pipeline Company will not translate into higher fuel prices for consumers,” Mbadi said. “EPRA will continue to regulate petroleum prices as it currently does and the government will retain a significant stake to safeguard public interest.”

Under the proposed transaction, the government plans to sell part of its shareholding in KPC while retaining 35 percent ownership, ensuring continued state influence over strategic decisions. Mbadi said the structure was designed to attract private capital while protecting national energy security.

Kenya operates a regulated fuel pricing regime, with EPRA announcing pump prices every month based on a formula that considers global oil prices, exchange rates, taxes, and operational costs. The formula limits how much oil marketers can charge consumers, regardless of changes in ownership within the fuel supply chain.

Addressing concerns raised by legislators, Mbadi said pipeline tariffs represent only a small portion of the final pump price and would not materially affect fuel costs even if operational efficiencies change under private participation. “The pipeline charge is a minor component within the pricing formula and any adjustments are subject to regulatory approval,” he said.

The Treasury CS added that privatisation is aimed at improving efficiency, reducing operational losses, and unlocking capital for expansion of storage and transportation infrastructure. Kenya Pipeline Company plays a central role in transporting petroleum products from the port of Mombasa to inland depots, including Nairobi and western Kenya, as well as serving regional markets.

EPRA has also previously stated that infrastructure ownership does not directly influence pump prices under Kenya’s regulatory framework. In a statement issued in December 2025, the regulator said fuel prices are “determined strictly in accordance with the approved pricing formula and not by the commercial decisions of individual infrastructure operators.”

The government has defended the privatisation plan as part of broader reforms to reduce fiscal pressure on the Exchequer while modernising state owned enterprises. Mbadi said proceeds from the KPC share sale would be used to support budget priorities without compromising essential services.

As the privatisation process advances, Mbadi said the Treasury will continue engaging Parliament and the public to address concerns. “This is not about surrendering control,” he said. “It is about strengthening KPC while protecting consumers and the economy.”